【Petroleum Coke】Inventory Critical, Strong Demand from Anode Materials...

Calcined petroleum coke, with its high carbon content, low sulfur, and low impurities, plays a vital role in modern manufacturing, especially in the aluminum and steel industries.

【Petroleum Coke】Inventory Critical, Strong Demand from Anode Materials—Low-Sulfur Coke May Rise by up to RMB 200/ton!

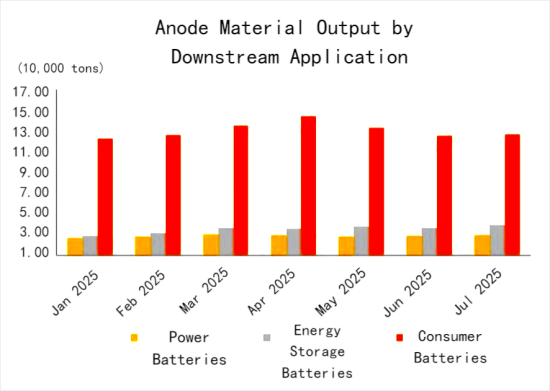

The new energy vehicle (NEV) market continues to push forward. In June, NEV production and sales reached 1.268 million and 1.329 million units respectively, up 26.4% and 26.7% year-on-year. NEV new car sales accounted for 45.8% of total new car sales.

The energy storage market has warmed since July. In early 2025 Europe experienced a cold snap, depleting natural gas inventories. The EU mandates replenishment to 90% by November. Combined with the summer peak in electricity demand and rising gas prices, electricity costs rose, driving increased household storage demand.

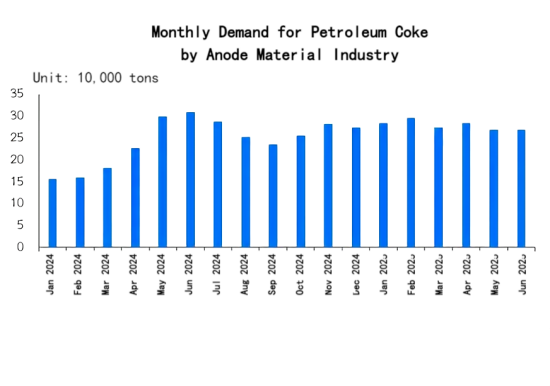

With macro-level tailwinds, anode material orders are increasing, and demand for raw petroleum coke is strong.Specifically:

1. Prior inventory consumed to low levels; restocking activity among anode manufacturers increasing.

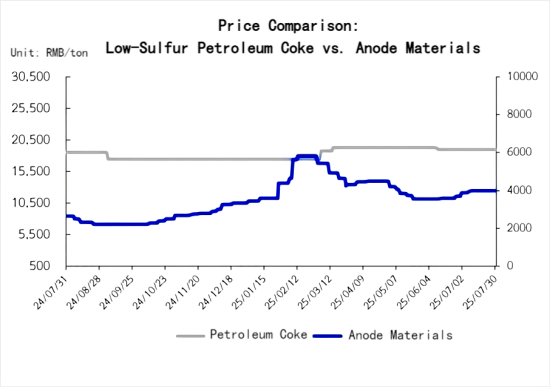

Starting in Q4 last year, anode materials entered a centralized procurement phase, boosting coke demand. By end-February, after coke prices peaked and procurement mostly ended, inventories began to be consumed. Given the typical 1–2 month production cycle, inventories were largely drawn down by late May. Since June, demand for petroleum coke from anode producers has rebounded markedly, restocking has increased, and coke prices have been pushed upward.

2. Battery plant orders for H2 are being released, favoring raw material procurement.

Beyond routine restocking, battery plant downstream orders and procurement plans began circulating in July. Some companies report decent volumes, and sentiment around petroleum coke purchases from anode producers remains positive.

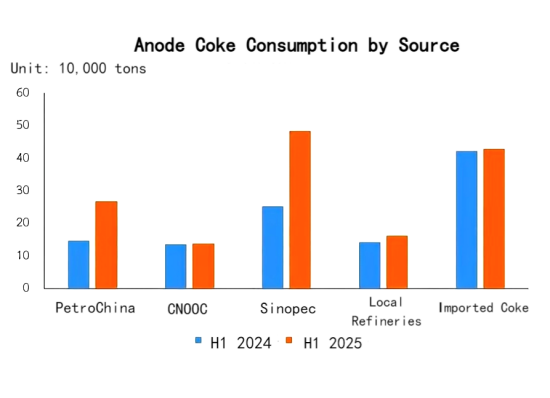

3. Raw material procurement scope expanding; structure of anode coke supply shifting.

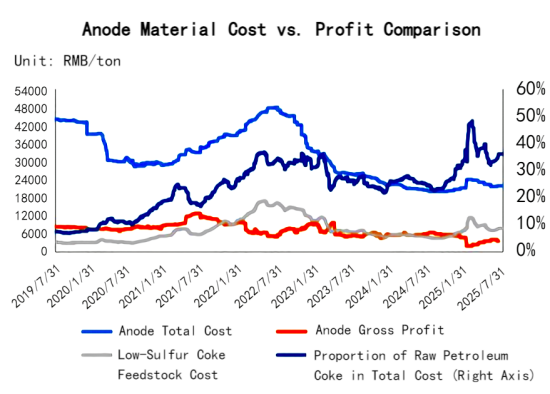

In H1 2025, total anode coke usage rose by approximately 380,000 tons—Sinopec's share grew noticeably, while PetroChina and local refineries remained relatively stable. As a result, Sinopec's anode coke demand now has greater influence on overall pricing. Coke feedstock constitutes around 30% of anode material total cost; other processing costs are relatively stable, so petroleum coke price movements significantly impact anode material costs. Low-sulfur coke and anode-grade coke remain primary procurement targets, though faced with ongoing cost pressure, some anode material firms have begun trial use of traditional carbon coke.

According to output data, #2–#3 short-term grades saw year-on-year increases in H1 2024. Additionally, some firms now custom-produce anode coke with optimized indicators (sulfur, ash content) to better align with anode material producers.

In summary, with strong demand from the energy storage market in H2 and continued support from traditional power-battery anode materials, overall anode material demand is rising. Demand for petroleum coke is expected to remain robust. In particular, Sinopec's demand in August is relatively stable. PetroChina's downstream restocking is active, even amid the Fushun Petrochemical maintenance. Therefore, in August, prices for low-sulfur coke and anode coke are expected to continue rising, with potential increases of RMB 50–200/ton.

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies