【Steel Industry】Manufacturing Demand Remains Resilient, Steel Prices Still Supported

Graphite electrodes are vital to EAF steelmaking—acting as the "core component" for arc heating. With excellent conductivity and heat resistance, they're key to improving steel quality and output. Master them, master EAF steelmaking!

【Steel Industry】Manufacturing Demand Remains Resilient, Steel Prices Still Supported

1. Recovery in Ferrous Futures Prices:

This week, the rebar main contract closed at RMB 2,995/ton, up RMB 3/ton from last week, an increase of 0.1%. The hot-rolled coil main contract closed at RMB 3,121/ton, up RMB 5/ton, or 0.16%. The iron ore main contract closed at RMB 717/ton, up RMB 14/ton from last week, or 1.92%.

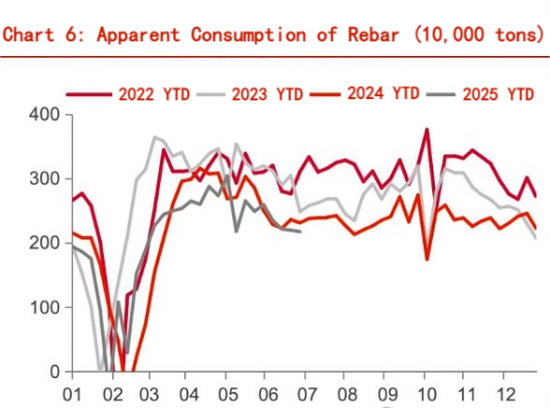

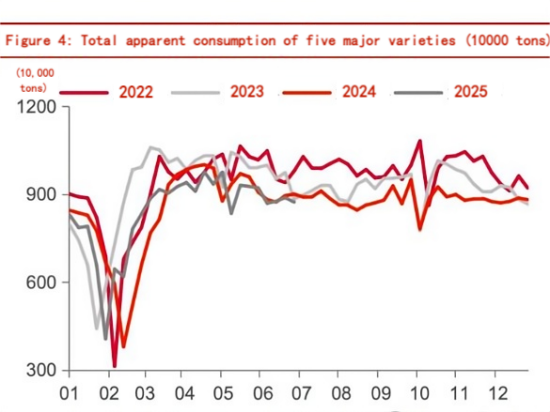

2. Apparent Consumption and Inventory of Major Steel Products:

This week, the apparent consumption of the five major steel products was 8.7317 million tons, down 151,500 tons from last week and down 274,000 tons year-on-year. Among them, rebar consumption dropped by 137,300 tons YoY, and hot-rolled coil consumption dropped by 31,700 tons YoY.

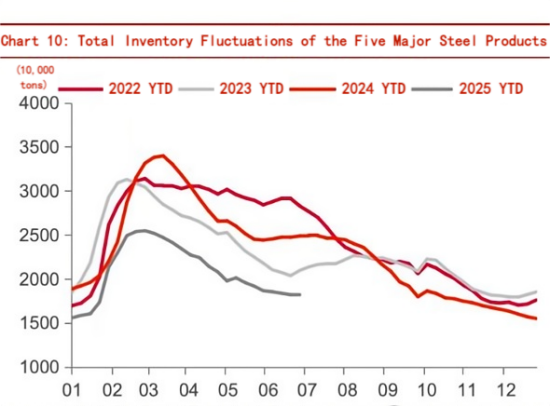

The inventory of the five major products declined. Total inventory was 18.2181 million tons, down 6.6744 million tons YoY. Rebar inventory was 7.4633 million tons (down 3.9591 million tons YoY); hot-rolled coil inventory was 4.2974 million tons (down 1.0226 million tons YoY).

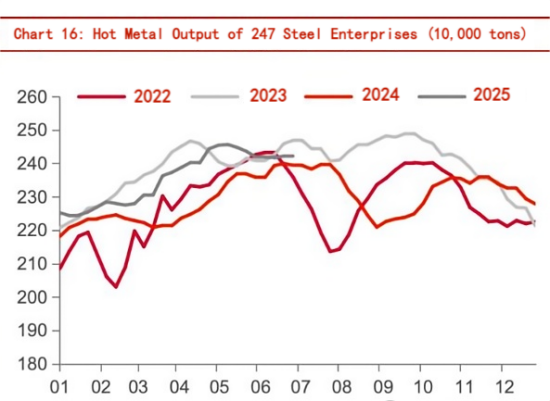

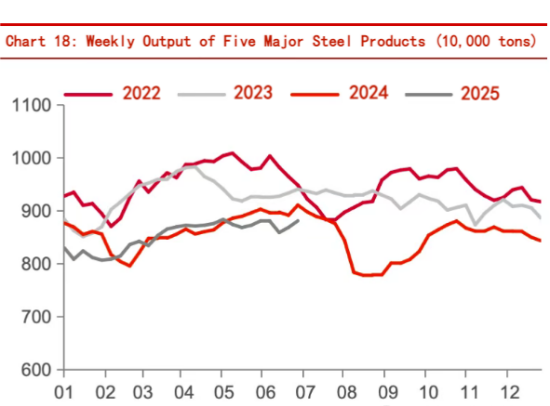

3. Pig Iron Output Up; EAF Utilization Down:

According to Mysteel, pig iron production from 247 steel mills reached 2.4229 million tons this week, up 1,100 tons WoW and 28,500 tons YoY.

Electric arc furnace operating rate and capacity utilization among 87 EAF mills dropped to 70.14% and 54.5%, respectively.

4. Steel Prices Declined Slightly:

The Myspic composite steel price index fell 0.53% from last week.

Shanghai rebar price was RMB 3,080/ton, down RMB 10/ton WoW; Shanghai hot-rolled coil was RMB 3,220/ton, down RMB 10/ton WoW.

5. Iron Ore Price Mixed, Raw Material Inventory Declines:

This week, Platts 62% iron ore rose USD 0.25 to USD 93.3/ton.

Australia's shipment volume was 18.84 million tons, up 785,000 tons WoW; Brazil's shipment volume was 8.584 million tons, down 1.865 million tons WoW.

Iron ore inventory at 247 steel plants stood at 88.4747 million tons, down 887,700 tons WoW.

Tianjin Grade 1 metallurgical coke price: RMB 1,220/ton, down RMB 50/ton WoW.

Scrap steel price: RMB 2,100/ton, down RMB 30/ton WoW.

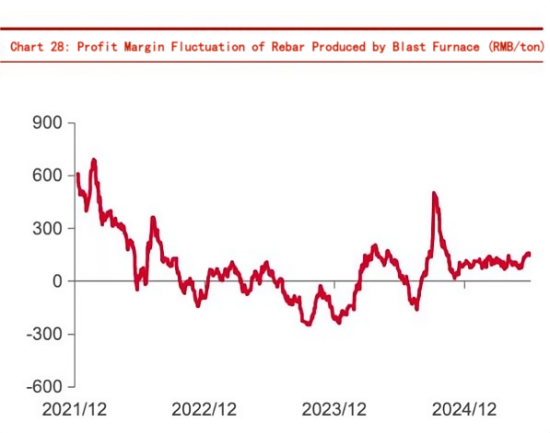

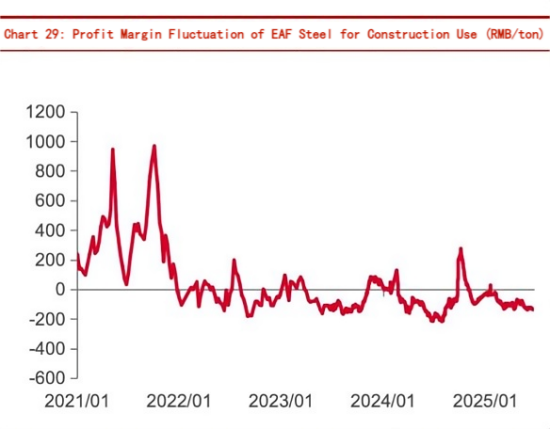

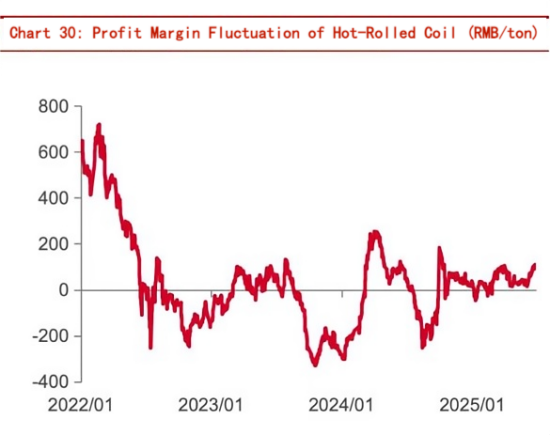

6. Steel Mill Profit Margins Remain Volatile:

This week, profit per ton was as follows:

1) Rebar (BF): -RMB 5/ton

2) Construction steel (EAF): -RMB 2/ton

3) Hot-rolled coil (BF): +RMB 5/ton

4) Cold-rolled coil: +RMB 17/ton

Among 247 steel mills, the profitability rate stood at 59.31%, stable compared with last week.

7. Downstream Demand Metrics:

1) Cement dispatch volume: 2.8075 million tons, down 1.0668 million tons YoY

2) PVC output: 459,200 tons, down 3,900 tons YoY

3) Semi-steel tire capacity utilization: 70.4%, down 9.61 percentage points YoY

4) Full-steel tire capacity utilization: 62.23%, down 0.32 percentage points YoY

Risk warning: macroeconomic volatility beyond expectations, weaker-than-expected policy support, and enterprise operational risks.

Source: “Zhongtai Steel|Manufacturing Demand Remains Resilient, Steel Price Support Still Exists”

Feel free to contact us anytime for more information about the EAF Steel market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies