【Needle Coke】High Costs, Strong Demand—Why Haven't You Risen Yet?

【Needle Coke】High Costs, Strong Demand—Why Haven't You Risen Yet?

This week, the needle coke market showed good shipment performance. Needle coke companies delivered to downstream enterprises according to orders. Inventories at most needle coke companies and port-imported needle coke stocks gradually declined, and in some cases, supply could not meet demand. Downstream enterprises placed orders at lower prices, with a few companies exchanging price for volume. However, recently, the prices of raw slurry and residual oil have been rising, and some transaction prices are about to break the needle coke cost line. Most needle coke companies have a strong intention to raise prices. Industry insiders indicate that the overall supply in the needle coke market is not high, and there are few companies with continuous stable production. Price undercutting is not conducive to the healthy development of the needle coke industry. Catering to downstream customer demand and producing differentiated, customized products is the path to healthy development.

An industry expert said: petroleum coke has already increased for 12 consecutive times, yet needle coke prices are still flat? Some transaction prices are even silently falling. Meaningless internal competition—if we do not support prices, they will collapse.

Given such falling needle coke prices, is the market

demand really that weak?

First, the graphite electrode industry, which forms the basic demand for needle coke, has already entered the traditional "golden September and silver October" period. Subsequent demand for raw materials is also expected to improve.

In the lithium battery market, analysts from Lithium Battery Cell Market and anode material sector indicate that lithium battery production remains robust. Full-capacity production for energy storage orders is expected to continue until the end of October. Therefore, incremental orders from battery plants mainly come from the power segment. The digital market in September has also clearly started, and the operation of major battery plants in October and November is expected to remain at a high level. Lithium battery output in September is expected to increase by about 10% month-on-month. The output of anode materials continues to grow, especially among first- and second-tier companies. The demand for raw material stockpiling by anode material producers is strong, and some companies are already fully occupied with preparing raw materials.

In summary:

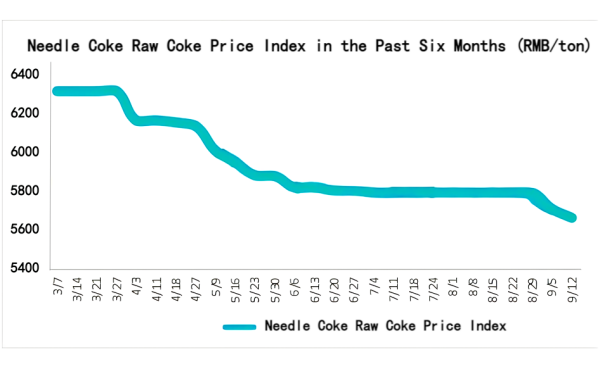

Currently, downstream anode material companies are actively stocking up, graphite electrode procurement remains stable, and overall needle coke inventories continue to decline. Meanwhile, the prices of raw slurry and residual oil keep rising. At the same time, low-sulfur petroleum coke has achieved "12 consecutive rises," yet needle coke prices remain at low levels, and some transaction prices are silently falling.

Against the backdrop of rising cost pressure and gradually improving supply-demand patterns, is it time for needle coke prices to undergo a rational recovery? Can needle coke companies break the deadlock of internal competition?

Feel free to contact us anytime for more information about the Needle Coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies