【GE】Analysis of the Recent Price Surge in Ultra-High Power Graphite Electrodes

【GE】Analysis of the Recent Price Surge in Ultra-High Power Graphite Electrodes

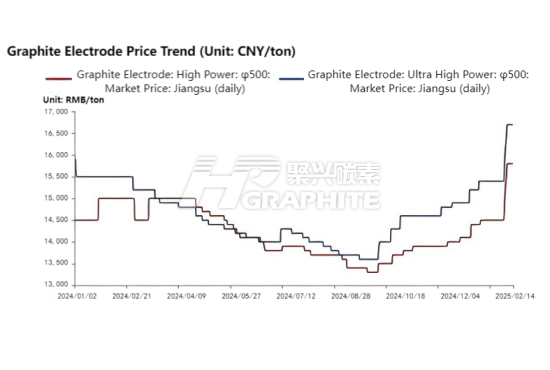

Recently, the price of raw materials for graphite electrodes has risen, leading to an increase in production costs for manufacturers. Ultra-high power graphite electrode prices have surged by CNY 1300/ton, sparking a market uptrend. Here's a breakdown of the factors behind this price rise:

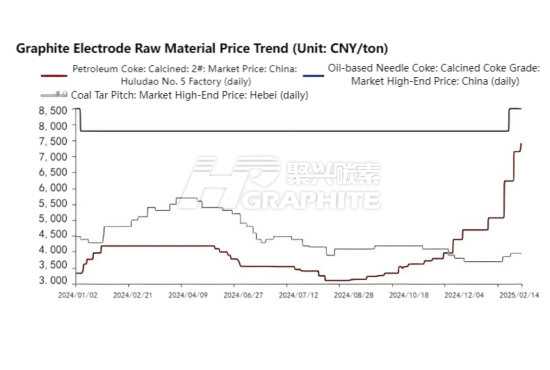

1. Raw Material Analysis:

· Medium-temperature coal pitch: After the Chinese New Year, coal pitch prices increased by CNY 200/ton, with bulk materials now quoted at CNY 3900/ton (tax included). However, downstream recovery after the holiday has been slow, and overall demand remains weak.

· Petroleum coke: Post-holiday, the price of calcined 2# petroleum coke rose by CNY 1180/ton. With growing production and more orders from anode material enterprises, the increased demand for petroleum coke has supported its price.

· Needle coke: After the holiday, oil-based needle coke prices surged by CNY 700/ton, driven by increased demand from downstream companies, including negative electrode material manufacturers. The active procurement environment has further boosted needle coke demand.、

2. Graphite Electrode Market Conditions:

· Demand: End demand has decreased due to falling electric arc furnace steel profits and reduced production enthusiasm. As a result, the demand for graphite electrodes has been weak, with production largely based on order fulfillment.

· Raw materials: The price hikes in needle coke, petroleum coke, and coal pitch have caused the overall cost of production to rise.

· Supply: With increased raw material costs, graphite electrode manufacturers face higher production costs, yet the demand from steel mills is slow to release. Manufacturers are mainly producing to complete existing orders.

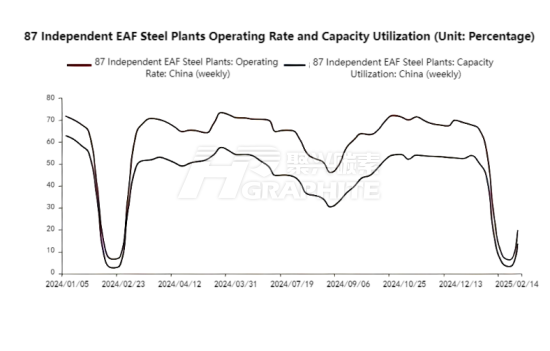

3. Downstream Operation Rates:

· Electric Arc Furnaces: As of February 17, the average operating rate for 90 independent electric arc furnace steel mills is 19.78%, up by 13.39 percentage points from the previous period and 13.11 percentage points higher year-on-year. Capacity utilization is 13.61%, down 10.34 percentage points from the previous period but up 10.9 percentage points year-on-year. Steel mills are ramping up their operations, and this trend is expected to continue into next week.

· Other Industries: According to a survey conducted on February 13, the operating rate of brown corundum furnaces was 44.8%, increasing by 6.4% from the previous week. The increase in the operating rate of corundum companies has driven up the demand for graphite electrodes. After the holiday, the overall recovery of downstream industries is speeding up, slowly releasing the demand for graphite electrodes.

4. Future Outlook:

As the prices of electrode raw materials rise, and with slow demand release and increasing production costs, manufacturers are being forced to raise their quotes for ultra-high power graphite electrodes. Many companies have reported halting their quotations. The ultra-high power graphite electrode market is expected to remain stable but may lean slightly towards strength in the near term.

(Source: My Steel Network)

Feel free to contact us anytime for more information about the Graphite Electrodes market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies