【Lithium Battery】Export Faces "Carbon Barriers" - How to Respond to New Regulations?

【Lithium Battery】Export Faces "Carbon Barriers" - How Should the Lithium Battery Industry Respond to New Regulations?

With the rapid growth of the global electric vehicle market and the sharp increase in demand for lithium batteries, China's lithium battery industry is playing an increasingly important role in the global market. The new regulations issued by the EU aim to ensure the sustainability and environmental friendliness of batteries, particularly regarding carbon emissions.

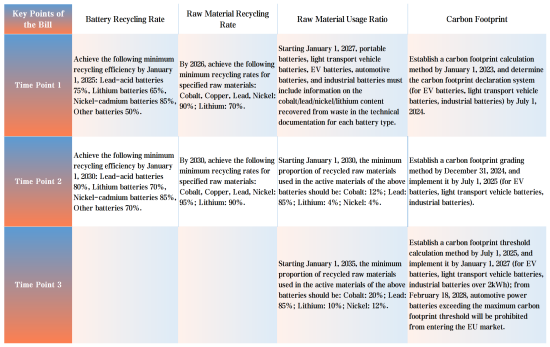

The EU Battery and Waste Battery Regulation (hereinafter referred to as the "New Battery Law"), which officially took effect in August 2023, not only strengthens market access standards for batteries but also explicitly imposes strict regulatory requirements on battery carbon footprints. From February 2025, battery manufacturers must provide carbon footprint reports for their products. By 2026, they will need to disclose carbon footprint performance levels, and by 2028, only batteries meeting specific carbon threshold values will be allowed to enter the EU market. These regulations undoubtedly increase the difficulty for Chinese lithium battery products to enter the EU market.

Graphitized petroleum coke is a high-purity petroleum coke after calcination, typically used to produce artificial graphite. It is a key raw material for manufacturing battery anode materials (especially graphite anodes). Graphitized petroleum coke has good conductivity and stability, making it suitable for use in battery anodes.

In April 2024, the EU published the "Calculation and Verification Methods for Carbon Footprints of Electric Vehicle Batteries" (draft for public consultation), further detailing the calculation rules for electric vehicle battery carbon footprints. In June 2024, the EU released the Net-Zero Industry Act, identifying batteries as critical net-zero technology products and proposing that by 2030, EU battery manufacturers should meet nearly 90% of the EU's annual battery demand.

On January 12, the Energy and Environmental Policy Research Center of Beijing Institute of Technology released a report indicating that the new battery law is expected to have a series of impacts on China's lithium battery industry.

01 Dual Challenges for the China-EU Lithium Battery Industry Chain

With 87% of the EU's imported lithium batteries coming from China, the implementation of the "New Battery Law" will have profound effects on the lithium battery industry chains in both China and the EU.

On the one hand, if the carbon footprint of Chinese battery products cannot meet the EU's new regulatory requirements, they risk losing market access to the EU, potentially leading to economic losses and employment pressure in related industry chains.

On the other hand, if the EU follows the targets of the Net-Zero Industry Act and shifts most battery production to domestic facilities, it will face significant capital investment and labor demand, possibly driving up production costs.

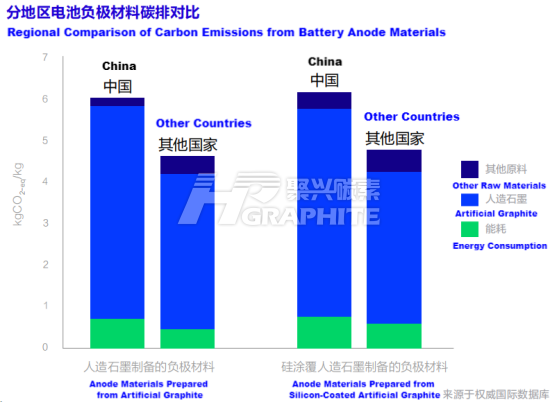

02 High Carbon Emissions in Domestic Lithium Battery Life Cycles

The report, adhering to the "New Battery Law" requirements, selected two mainstream, technologically advanced battery products in China—one lithium iron phosphate (LFP) battery and one ternary lithium battery—as research samples.

To comprehensively assess the carbon footprints of these batteries, the research team established a life-cycle carbon footprint calculation model and adopted a global multi-regional input-output analysis technique, accounting for product and sectoral differences.

This comprehensive approach aims to accurately measure product carbon footprints, predict their future trends, and uncover potential risks in the industry chain.

Detailed calculations show that the life-cycle carbon emissions of domestic LFP batteries are 1.6 times the EU average and 2.5 times the top 10% most advanced levels in the EU. For ternary lithium batteries, the life-cycle carbon emissions are 1.5 times the EU average and 2.2 times the top 10% most advanced levels. These figures clearly indicate that domestic lithium batteries still have significant room for improvement in terms of carbon emissions compared to the EU's advanced levels.

03 Main Paths to Carbon Reduction

According to predictions, the life-cycle carbon emissions of Chinese lithium batteries are expected to decrease to the current EU average level by around 2040. To reach the EU's top 10% optimal level, it may take until around 2058.

This forecast suggests that the implementation of the "New Battery Law" will have significant impacts and challenges for multiple related industries in China, including power batteries, automotive manufacturing, chemicals, and mining.

The report further points out that to effectively reduce the carbon emissions of LFP batteries, it is crucial to lower emissions during aluminum alloy production and electricity usage while significantly improving resource recycling capabilities.

For ternary lithium batteries, reducing carbon emissions focuses on cutting emissions during the production of cathode active material precursors and aluminum alloy production, as well as electricity usage, alongside strengthening resource recycling and reuse.

04 Industry Outlook and Recommendations

Faced with the challenges brought by the "New Battery Law," China's lithium battery industry encounters both challenges and opportunities. The industry needs to adjust its development model and enhance product value to meet new market demands. At the same time, it is essential to strengthen international cooperation and actively participate in the formulation and discussion of global battery standards to gain more influence.

In the long run, the lithium battery industry should focus on sustainable development, achieve seamless alignment with international standards through technological innovation and upgrades, and rely on proper policy guidance and enterprise transformation to determine the future success of the industry.

In this era of profound change, how the lithium battery industry seizes opportunities and takes the lead in tackling challenges will be a critical question every company must ponder.

Feel free to contact us anytime for more information about the artificial graphite anode market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies