【Steel Market】Ignition! Tariffs Delayed by 90 Days! Coking Coal September Contract Hits Limit-Up...

Graphite electrodes are vital to EAF steelmaking—acting as the "core component" for arc heating. With excellent conductivity and heat resistance, they're key to improving steel quality and output. Master them, master EAF steelmaking!

【Steel Market】Ignition! Tariffs Delayed by 90 Days! Coking Coal September Contract Hits Limit-Up! Rumors of Shandong Production Cuts! Can Steel Prices Push Higher Again?

The two coking products, as predicted yesterday, staged a second rally. Once stabilized, the upside space will further open up. Rebar and hot-rolled coil also moved slightly higher as expected, but it should be noted that hot-rolled coil has touched a long-term downtrend line, while rebar has reached daily trendline resistance. With recent lower trading volumes, a pullback followed by an upward breakout remains highly probable. Meanwhile, iron ore closed at a whole-number level, leaving room for further gains.

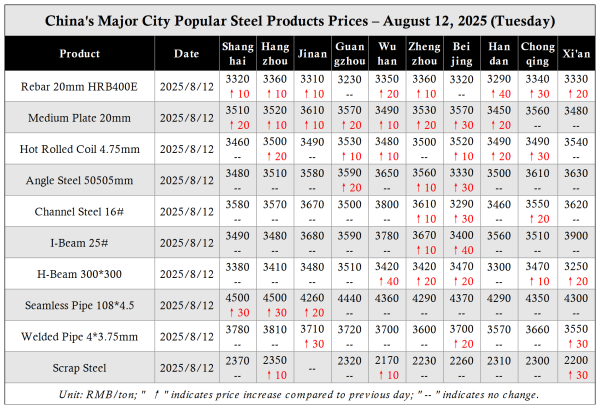

Spot Market:

Currently, spot prices have risen by 10–20 yuan/ton on average, with some increases reaching 30–50 yuan/ton. Overall market transactions are acceptable, but wait-and-see sentiment has increased.

Focus Points: Shandong coking plant production cuts, accelerated capacity control, and the special LP signing of the tariff delay order.

Factors Influencing Steel Prices

01. Rumors of Shandong Coking Plants Facing Production Cuts! Near-month Coking Coal Contracts Hit Limit-Up!

Market rumors suggest that due to activities scheduled on September 3, some coking plants in Shandong have already received verbal environmental production-cut notices, requiring them to reduce output by 30–50% from August 16 to early September. In addition, the State Mine Safety Supervision Bureau will hold a special press conference on the new version of the Coal Mine Safety Regulations at 10:00 a.m. on August 13.

Interpretation: As the September 3 event approaches, and with historical start dates for production cuts such as the 15th and 20th of the month drawing near, talk of production curtailment is increasing. Based on rough calculations, Shandong's coking capacity accounts for about 5.24% of the national total, with a 30–50% cut implying a median impact of around 2.1%. Moreover, the Shandong rumors may spark speculation about similar actions in other provinces. Against the backdrop of the new coal mining regulations and overproduction inspections, bullish sentiment in the coal market remains strong, with the September coking coal contract hitting its limit-up.

02. China–US Tariff "Truce" Extended Again

According to CNBC, U.S. President Special LP signed a last-minute decision to extend the China–US tariff "truce" for another 90 days, effective August 12.

Interpretation: On July 30, following talks between the two sides, China's public statements were positive, while the U.S. was somewhat pessimistic, stating it was waiting for Special LP's final decision. Now, the tariff delay is confirmed for 90 days. This period covers China's National Day, a time just before the U.S. Christmas import order season, meaning export resilience is still expected, which is positive for market sentiment.

Modest Rise in Spot Prices

Data shows:

1) In 19 of 24 construction steel markets, prices rose by 10–50 yuan/ton. The average price for 20mm HRB400E rebar was 3,398 yuan/ton, up 12 yuan/ton from the previous trading day.

2) In 19 of 24 hot-rolled coil markets, prices rose by 10–50 yuan/ton. The average price for 4.75mm hot-rolled coil was 3,500 yuan/ton, up 16 yuan/ton from the previous trading day.

3) In 19 of 24 medium plate markets, prices rose by 10–30 yuan/ton. The average price for 14–20mm common medium plate was 3,577 yuan/ton, up 12 yuan/ton from the previous trading day.

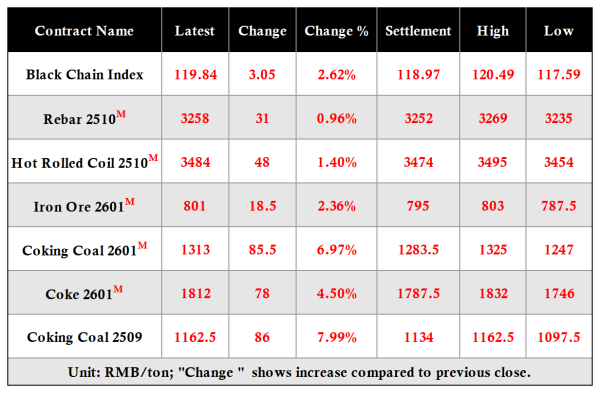

03. Futures Slightly Higher

On August 12, the black commodity complex saw gains:

4) Rebar main contract rose 31 to close at 3,258 (+0.96%)

5) Hot-rolled coil main contract rose 48 to close at 3,484 (+1.4%)

6) Iron ore main contract rose 18.5 to close at 801 (+2.36%)

7) Coking coal main contract rose 85.5 to close at 1,313 (+6.97%)

8) Coke main contract rose 78 to close at 1,812 (+4.5%)

9) September 2025 coking coal contract again hit its daily limit-up.

Comprehensive View

Judging from the current speculative behavior, the start time for this round of production cuts will likely fall between the 16th–20th or 20th–25th. In mid-August, steel mills' inventory accumulation will likely continue. Although steel data releases on Wednesday and Thursday may temporarily dampen the market's rise, if the shift from mill inventories to social inventories proceeds smoothly and orders remain strong, near-term price support will be difficult to shake.

Meanwhile, with coal market production cut logic intact and raw material costs strengthened by high hot metal output and low iron ore port stocks compared to the same period last year, short-term cost support will likely continue to resonate. In the second half of August, attention should be paid to actual destocking after the two above-mentioned time points. Tomorrow, spot prices are expected to remain stable with slight gains of 0–20 yuan.

Feel free to contact us anytime for more information about the EAF Steel market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies