【Calcined Petroleum Coke】Prices Slightly Decline — Low-Sulfur Holds Firm, ...

【Calcined Petroleum Coke】Prices Slightly Decline — Low-Sulfur Holds Firm, Mid-to-High Sulfur Under Pressure! When Will the Market Rebound?

Market Overview

On July 14, the average market price for calcined petroleum coke (CPC) in China was 2,836 RMB/ton, a decrease of 12 RMB/ton or 0.42% from the previous trading day. The low-sulfur CPC market remained stable, with most companies reporting decent sales. Thanks to favorable raw material prices, corporate losses have slightly eased. However, most producers are maintaining current capacity levels and remain cautiously optimistic about the market outlook. Prices for mid-to-high sulfur CPC were weak and stable. Some enterprises reported increasing cost pressures, but downstream buyers resist price hikes, leading to significant profit losses. A few companies have slightly reduced production based on order volumes.

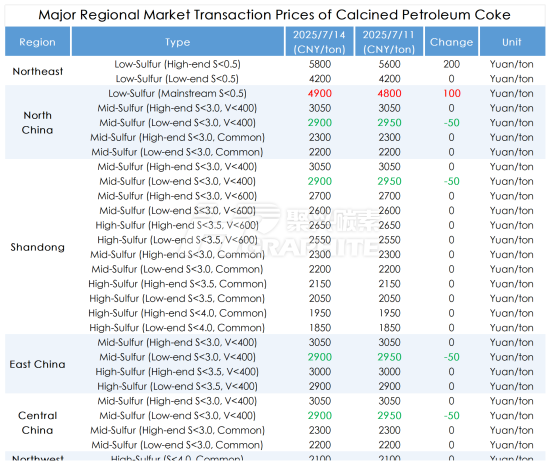

Main Regional Transaction Prices

Market Prices

Low-sulfur CPC

(1) (Raw material from Jinxi, Jinzhou): Mainstream transaction price 4,700–5,000 RMB/ton.

(2) (Raw material from Fushun): Ex-factory mainstream transaction price 5,700–5,800 RMB/ton.

(3) (Raw material from Liaohe and Binhai CNOOC): Mainstream market transaction price 4,200–4,900 RMB/ton.

Mid-to-high sulfur CPC

(1) (Sulfur content 3.0%, no trace element requirements): Previously contracted ex-factory cash price 2,200–2,300 RMB/ton; current negotiation price remains the same

(2) (Sulfur content 3.5%, no trace element requirements): Previously contracted ex-factory cash price 2,050–2,100 RMB/ton; current negotiation price remains the same

(3) (Sulfur content 3.0%, V < 400): Previously contracted ex-factory cash price 2,900–3,050 RMB/ton; current negotiation price remains the same.

Supply Side

Today, Chinese commercial CPC daily supply reached 26,355 tons, with an operating rate of 55.75%. Compared to the previous day, the supply volume remained stable.

Upstream Market

Petroleum Coke:

(1) Sinopec-affiliated refineries maintained stable pricing and shipments. Downstream anode material procurement remained solid. In regions like the Yangtze River and Shandong, anode coke shipments were active. Aluminum carbon producers mostly purchased as needed, providing some support.

(2) In East China, Yangzi Petrochemical mainly produces medium-sulfur coke, Zhenhai Refining uses its coke internally, and Shanghai Petrochemical mainly produces 4#B grade.

(3) In Northwest China, Tarim Petrochemical mainly sells to areas outside Xinjiang.

(4) CNPC-affiliated refineries shipped according to orders. In Northeast China, low-sulfur coke shipments were generally good, but Daqing and Fushun Petrochemical had limited spot supplies. Downstream steel-use carbon and anode material companies are stocking up.

(5) In Northwest China, refineries maintained steady shipments.

(6) CNOOC-affiliated refineries shipped according to orders, with Taizhou Petrochemical commencing operations today and auctioning normally this week.

Downstream Markets

(1) Graphite Electrode:

With expectations of rising raw material prices, support for electrode price negotiations slightly improved. Since many transactions are currently at a loss, mainstream producers are eager to raise prices. Low-price resources are being withdrawn, and current quotations are stable. New orders are still under negotiation.

(2) Electrolytic Aluminum:

Aluminum ingot social inventory increased by more than 20,000 tons. Coupled with weak demand, procurement is sluggish, and spot aluminum prices are falling.

(3) Anode Materials:

The anode materials market remained stable today. According to market feedback, downstream demand release is still limited. Anode producers maintain a cautious stance and continue production based on sales to avoid inventory buildup. Prices remained largely unchanged, and transaction prices stayed in a low range.

Market Outlook

In the short term, low-sulfur green coke prices are expected to remain stable, and CPC producers will continue to hold firm on pricing. Although there is some upstream optimism for mid-to-high sulfur CPC, weak downstream demand continues to weigh on pricing. The mid-to-high sulfur CPC market is likely to remain weak in the near term.

(Source: Baiinfo)

Feel free to contact us anytime for more information about the calcined petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies