【Anode Materials】Prices Rise, Profit Margins Partially Restored

With the rapid growth of electric vehicles and energy storage systems, the demand for high-performance lithium batteries is increasing, driving the need for high-quality petroleum coke and artificial graphite. The quality and specifications of calcined petroleum coke directly affect the performance of artificial graphite, making high-quality petroleum coke crucial for lithium battery anode production.

【Anode Materials】Prices Rise, Profit Margins Partially Restored

Due to the sharp rise in raw material prices for anode materials in the previous period, production profits entered a negative margin phase. After negotiations with major downstream battery manufacturers, a new round of anode material price increases has finally arrived.

1. New Round of Anode Material Price Increases

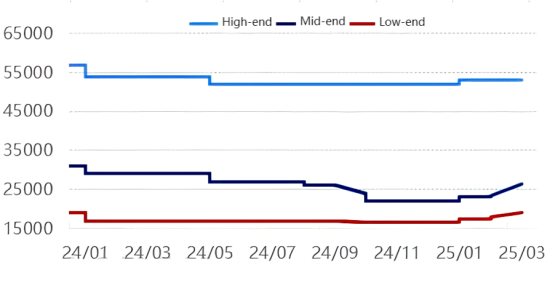

Figure 1: Artificial Graphite Market Price Trend (Unit: Yuan/Ton)

Data Source: Oilchem

In March, the price of mid-range artificial graphite anode material reached 27,500 yuan/ton, increasing by 3,000-4,000 yuan/ton (+17%). The mainstream price of low-end artificial graphite rose to 20,000 yuan/ton, up 2,500 yuan/ton (+14.3%). This price increase mainly focused on mid-to-low-end products, as these products primarily use petroleum coke as a raw material. In February, the surge in petroleum coke prices resulted in severe negative profit margins for mid-to-low-end products.

2. Anode Material Profits Partially Recovered

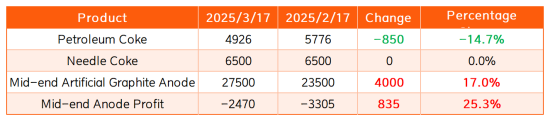

Table 1: Price Changes of Anode Materials and Related Products (Unit: Yuan/Ton)

Data Source: Oilchem

Since March, low-sulfur petroleum coke prices have started to decline, but due to the lag effect in production cycles, most of the current market products are still produced using high-cost raw materials from February. Therefore, although anode material prices have increased, anode enterprises using February's high-cost raw materials are still experiencing losses.

As of March 17, the weekly loss for mid-range artificial graphite anode material was 2,470 yuan/ton, with a profit recovery of 835 yuan/ton.

Unless anode manufacturers consume earlier low-cost raw material inventories, losses will persist.

3. Localized Decline in Anode Material Production Load in March

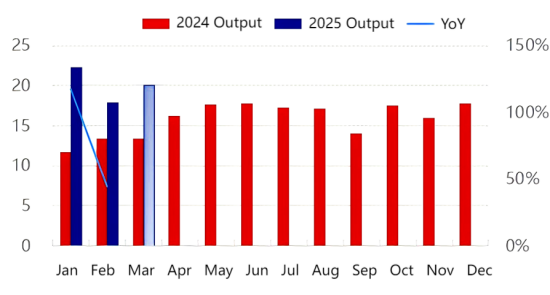

Figure 2: Monthly Production of Anode Materials (Unit: 10,000 Tons)

Data Source: Oilchem

In March, overall anode material production is expected to increase month-on-month, but operating rates vary across enterprises. Some companies have slightly reduced production due to rising raw material costs and difficulties in increasing product prices.

Downstream demand for anode materials remains stable to improving.

The rational price recovery of anode materials is expected to boost production output.

With petroleum coke prices showing signs of decline, the cost pressure on anode manufacturers is easing.

Market Outlook

Overall, battery manufacturers continue to emphasize cost reduction and efficiency improvement. The gradual price adjustment of anode materials is ongoing, and anode enterprises will continue to expand market share through product differentiation and cost-saving measures in production processes.

Feel free to contact us anytime for more information about the Anode Material market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies