【Graphite Electrode】August Forecast for China's UHP Graphite Electrode Market

【Graphite Electrode】August Forecast for China's UHP Graphite Electrode Market

Price Review for July

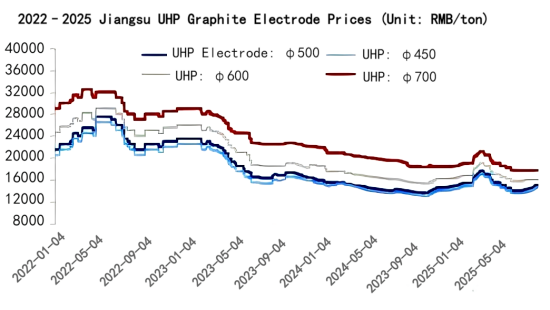

The domestic ultra-high power (UHP) graphite electrode market showed a continued upward trend in July. Taking the mainstream Φ500 specification as an example, the price in Jiangsu rose from RMB 14,300/ton at the beginning of the month to RMB 15,000/ton by the end of the month, with a cumulative increase of 4.9%. Prices for the same specification in Henan, Hebei, and Liaoning also increased accordingly. UHP graphite electrodes of Φ350–Φ450 rose from RMB 13,800/ton to RMB 14,500/ton, up 5.1% for the month. Larger diameter electrodes such as Φ600–Φ700 remained relatively stable in price.

2022–2025 Jiangsu UHP Graphite Electrode Prices

Rising Costs Provide Strong Price Support

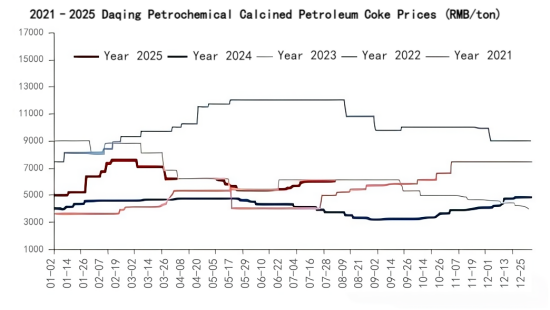

In July, domestic petroleum coke prices rose twice. Taking Daqing calcined petroleum coke as an example, as of July 31, prices had increased by RMB 330/ton, a rise of 5.82%. Starting August 1, petroleum coke prices increased again, and price hikes are still expected in August. As a result, the cost of UHP graphite electrodes is likely to remain high.

2021–2025 Daqing Petrochemical Calcined Petroleum Coke Prices

Demand for Graphite Electrodes May Peak Early Then Decline

Looking at production in independent electric arc furnace (EAF) mills in July, capacity utilization rates fell slightly compared to June. However, as finished steel prices recovered, operating enthusiasm among EAF mills improved, leading to increased demand for electrodes. Toward late August, policy requirements and safety production measures are expected to intensify, likely causing a decline in production, operations, and refining activities at independent EAF mills and steel enterprises. Thus, demand for graphite electrodes is expected to decrease. For the month as a whole, demand may follow a trend of being high at the beginning and low toward the end.

August Market Forecast

In summary, with steel procurement tenders concluding in August, the post-rise prices of UHP graphite electrodes are expected to be further consolidated. Moreover, rising petroleum coke prices and increased demand may drive another round of price increases for UHP electrodes. However, the space for demand growth is limited and there remains a risk of pullback. Therefore, the domestic UHP graphite electrode market in August is expected to show a trend of rising first and then stabilizing.

(Source: Mysteel)

Feel free to contact us anytime for more information about the Graphite Electrodes market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies