【Petroleum Coke】Q3 2025 Market Report

Calcined petroleum coke, with its high carbon content, low sulfur, and low impurities, plays a vital role in modern manufacturing, especially in the aluminum and steel industries.

【Petroleum Coke】Q3 2025 Market Report

Q3 Petroleum Coke Market Analysis and Outlook

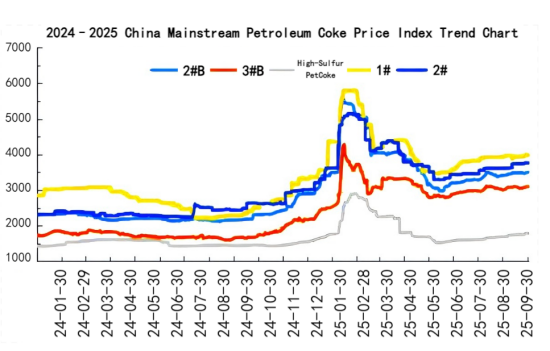

In the third quarter of 2025, China's petroleum coke market showed significant structural differentiation during the traditional "Golden September and Silver October" peak season. Low-sulfur petroleum coke saw strong price growth, supported by robust downstream demand from the new energy sector, while medium- and high-sulfur petroleum coke remained under continuous pressure due to competition from imported supplies and weak traditional demand.

In terms of price trends, the market was generally stable in July, though signs of regional divergence had already appeared. August saw increased volatility, with some companies' prices diverging significantly due to differences in resource advantages and market positioning. Entering the September peak season, market sentiment improved: major integrated refineries gradually raised their quotations, local refineries experienced smooth sales, collectively driving prices into a fluctuating upward trajectory.

On the supply side, domestic refinery coking units maintained low operating rates due to the ongoing "dual-carbon" policy and adjustments in fuel oil import tariffs. Some refineries reduced operating rates or underwent maintenance due to rising costs and compressed profits. Statistics show that national petroleum coke production from January to June 2025 fell 6.09% year-on-year, and this declining trend is expected to continue into Q3.

The import market remained active, especially with substantial shipments from the U.S., directly impacting the domestic medium- and high-sulfur segments. Port inventories showed a "high initially, then falling" pattern: inventories accumulated during July–August but rapidly declined in September as downstream procurement increased, leading to a reduction in total stock levels.

Demand continued to show differentiation. The anode materials industry remained highly active, with peak-season sales of new energy vehicles driving demand for power batteries and strongly supporting low-sulfur petroleum coke. Demand in the prebaked anode–aluminum electrolytic sector was stable, but overcapacity limited purchasing willingness. The broader carbon sector remained weak, providing limited support to the petroleum coke market.

Outlook

Supply: Domestic petroleum coke supply will remain constrained, mainly due to "dual-carbon" policy enforcement and import tariff adjustments, keeping refinery coking unit operating rates low. Production in the first three quarters of 2025 has already declined by 6.09% year-on-year. Although some refineries are expected to resume coking units in Q4, additional capacity is limited, and frequent maintenance will restrict supply recovery. On the import side, petroleum coke imports remain high, especially U.S. high-sulfur coke, which puts pressure on domestic medium- and high-sulfur prices. However, U.S. import tariffs on petroleum coke may significantly curb subsequent shipments due to China–U.S. trade friction.

Demand: Entering Q4, post-holiday market activity is expected to be cautious, with most participants observing inventories before resuming transactions. Specifically, low-sulfur coke demand will remain strong, benefiting from high growth in the new energy vehicle sector, which drives power battery anode material demand and indirectly stimulates electrolytic aluminum consumption and associated low-sulfur coke demand. Traditional sectors will maintain stable but pressured demand: the prebaked anode–aluminum chain continues essential procurement, but overcapacity suppresses profits. Graphite electrode demand remains weak.

It is expected that the Q4 petroleum coke market will continue to display a differentiated structure. Low-sulfur petroleum coke prices are likely to remain strong, supporting high-level prices, while medium- and high-sulfur petroleum coke will remain under pressure, constrained by import competition and weak downstream demand. Overall market volatility is expected to narrow, with a low probability of sharp rises or falls. Market participants need to fully understand this structural change and adjust strategies in a timely manner to seize opportunities and achieve sustainable growth in a complex and dynamic environment.

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies