【EAF Steel】Survey and Statistics on China's Independent Electric Arc Furnace Production

With the growth of electric arc furnace steelmaking and the new energy industry, the needle coke market has broad prospects, especially driven by the demand for high-power graphite electrodes.

【EAF Steel】Survey and Statistics on China's Independent Electric Arc Furnace Production

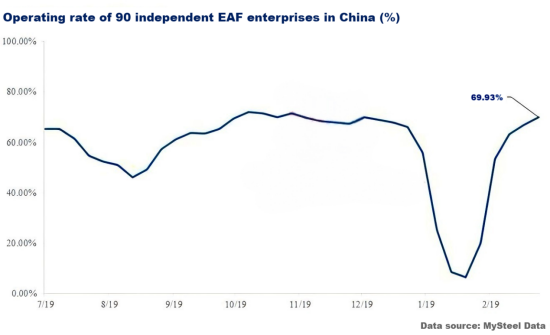

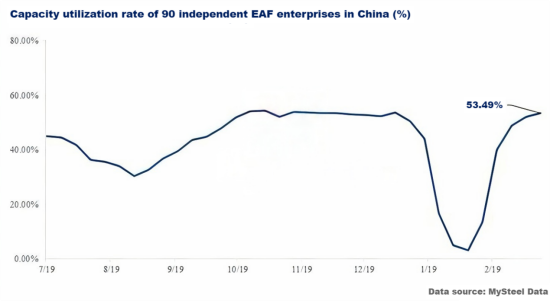

This week, the production status of 90 independent electric arc furnace (EAF) steel plants surveyed by our network (including 77 independent EAF enterprises producing construction steel) is as follows:

1、The average operating rate of 90 independent EAF steel plants in China stands at 69.96%, up 3.0 percentage points week-on-week and 1.11 percentage points year-on-year. Notably, the Northeast region showed a significant increase, while the North China, East China, Central China, and Southwest regions saw slight increases, with other regions remaining stable.

2、The average capacity utilization rate of these 90 independent EAF steel plants is 53.49%, up 1.4 percentage points week-on-week and 1.9 percentage points year-on-year. The Southwest and South China regions saw slight declines, the North China, East China, and Central China regions experienced slight increases, and the Northeast region rose significantly, while other regions remained stable.

3、The average daily crude steel output of the 90 independent EAF steel plants increased by 2.69% week-on-week.

4、Among the 77 independent EAF construction steel plants, weekly output of rebar increased by 1.93%, and weekly output of wire rod rose by 1.91%.

5、The profitability of the 77 independent EAF construction steel plants is as follows: 46.75% of the plants are making slight profits, 45.45% are breaking even (some of which are maintaining balance due to production suspensions), and 7.79% are operating at a loss.

This week, the operating rate and capacity utilization rate of independent EAF steel plants saw slight increases, with a few plants continuing to resume production. Specifically, a steel plant in Jiangsu, East China, resumed production on the 6th, involving a 60-ton EAF with a daily crude steel output of approximately 1,500 tons. Meanwhile, a steel plant in Hubei, Central China, resumed single-shift production on the 6th, involving a 70-ton EAF with a daily crude steel output of about 1,000 tons.

Currently, finished steel prices show signs of stabilizing after previous declines, and most EAF plants continue to maintain certain profits under both valley and flat electricity pricing schemes. As a result, production remains at a normal pace. However, due to weak macroeconomic drivers and limited downstream consumption, steel plants face sluggish sales, leading some to proactively reduce production time to curb output.

According to feedback from steel plants, regions like Southwest and Central China are beginning to experience tight scrap steel supply, mainly reflected in decreased arrivals at scrap recycling and processing bases. However, whether this situation will persist remains to be seen.

Looking ahead to next week, a steel plant in Henan, Central China, which suspended production last week, is expected to resume operations on the 15th. Additionally, a steel plant in Anhui, East China, is anticipated to resume production around the 20th.

As a result, the operating rate and capacity utilization rate of independent EAF steel plants are expected to continue to rise slightly next week.

Feel free to contact us anytime for more information about the artificial graphite anode market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies