【Graphite】Export Volume in the First Three Quarters Surpasses Full-Year 2024! ...

The rapid growth of the EV and energy storage industries is boosting demand for high-performance lithium batteries, driving the market for quality petroleum coke and synthetic graphite. The quality and particle size of calcined petroleum coke directly affect synthetic graphite performance, especially in anode production.

【Graphite】Export Volume in the First Three Quarters Surpasses Full-Year 2024! How Will the Easing of U.S.-Related Graphite Trade Controls Affect the Market?

On November 9, 2025, China's Ministry of Commerce issued Announcement No. 72, declaring that from now until November 27, 2026, the implementation of Article 2 of Announcement No. 46 (2024) will be suspended. This article involves adjustments to the export control of graphite and other items, drawing significant attention from the market.

Looking back, Announcement No. 46, issued by the Ministry of Commerce on December 3, 2024, based on the Export Control Law of the People's Republic of China and international non-proliferation obligations, introduced two core control measures:

A complete ban on the export of dual-use items to U.S. military end-users or for military purposes;

In principle, no approval would be granted for the export of gallium, germanium, antimony, and items related to super-hard materials to the U.S., while stricter end-user and end-use reviews on graphite exports were imposed.

This latest policy adjustment only suspends the second measure; restrictions targeting military use remain in effect.

As a strategic resource positioned at a key point in the global industrial chain, graphite has extensive applications primarily in industrial manufacturing, new energy technologies, and electronics. Its export dynamics have always been closely monitored by the market. The United States' reliance on graphite imports and supply chain layout further highlights graphite's strategic importance.

According to U.S. import statistics for 2024, its major graphite import sources include China, Canada, Madagascar, Mozambique, Mexico, Brazil, South Korea, Sri Lanka, Japan, Norway, Turkey, Germany, etc. Among them, China accounted for as much as 48.21%, maintaining an absolute leading position.

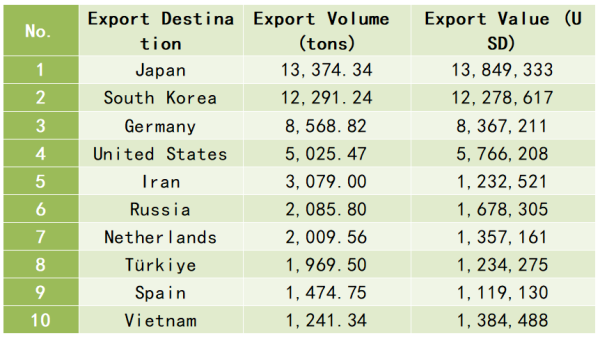

According to China's Customs data, the total graphite export volume in 2024 reached 64,043.16 tons, and the top 10 export destinations accounted for 51,119.82 tons or 79.82% of the total exports, indicating strong concentration in export destinations. Among these major destinations, the U.S. ranked fourth, with 5,025.47 tons of graphite exported from China to the U.S. in 2024. Detailed export data is shown in the table below:

Facing its high dependency on Chinese graphite, U.S. enterprises have launched global supply chain expansion initiatives. Titan Mining Corporation announced that the construction of the United States' first integrated natural flake graphite production facility in more than 70 years is progressing as planned and is expected to complete commissioning by the end of 2025, aiming to fill domestic production gaps.

Recently, U.S.-based graphite company Nouveau Monde Graphite Inc. (NMG) and international metal commodity trader Traxys North America announced an upgraded cooperation agreement. The parties finalized a binding revised joint marketing and offtake agreement under which Traxys will procure 20,000 tons of graphite concentrate annually from NMG's Matawinie Phase-II Project. The agreement only awaits approval by the Traxys Board of Directors.

Even so, due to the U.S. domestic graphite industry still falling short in quality and scale, it remains reliant on imports from China in the short term.

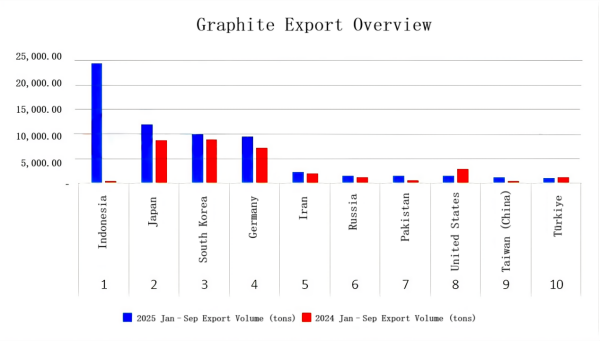

Entering 2025, China's graphite exports have shown a significant upward trend. From January to September 2025, the total export volume reached 73,678.06 tons, an increase of 25,974.98 tons or 67.06% YoY. Compared with the full-year volume of 2024, this is still 9,634.90 tons higher.

From a comparison of the top 10 major export destinations during the same period, the landscape has shifted. Detailed figures are shown in the table below:

From these comparative data, Indonesia has become China's largest graphite export destination in January–September 2025, with export volume surging by 23,980 tons YoY. Except for the U.S. and Turkey, China's graphite exports to the other eight major markets all achieved positive growth.

Among them, China's graphite exports to the U.S. decreased by 1,452.31 tons YoY in January–September 2025, a drop of 49.73%—a trend that may correspond with U.S. tariff policies and supply chain localization efforts; however, its reliance remains hard to overturn in the short term.

It is noteworthy that on November 7, the Ministry of Commerce already suspended certain export controls on super-hard materials, rare earths, lithium batteries, and other items. Together with this recent suspension concerning graphite, it sends a broad signal of easing trade tensions across multiple sectors.

As a crucial strategic resource, graphite's export policy adjustments, the shifts in China-U.S. import and export data, and the U.S. pursuit of supply chain autonomy together provide an essential lens into current China-U.S. economic interactions and global industrial chain dynamics.

The temporary suspension of the measure applying "stricter end-user and end-use review on the export of dual-use graphite items to the U.S." will undoubtedly shape future graphite export trends. Mysteel Refractories Window will continue to monitor updates.

Feel free to contact us anytime for more information about the Anode Material market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies