【Petroleum Coke】Prices Changing Daily! Is the Graphite Market at a Turning Point?

【Petroleum Coke】Prices Changing Daily! Is the Graphite Market at a Turning Point?

Recently, the graphite-related market has been booming, with petroleum coke prices fluctuating daily. At the same time, needle coke, carbon products, and graphite electrodes are also seeing price increases! This surge in the market has reignited enthusiasm among industry enterprises and professionals, especially since most companies faced losses in 2024. The tight supply and continuous price hikes of petroleum coke signal that the raw material market is leading the turnaround!

Petroleum Coke:

Fushun Petrochemical: Raised petroleum coke sales price by 200 CNY/ton to 6,000 CNY/ton on February 12.

Daqing Petrochemical: Increased sales price by 200 CNY/ton to 5,830 CNY/ton.

Jinxi Petrochemical: Adjusted price up by 200 CNY/ton, now selling at 5,700 CNY/ton.

Jinzhou Petrochemical: Raised price by 200 CNY/ton, now selling at 5,700 CNY/ton.

With petroleum coke supply tightening, anode and negative electrode enterprises are rushing to procure, pushing prices higher. Major refineries continue to follow the uptrend, and local refiners also maintain the rising momentum. Meanwhile, imported sponge coke prices have risen alongside domestic coke, reflecting a supply-demand imbalance in the low-sulfur coke sector.

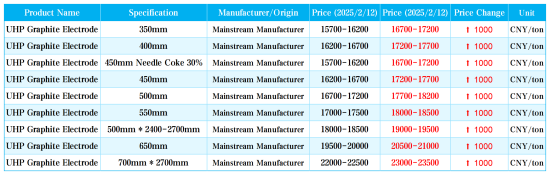

Graphite Electrodes:

In the past two days, multiple steel mills have reported a price increase of around 1,000 CNY/ton for graphite electrodes. This indicates that the price hike is not just at the supplier level but has successfully passed down to steel mills, completing the full pricing transmission from raw materials to end products.

Looking ahead to 2025, graphite electrode prices are expected to surge. Tokai Carbon recently announced a 10% price increase on all graphite electrode orders.

As a leading company in the graphite electrode industry, Fangda Carbon saw its stock hit the daily limit-up on February 12, with assets soaring!

The primary driver behind this wave of graphite electrode price increases is the rising raw material costs, which have kept production costs high and companies in a loss-making situation. However, as the market rebounds, manufacturers are actively adjusting prices to improve profitability.

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies