【GE】Achieving a 15% EAF Steel Ratio: How Can the Year of the Snake Swallow the Elephant?

【GE】Achieving a 15% EAF Steel Ratio: How Can the Year of the Snake Swallow the Elephant?

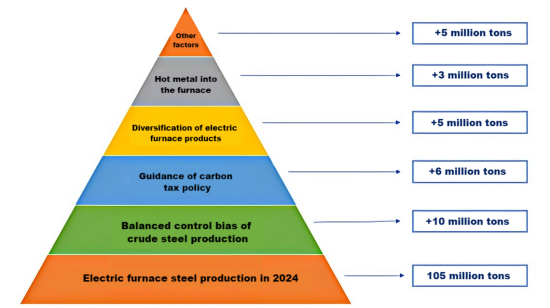

In 2024, China's electric arc furnace (EAF) steel production rebounded to over 100 million tons, raising the EAF steel ratio to approximately 10.5%. Graphite electrodes play a dual role in conductivity and high temperature resistance during this process, ensuring the smooth progress of electric furnace steelmaking.

The State Council's "2024-2025 Energy Conservation and Carbon Reduction Action Plan" aims to increase this ratio to 15% by the end of 2025, necessitating an additional 40 million tons of EAF steel production—a challenging goal without significant support.

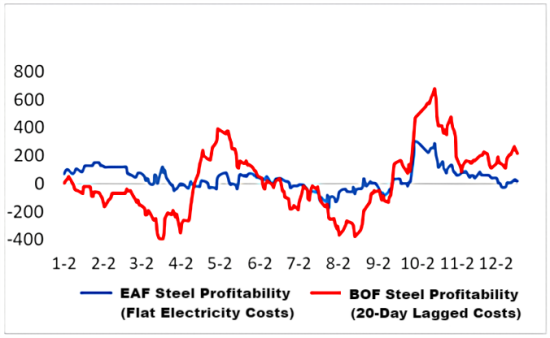

Since April 2024, domestic EAF steel mill profits have declined, with December figures showing EAF steel mill profits approximately 150 yuan per ton lower than those of long-process steel mills. This downturn has led to reduced confidence among EAF steel producers in achieving the 15% target for 2025.

To bridge this gap, several strategies could be considered:

1. Implementation of Carbon Tax Policies: If a carbon tax is introduced by 2026, it could increase blast furnace production costs by about 150 yuan per ton, potentially encouraging a shift towards EAF production. This policy could boost EAF steel output by 5-7 million tons, particularly in North China.

2. Adjustments in Production Control Policies: Easing production restrictions on EAFs while tightening controls on less environmentally friendly blast furnaces could effectively increase EAF steel production by 8-12 million tons, especially benefiting independent EAF steel mills producing common materials.

3. Product Diversification by Independent EAF Mills: With China's steel consumption shifting towards manufacturing, EAF mills could expand into producing flat steel and alloy steel, potentially increasing output by 3-5 million tons, notably in East and South-Central China.

4. Increasing Hot Metal Ratios in EAFs: Some EAF mills have previously raised hot metal ratios to over 80% to reduce costs. While this approach has limitations, it could temporarily boost EAF steel production by 3-5 million tons, particularly in Jiangsu Province and certain northern special steel plants.

Overall, 2025 is expected to be a transitional period for China's steel market, with limited prospects for significant price increases. Despite potential policy incentives and shifts in domestic demand, achieving the 15% EAF steel ratio target remains challenging. Nonetheless, EAF steel production is likely to reach a record high, potentially exceeding 130 million tons. In the long term, aligning EAF capacity and product offerings with market demand will be crucial for sustainable growth.

Feel free to contact us anytime for more information about the Graphite Electrodes market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies