【Petroleum Coke】Will Prices Keep Rising? Supply Increases While Demand Weakens, ...

Calcined petroleum coke, with its high carbon content, low sulfur, and low impurities, plays a vital role in modern manufacturing, especially in the aluminum and steel industries.

【Petroleum Coke】Will Prices Keep Rising? Supply Increases While Demand Weakens, Prices May Continue Narrow Fluctuations!

1. Market Overview

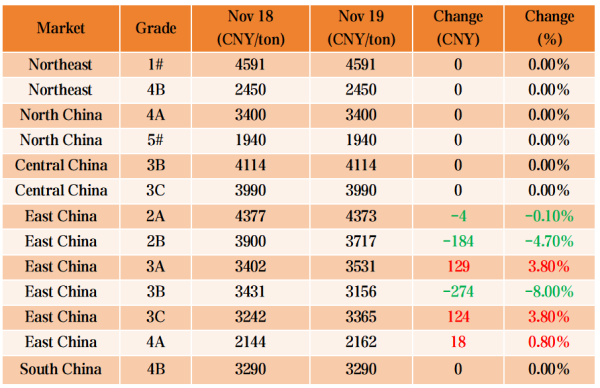

On November 19, the domestic petroleum coke market showed a general pattern of mainstream stability and differentiation among local refineries. Trading activity was moderate, with transaction prices fluctuating within a stable range. Among them, major refineries such as Sinopec and PetroChina mainly executed order contracts, shipments were smooth, and coke prices remained stable; meanwhile, local refineries' shipments varied, resulting in mixed transaction price changes, with adjustments ranging from 10 to 160 CNY/ton. On the demand side, performance was slightly weak. Traditional aluminum carbon enterprises slowed their purchasing sentiment, mostly adopting a wait-and-see approach; anode material enterprises were cautious in entering the market, providing limited support for raw material purchases. In addition, affected by export control policies, petroleum coke—especially low-sulfur coke—has increasingly shown strategic resource characteristics. In the long term, its supply-demand pattern and price level face a systematic re-evaluation.

2. Fundamentals

01 Supply

On November 19, the domestic petroleum coke market supply generally showed a steady-to-increasing trend. Regarding major refineries, Sinopec, PetroChina, and refineries under CNOOC mainly executed order contracts, shipments were smooth, inventories were mostly at medium to low levels, and coke prices remained stable, keeping supply steady. However, local refineries' shipment situations were differentiated. Some refineries flexibly adjusted prices according to their shipment conditions, resulting in mixed transaction price movements. It is noteworthy that the national daily output of petroleum coke reached 83,450 tons, and the operating rate of coking units rose to 65.37%, an increase of 0.99% compared with the previous day. Meanwhile, units such as Hualong Petrochemical resumed production, indicating an overall increase in total market supply. Nevertheless, the overall supply pattern still features mainstream stability with minor local adjustments.

02 Demand

On November 19, downstream demand for petroleum coke was generally weak and support was limited, with overall purchasing sentiment tending to be cautious. In the traditional aluminum carbon market, purchasing slowed, and enterprises mostly adopted a wait-and-see stance; in the anode material market, market participants were cautious, providing weak support for petroleum coke purchases. Specifically, demand in the low-sulfur calcined petroleum coke market was weak, and enterprises maintained low production loads; medium- and high-sulfur ordinary calcined petroleum coke lacked cost support, and downstream graphitization enterprises were not strongly motivated to purchase, showing a polarized trend. In addition, procurement enthusiasm in silicon enterprises, fuel markets, and port spot markets also slowed, with fewer orders signed. Overall, downstream sectors mainly purchased on demand, providing limited positive pull for the petroleum coke market.

3. Price Forecast

It is expected that on November 20, domestic petroleum coke prices will generally remain stable, with some local refineries possibly making slight adjustments according to the market. On the one hand, major refineries such as Sinopec and PetroChina mainly execute order contracts, shipments are smooth, inventories are mostly at medium to low levels, providing support for coke prices; on the other hand, trading activity in local refineries is acceptable, but downstream support is uneven, and some enterprises may flexibly adjust prices according to their own shipment conditions, with expected adjustments ranging from 10 to 100 CNY/ton. However, purchasing sentiment among downstream aluminum carbon, anode material, and other enterprises is generally cautious, with purchases mainly on demand, providing limited overall support for the petroleum coke market. Coupled with market participants' mostly wait-and-see attitude, the market is expected to continue the pattern of mainstream stability with localized narrow fluctuations.

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies