【Petroleum Coke】Market Active Trading! Main Refiners Continue to Raise Prices!

【Petroleum Coke】Market Active Trading! Main Refiners Continue to Raise Prices!

Market Overview

As of October 21, the average price of petroleum coke is 1,755 CNY/ton, an increase of 5 CNY/ton (0.29%) from the previous working day. The petroleum coke market is currently active, with downstream graphite electrodes purchasing and main refiners raising prices by 20-50 CNY/ton. Local refineries show mixed performance, with varying price movements.

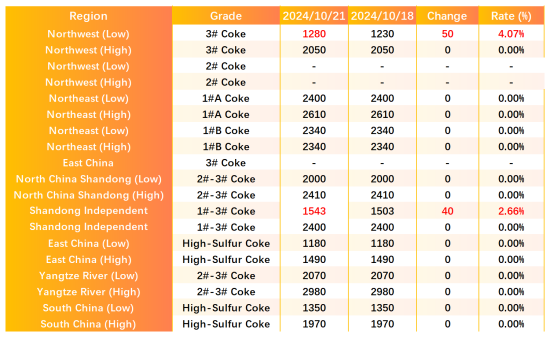

Main Regional Market Transaction Prices

Some Sinopec refineries have continued to raise prices slightly, with reasonable purchasing enthusiasm from downstream aluminum carbon product buyers. Coupled with support from low-sulfur coke prices, medium- and high-sulfur coke prices are actively increasing. In North China, Yanshan Petrochemical has raised prices by 20 CNY/ton, while Shijiazhuang Refinery and Qingdao Refinery have also increased by 20 CNY/ton. Qingdao Petrochemical and Jinan Refinery have raised prices by 40 CNY/ton. Meanwhile, PetroChina refineries in Northeast China are maintaining stable prices and active shipments with low inventory levels. In Northwest China, some refineries, including Yumen Refining, Lanzhou Petrochemical, Urumqi Petrochemical, and Dushanzi Petrochemical, have raised prices by 50 CNY/ton, while Karamay Petrochemical's shipments remain average, with stable prices. CNOOC refineries are shipping according to orders.

Local Refinery Situation

Currently, the local petroleum coke market shows mixed price movements, with some refineries experiencing price increases while others face declines. In the local market, medium-sulfur low-vanadium petroleum coke supply is tight, leading to price increases of 10-100 CNY/ton at some refineries; however, the sales of some high-sulfur common petroleum coke remain sluggish, with prices declining by 10-60 CNY/ton. Current indicators show that the sulfur content of petroleum coke from Xinhai Petrochemical has risen to about 4.45%, while that from Panjin Baolai has reached about 3.6%, and from Huifeng Petrochemical, about 3.19%.

Import Coke Situation

Downstream demand for anode and carbon products remains stable, with satisfactory sales of low-sulfur sponge coke at ports. The market for medium-high sulfur low-vanadium sponge coke is tight, while demand from the aluminum market remains stable, resulting in decent sales of medium-high sulfur products. Conversely, high-sulfur high-vanadium sponge coke supply is ample, but downstream demand is weak, putting pressure on traders' sales.

Supply Side

As of October 21, there are 10 conventional coking facilities under maintenance nationwide, with a daily production of petroleum coke at 88,915 tons and a coking operation rate of 70.11%, a decrease of 0.12% from the previous working day.

Demand Side

Downstream demand for aluminum carbon products provides certain support to the petroleum coke market. Anode manufacturers have been cautious in their previous purchases, maintaining low raw material inventory levels. However, recent signs of recovery in demand from some downstream companies have led to a slight increase in petroleum coke procurement. Steel mills are facing tighter profit margins, operating at low levels, with limited downstream demand for graphite electrodes. Many firms are focusing on fulfilling prior orders, remaining cautious in raw petroleum coke procurement. The silicon carbide industry and southern fuel markets still show some demand for high-sulfur pebble coke.

Market Outlook

The overall trading atmosphere in the petroleum coke market is favorable, with downstream procurement continuing to meet basic needs, providing support for the market. It is expected that petroleum coke prices will stabilize tomorrow, with some refiners experiencing price fluctuations ranging from 10 to 50 CNY/ton. The price of pebble coke is anticipated to remain stable in the near term.

(Source: Baiinfo)

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies