【Calcined Petroleum Coke】Cost Boost Drives Significant Price Hikes!

【Calcined Petroleum Coke】Cost Boost Drives Significant Price Hikes!

Market Overview

On October 24, the average market price for calcined petroleum coke (CPC) reached 2,201 RMB/ton, a 32 RMB/ton increase from the previous working day, reflecting a 1.48% rise. Market prices are currently climbing. Low-sulfur CPC prices are being pushed up by the ongoing rise in raw material costs, with many companies adjusting their transaction prices accordingly. The trading atmosphere remains generally favorable, and mid- to high-sulfur CPC prices have seen notable increases for new orders due to cost-driven pressures. Standard-grade mid- to high-sulfur CPC remains in good demand, with certain companies already taking orders for next month.

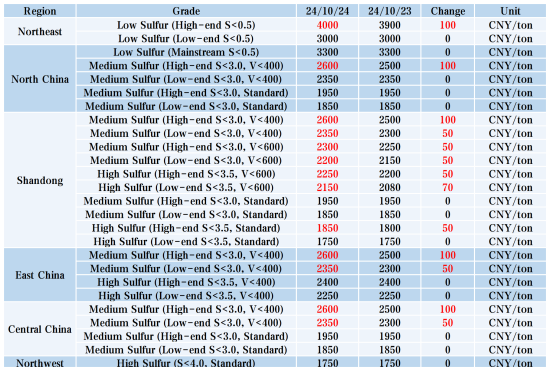

Current Regional Market Prices

Low-Sulfur CPC: The main transaction prices are 3,200-3,400 RMB/ton for CPC made from Jinxi and Jinzhou petroleum coke; 3,800-4,000 RMB/ton for CPC made from Fushun petroleum coke; and around 3,000-3,600 RMB/ton for CPC using Liahe and Binzhou CNOOC petroleum coke as feedstock.

Mid-High Sulfur CPC: For 3.0% sulfur CPC with no specific trace element requirements, previous contract prices were at 1,900 RMB/ton (cash, ex-factory); current discussion prices range from 1,900-1,950 RMB/ton. For 3.5% sulfur CPC with no trace element requirements, contract prices remain stable at 1,750-1,850 RMB/ton. For 3.0% sulfur CPC with vanadium levels around 400 ppm, prices continue between 2,350-2,600 RMB/ton.

Supply and Production

Nationwide daily supply of CPC is currently 27,493 tons, with an operational rate of 62.78%, consistent with the previous day's supply levels.

Upstream Market

Petroleum coke production is active among PetroChina refineries, with prices rising 100 RMB/ton yesterday at facilities such as Daqing, Fushun, Jinzhou, Jinxi, and Jilin Petrochemical. Low-sulfur coke is in tight supply, while downstream buyers are encouraged to stock up amid rising prices. In the northwest, refinery shipments remain steady, with carbon and silicon material manufacturers purchasing as needed. CNOOC refineries are fulfilling ongoing orders.

Downstream Market

Graphite Electrodes: Petroleum coke, a key raw material for graphite electrodes, has seen slight price increases, supporting a stronger market outlook for electrodes. However, actual trading volumes remain low as downstream sectors have limited capacity to absorb high prices, resulting in a sluggish transaction pace.

Electrolytic Aluminum: Positive market sentiment is boosted by the central bank's LPR rate cut and proactive policies to stimulate growth. Combined with reduced aluminum ingot inventories and rising domestic alumina prices, aluminum spot prices are climbing.

Anode Materials: Transaction volumes in the anode materials market are relatively stable. Some downstream battery cell manufacturers are increasing procurement, driving up production rates at major anode material factories. Yet, due to high market concentration and unmet downstream demand expectations, small- and mid-sized enterprises are still under pressure to secure orders.

Outlook

With rising costs, low-sulfur CPC prices are expected to increase incrementally. Mid- to high-sulfur CPC prices are likely to follow suit, showing steady to modest gains as market demand and raw material costs stabilize.

(Source: Baiinfo)

Feel free to contact us anytime for more information about the calcined coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies