【Petroleum Coke】Prices Surge: The Battle Between Natural Graphite, Synthetic Graphite, and ...

【Petroleum Coke】Prices Surge: The Battle Between Natural Graphite, Synthetic Graphite, and Silicon-Carbon Anode Materials!

As of February 7, 2025, the ex-factory price of some low-sulfur petroleum coke has quietly approached 6,000 yuan per ton, a 150% surge compared to early 2023. As a core raw material for lithium battery anode materials, fluctuations in petroleum coke prices not only impact corporate profits but could reshape the cost curve of power batteries.

Price Surge: A Confluence of Supply, Demand, Policy, and Capital

After the Spring Festival holiday, as graphite electrode companies resumed operations, the price increase of low-sulfur petroleum coke before the holiday began to show its positive impact on the graphite electrode market. This price hike, driven by rising costs, increased production pressure for companies. Major players have shown strong confidence in price hikes, although the market is slow to recover after the holiday. Currently, price increases are being driven based on pre-holiday price levels.

Supply Side: "Refining Cuts + New Energy Squeezing" as a Deadly Stranglehold

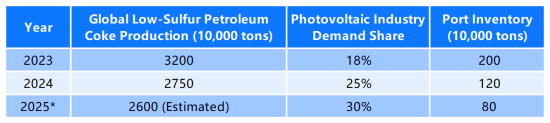

Refining Capacity Shrinks: Under global "dual carbon" policies, European and American refineries are accelerating the elimination of outdated capacity. In 2024, European refining capacity decreased by 8%, and 12% of U.S. shale oil refineries were shut down, leading to a sharp reduction in low-sulfur petroleum coke supply.

Explosive Demand for Photovoltaics: In 2024, global demand for photovoltaic-grade petroleum coke surged by 35%, with companies like Tongwei and GCL scrambling for low-sulfur coke resources, pushing prices higher.

Stockpiling Battle: Traders' stockpiles reached historical peaks, and domestic port inventory dropped from 2 million tons in 2023 to 800,000 tons, artificially creating a "false shortage."

Demand Side: The "Resource Black Hole" of Anode Material Capacity Explosion

Demand Surge: In 2024, global demand for lithium battery anode materials reached 2.2 million tons, corresponding to a demand for over 3 million tons of petroleum coke. However, actual supply was only 2.6 million tons, with a gap of 13%.

Capacity Bubble: China's anode material companies plan to produce over 5 million tons by 2025, far exceeding the global demand forecast of 3.5 million tons, escalating the competition for raw materials.

Triple Hit: Cost, Payment Terms, and Substitution Crisis

Geopolitical Impact: The "butterfly effect" of crude oil and coke prices—international oil prices surged over $120 per barrel in 2024, squeezing refining margins and exacerbating petroleum coke shortages.

Soaring Costs: The cost per ton surged by 8,000 yuan, and gross margin dropped below 10%. Producing 1 ton of synthetic graphite requires 1.2-1.5 tons of petroleum coke. At 6,000 yuan/ton, raw material costs rose from 5,000 yuan/ton in 2023 to 9,000 yuan/ton.

Funding Chain Crisis: With price cuts from downstream battery factories and payment terms extending, risks of cash flow disruption for SMEs have increased.

Threat of Technological Substitution: Silicon-Based Anode Materials

Silicon-Carbon Anode Mass Production: Tesla's 4680 battery with silicon-carbon anodes improves energy density by 20%. If petroleum coke prices remain high, the process of technological substitution may accelerate.

Industry Anxiety: Leading companies like BETTERY and SANYO have ramped up R&D investments in silicon-based anodes by 50%, but commercialization may take 3-5 years.

Breakthrough Battle: From Resource Bottlenecks to Industrial Chain Restructuring

Vertical Integration: Companies are investing in refineries and securing low-sulfur coke supplies. Others are exploring coal-based needle coke as a substitute, reducing costs by 20%.

Horizontal Technological Revolution: Natural graphite is making a comeback through surface coating modification, and silicon-based anodes are accelerating, with theoretical capacity 10 times higher than graphite.

Global Supply Chain Restructuring: From "Made in China" to "Global Layout"

Overseas Expansion: Several domestic anode material companies are investing in production bases abroad.

Petroleum Coke Import Substitution: Imports of high-sulfur coke from Russia and Venezuela are being processed through desulfurization techniques to ease supply pressures.

Future Outlook: 2026 May Be the Industry Watershed

Price Turning Point: In the second half of 2025, the supply gap for low-sulfur coke may narrow to 5% with new refining capacities in the Middle East and India.

Upward Risk: If oil prices break $150 per barrel, continued low refinery operating rates could push coke prices to 8,000 yuan/ton.

Endgame of Technological Routes

Synthetic Graphite: Market share drops from 80% to 60%, but remains the mainstream route.

Natural Graphite: Market share rises from 15% to 25%, with cost advantages.

Silicon-Based/Hard Carbon: Market share increases from 5% to 15%, entering a second growth curve.

Industry Reshaping

Market Concentration: The CR5 (top five companies) market share will rise from 70% to 85%, while smaller companies are likely to exit.

International Cooperation and Competition: Japanese and Korean companies (such as POSCO Chemical) are accelerating acquisitions of Chinese second-tier manufacturers to seize the remaining market share.

Crisis or Opportunity? The Industrial Dilemma Amid the Petroleum Coke Price Surge

The sharp rise in petroleum coke prices reflects a crisis of resource shortages but also marks a turning point in the industry, where the shift from broad expansion to lean operations could create global lithium battery material giants. The answer may lie in the next technological breakthrough or resource acquisition battle.

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies