【Petroleum Coke】Prices Rising Again?!

【Petroleum Coke】Prices Rising Again?!

Market Overview

On November 20, the average price of petroleum coke in China reached 1,821 RMB/ton, up 10 RMB/ton from the previous working day, a 0.55% increase. Petroleum coke can be used in industries such as graphite production, smelting, and chemical engineering based on its quality. Low sulfur, high-quality mature coke, such as needle coke, is mainly used to manufacture ultra-high power graphite electrodes and certain special carbon products. The major refineries in Northeast China raising low-sulfur coke prices by 50 RMB/ton. Market supply remains tight, and prices continue to rise. Meanwhile, medium- to high-sulfur coke is selling steadily, with local refineries maintaining strong pricing and active shipments.

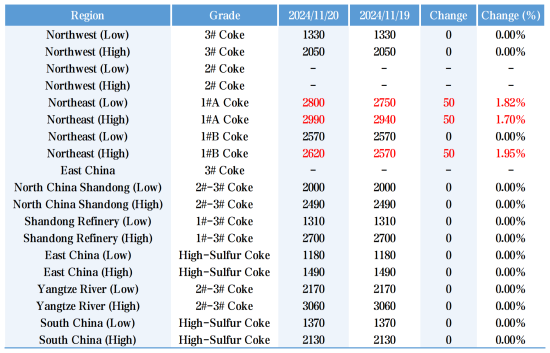

Key Regional Market Prices

Sinopec Refineries: Transactions remain stable, with downstream focused on fulfilling existing orders. In the Yangtze River region, sales of anode-grade coke are steady, while in East China, medium- to high-sulfur coke sales are stable, with most refineries selling as Grade 4#B. Other regions, including South China, North China, and Shandong, report steady transactions, while Northwest China’s Tahe Petrochemical mainly supplies within Xinjiang.

CNPC Refineries: Northeast refineries (Daqing, Fushun, Jinzhou, and Jilin) raised prices by 50 RMB/ton and reported strong sales. In the Northwest, prices remain stable, supported by steady aluminum carbon demand.

CNOOC Refineries: Mainly fulfilling contract orders.

Local Refineries: Sales are solid, with refinery prices trending upward by 50-100 RMB/ton for low-sulfur coke. Downstream demand remains stable, supporting prices. Inventory levels are generally low. Other grades have seen price increases of 20-100 RMB/ton. Shandong-based refineries have reduced prices in some cases, with one cutting by 50 RMB/ton to de-stock. Tianhong Chemical’s coke sulfur content has risen to 5.0%, with auction floor prices reduced by 60 RMB/ton. Fuhai United's coke has a sulfur content of 2.38% and vanadium content of 374 PPM, now sold as Grade 3#B.

Imported Coke: Spot resources of Formosa coke at ports remain limited, and traders are optimistic about price hikes. Rising domestic prices have improved import sales, with port inventory moving quickly.

Supply

As of November 20, 12 coking units nationwide were undergoing routine maintenance. The daily output of petroleum coke is 86,895 tons, with a coking operation rate of 68.29%, unchanged from the previous day.

Demand

Aluminum Carbon: Enterprises maintain rigid demand for petroleum coke.

Anode Materials: Large manufacturers maintain high operating rates, supporting low-sulfur coke price increases.

Graphite Electrodes: Demand remains weak, with downstream buyers pressing for lower prices, limiting raw material requirements.

Silicon Carbide and Fuel Markets: Demand for high-sulfur shot coke persists, especially in southern markets.

Market Outlook

Domestic petroleum coke supply remains stable, with downstream buyers continuing rigid procurement, offering price support. Prices are expected to stabilize in the near term, with low-priced petroleum coke potentially seeing small increases of 10-30 RMB/ton. Shot coke prices are likely to remain steady.

(Source: Baiinfo)

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies