【Calcined Petroleum Coke】Prices Rise Significantly!

【Calcined Petroleum Coke】Prices Rise Significantly!

Market Overview

On October 16th, the average price of calcined petroleum coke (cpc) in the market reached 2,169 yuan/ton, an increase of 29 yuan/ton from the previous working day, representing a rise of 1.36%. Currently, the overall market price of calcined petroleum coke is on an upward trend. The price of low-sulfur calcined petroleum coke has increased in response to the continuous rise in raw material prices, with some companies raising transaction prices accordingly. The overall trading atmosphere remains moderate, and a few previously reduced-production factories have slightly increased production based on orders. Prices for medium- and high-sulfur raw petroleum coke continue to rise, leading to higher production costs for companies. High-end quotations for 3.5 general-purpose calcined petroleum coke have risen to 1,800 yuan/ton, and market activity for medium- and high-sulfur grades remains strong, with mainstream price quotes continuing to rise.

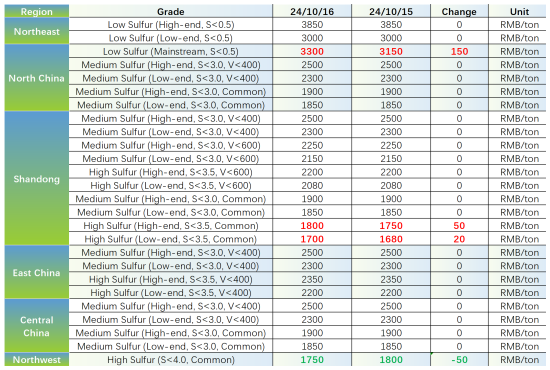

Main Regional Market Transaction Prices

Low-Sulfur Calcined Petroleum Coke (using Jinxi and Jinzhou petroleum coke as raw materials): mainstream transaction prices are between 3,150-3,300 yuan/ton.

Low-Sulfur Calcined Petroleum Coke (using Fushun petroleum coke as raw material): mainstream ex-factory transaction prices range from 3,700-3,850 yuan/ton.

Low-Sulfur Calcined Petroleum Coke (using Liaohe and Binzhou CNOOC petroleum coke as raw materials): mainstream market transaction prices are around 3,000-3,500 yuan/ton.

Medium-High Sulfur Calcined Petroleum Coke (3.0% sulfur, no specific trace element requirements): previous mainstream ex-factory contract price was 1,900 yuan/ton in cash, with current negotiation prices between 1,850-1,900 yuan/ton.

Medium-High Sulfur Calcined Petroleum Coke (3.5% sulfur, no specific trace element requirements): previous mainstream ex-factory contract price ranged from 1,700-1,750 yuan/ton, with current negotiation prices remaining between 1,700-1,750 yuan/ton.

Medium-High Sulfur Calcined Petroleum Coke (3.0% sulfur, vanadium content of 400 ppm): previous contract price ranged from 2,330-2,500 yuan/ton in cash, with current negotiation ex-factory prices remaining in the same range.

Supply Overview

Currently, the daily supply of commercial calcined petroleum coke across the country is 26,640 tons, with an operating rate of 60.83%. The supply has increased by 0.03% compared to the previous working day.

Upstream Market

· Petroleum Coke: Prices for petroleum coke under PetroChina remain stable, with Jilin Petrochemical in the Northeast beginning production, showing good sales of low-sulfur coke. With short-term market supply benefiting, the atmosphere for price hikes is strong. In the Northwest, refinery sales are stable, with just-in-time purchases for aluminum carbon products, while sales for silicon applications have decreased. CNOOC's recent tender performed well, with tight supply of low-sulfur coke leading to active purchasing from downstream buyers who are buying in anticipation of further price increases. Orders for anode materials have increased, with price hikes of 300 yuan/ton at Zhoushan Petrochemical, 350 yuan/ton at CNOOC Asphalt, 280 yuan/ton at Taizhou Petrochemical, and 250 yuan/ton at Huizhou Petrochemical.

Downstream Market

· Graphite Electrodes: The graphite electrode market remains sluggish, with slow transaction progress due to weak demand, hampering companies' ability to push for price increases. The focus is on maintaining stability while aiming for price hikes. In the short term, the market lacks positive momentum, leading graphite electrode companies to adopt a wait-and-see approach.

· Electrolytic Aluminum: Despite high aluminum prices, the buying interest among purchasers remains low even with discount offers from sellers. Trading enthusiasm has decreased compared to earlier periods, leading to a consolidation in spot aluminum prices.

· Anode Materials: Overall, the raw material prices for anode materials are mixed, providing limited support for price increases. Additionally, current downstream demand recovery has not met the expectations of anode material companies, making price hikes difficult in the short term.

Market Forecast

It is expected that prices for various grades of calcined coke will remain stable tomorrow, with slight adjustments in new order prices following raw material price changes.

(Source: Baiinfo)

Feel free to contact us anytime for more information about the calcined coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies