【Petroleum Coke】Market Annual Reversal: Prices Follow an "N" Trend

【Petroleum Coke】Market Annual Reversal: Prices Follow an "N" Trend

Market Overview

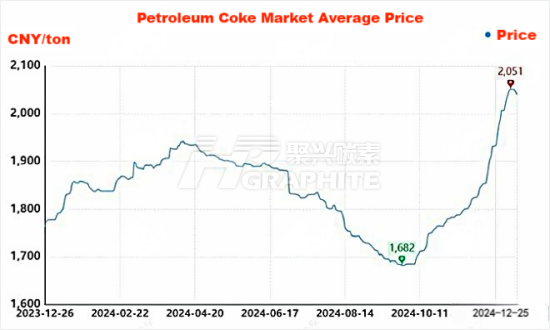

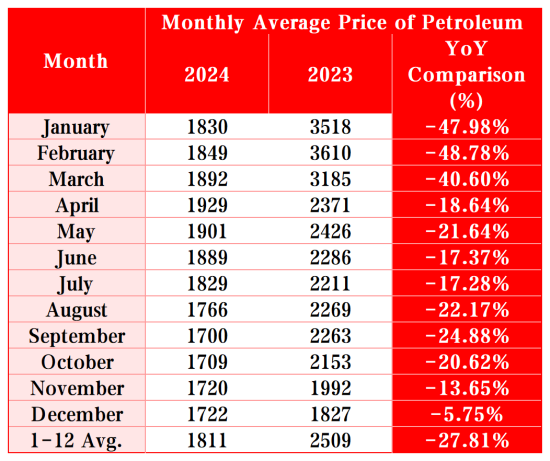

In 2024, China's petroleum coke market underwent a significant reversal, with prices displaying an "N-shaped" trend throughout the year.

Key dynamics included reduced overall supply—particularly for imported petroleum coke—and divergent price trends across segments. The demand for calcined petroleum coke in the market is improving, learn more.

Key Factors Influencing the Market

Domestic Refinery Production Declines:

1. Refinery operating rates fell YoY due to maintenance and production cuts.

2. Reduced demand for primary refinery products, stricter tax audits, and low refining margins prompted supply constraints.

3. Zhejiang Petrochemical halted its 3.2-million-ton/year delayed coking unit, while Qicheng Petrochemical and Yongxin Petrochemical added capacity, contributing to localized supply shifts.

Significant Drop in Imports:

1. January–November imports totaled 12.42 million tons, down 15.22% YoY.

2. Reduced imports of low-sulfur and high-sulfur sponge coke tightened port inventories, particularly for medium- to low-sulfur grades. Delays in shipments from Indonesia and Brazil in Q4 further strained supply.

Rising Sponge Coke Demand:

1. Growth in aluminum and carbon production drove demand for sponge coke with stricter impurity requirements.

2. Negative electrode material production expanded, prompting periodic price surges for petroleum coke.

Declining Demand for Fuel-Grade Coke:

1. High-sulfur fuel-grade coke faced policy restrictions, with some power plants halting use starting in August.

2. Float glass demand declined due to stricter environmental inspections and increased furnace maintenance from August onward.

2024 Petroleum Coke Price Ranges

Low-Sulfur Coke (≤1.0% S): 1,960–3,500 RMB/ton

Medium-Sulfur Coke (~3.0% S, ≤500 ppm V): 1,330–2,520 RMB/ton

High-Sulfur Coke (~6.0% S, ~300 ppm V): 1,100–1,660 RMB/ton

High-Sulfur Bulk Coke (~5.0% S): 903–1,300 RMB/ton

Outlook

The "N-shaped" trend reflects a complex interplay of tightening supply and fluctuating demand. As key sectors like aluminum and negative electrode materials grow, sponge coke demand is expected to remain robust, while fuel-grade coke faces increasing headwinds.

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies