【Import & Export】China Calcined Petroleum Coke & Petroleum Coke Import and Export Big Data

【Import & Export】China Calcined Petroleum Coke & Petroleum Coke Import and Export Big Data

Calcined Petroleum Coke Supply & Demand

1. Global Calcined Petroleum Coke Production Capacity

In 2024, global calcined petroleum coke production capacity will increase by about 1.54 million tons, a 2.7% year-on-year growth. In 2025, global calcined petroleum coke production capacity is expected to increase by about 3.1 million tons. China plans to add 5.275 million tons of new calcined petroleum coke capacity. In 2024, global calcined petroleum coke production will increase by about 1.87 million tons, a 5% year-on-year growth.

►Global Demand for Aluminum Calcined Petroleum Coke

In 2024, the demand for aluminum calcined petroleum coke is expected to reach 30.09 million tons, an increase of 770,000 tons compared to the previous year.

►Global Demand for Calcined Petroleum Coke in Anode Materials

The consumption of calcined petroleum coke in anode materials, especially for energy storage, will grow significantly in the coming years.

►China's Demand for Calcined Petroleum Coke in Graphite Electrodes

In 2024, China's demand for calcined petroleum coke in graphite electrodes will reach approximately 270,000 tons, a 3.8% increase year-on-year.

2. Summary

In 2024, global calcined petroleum coke supply is slightly in surplus, with a low capacity utilization rate. China's supply surplus is estimated at about 280,000 tons. Both China and overseas markets will see new production capacity, especially in China.

By 2025, this surplus may worsen.

As overseas electrolytic aluminum production resumes (South America and Europe) and new capacity is released (Southeast Asia), and with China's electrolytic aluminum output increasing, global calcined petroleum coke demand will continue to rise, but at a slower pace.

With the growth in anode materials production (especially energy storage anodes), the demand for calcined petroleum coke from anode materials is expected to increase.

In the graphite electrode sector, the increasing use of electric arc furnaces and high-power graphite electrodes (which require all needle coke) will boost the demand for needle coke, but calcined petroleum coke demand may decrease.

China Calcined Petroleum Coke Import & Export Situation

1. China Calcined Petroleum Coke Exports

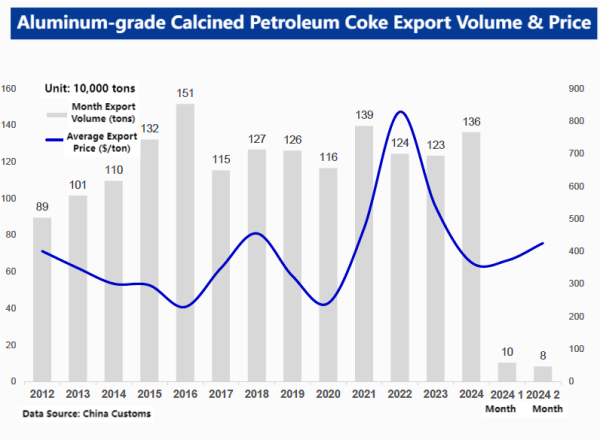

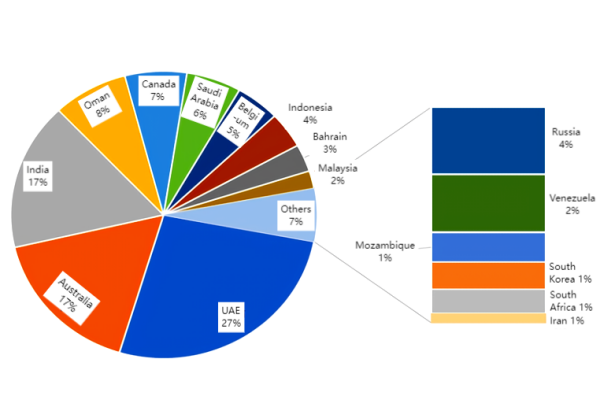

Aluminum Calcined Petroleum Coke Export Volume Change (2023 & 2024)

Exports in 2024 increased by about 130,000 tons compared to 2023.

The increase came primarily from Indonesia, Bahrain, Russia, and Australia.

Significant decrease in exports to India.

2. China Petroleum Coke Imports

►Total Petroleum Coke Imports

In 2024, China's petroleum coke imports will be about 13.39 million tons, a 1.6% decrease year-on-year.

►High Sulfur Petroleum Coke Imports (S > 3%)

Imports of high sulfur petroleum coke will be about 9.53 million tons, a 20% year-on-year decrease.

►Low Sulfur Petroleum Coke Imports (S < 3%)

Imports will be about 3.86 million tons, a 6.4% year-on-year decrease.

►Low Sulfur Petroleum Coke Import Changes

Brazil's petroleum coke imports decreased by 41% year-on-year.

Argentina's petroleum coke imports increased by 6.4%.

Azerbaijan's petroleum coke imports decreased by 69%.

Indonesia's petroleum coke imports decreased by 9.6%.

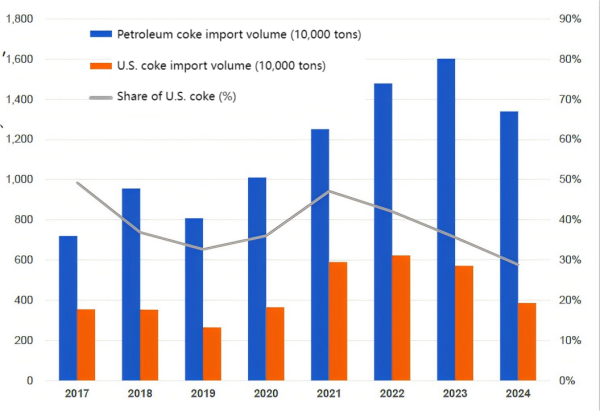

3. Impact of U.S. Tariff on Petroleum Coke Imports

From 2021 to 2024, the U.S.'s share of China's total petroleum coke imports dropped from 47% to 29%. After the implementation of equivalent tariffs, U.S. imports are expected to sharply decline.

China mainly imports high-sulfur sponge coke and low, medium, and high sulfur pellet coke from the U.S., so the impact on domestic carbon-grade petroleum coke is limited.

The U.S. petroleum coke has high substitutability, with options like Saudi Arabian and Venezuelan petroleum coke.

Fuel-grade petroleum coke is competing with coal, natural gas, and heavy oil, and the low coal prices in the fuel market will limit the medium- to long-term impact on fuel-grade petroleum coke.

4. China's Petroleum Coke Port Stock

In 2025, port inventories are expected to fluctuate between 2.5 million to 3.5 million tons.

Feel free to contact us anytime for more information about the calcined petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies