【Calcined Petroleum Coke】Prices Surge Post-Holiday—Market Outlook & Trends

【Calcined Petroleum Coke】Prices Surge Post-Holiday—Market Outlook & Trends

Market Overview

On February 5, the average market price of calcined petroleum coke (CPC) was CNY 3,068/ton, up by CNY 149/ton (+5.10%) from the previous working day. Currently, CPC prices are on an upward trend. Some low-sulfur CPC producers replenished high-cost raw materials before the holiday, leading to price increases of CNY 800-1,000/ton. However, downstream operations are resuming slowly, and market transactions remain stable. During the Chinese New Year, mid-to-high sulfur CPC raw material prices rose significantly, increasing cost pressure. Consequently, CPC prices are expected to follow the upward trend. Some CPC producers slightly reduced output during the holiday, and further production trends require monitoring.

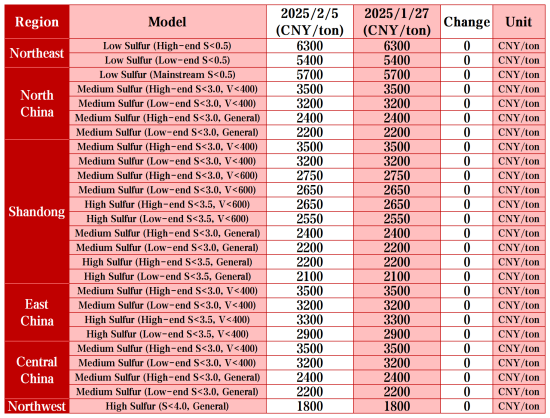

Key Market Transaction Prices

· Low-Sulfur CPC:

o Using Jinxi and Jinzhou petcoke: CNY 4,700-5,700/ton

o Using Fushun petcoke: CNY 5,400-6,300/ton

o Using Liaohe and Binzhou Zhonghai petcoke: ~CNY 5,200-5,400/ton

· Mid-to-High Sulfur CPC:

o (S<3.0%, no element requirements): Previously CNY 2,200-2,300/ton, now under negotiation at CNY 2,300-2,400/ton

o (S<3.5%, no element requirements): Previously CNY 2,050-2,220/ton, now under negotiation at CNY 2,200-2,300/ton

o (S<3.0%, V 400): Previously CNY 3,100-3,300/ton, now under negotiation at CNY 3,200-3,500/ton

Supply

The current daily commercial CPC supply nationwide is 27,813 tons, with an operating rate of 62.15%, unchanged from the previous working day.

Upstream Market

· Petroleum Coke: Most Sinopec refineries maintain stable pricing and are executing orders. In the Yangtze River region, refineries report smooth shipments, with high utilization rates at major anode material plants supporting petcoke demand. In North China, Yanshan Petrochemical mainly supplies 4B petcoke, Shijiazhuang refinery ships 4A, and Cangzhou refinery sells 3#C and 4#A petcoke. PetroChina refineries also maintain stable pricing, with Northeast low-sulfur petcoke in tight supply. Yumen Petrochemical in Northwest China raised auction prices by CNY 150/ton. CNOOC refineries have not yet held auctions, with details pending.

Downstream Market

· Graphite Electrodes: Post-holiday, graphite electrode plants are gradually resuming production. Due to the pre-holiday rise in low-sulfur petcoke prices, market sentiment favors price increases, but actual price adjustments may face challenges as downstream demand remains uncertain.

· Aluminum Smelting: China's Ministry of Commerce and five other departments announced subsidies for home renovations, including kitchen and bathroom upgrades, boosting consumer sentiment and driving aluminum prices higher.

· Anode Materials: After the holiday, most anode material companies are fulfilling previous orders, with production based on sales. The market remains structurally oversupplied, but some anode plants that had halted production pre-holiday are gradually resuming operations, keeping supply ample.

Market Outlook

Low-sulfur CPC prices are expected to rise as some companies replenish raw materials at higher costs. Mid-to-high sulfur CPC prices will likely remain firm, following the increase in petroleum coke costs.

(Source: Baiinfo)

Feel free to contact us anytime for more information about the calcined petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies