【Petroleum Coke】Year-on-Year Increase of 48.76%! Capacity Release and High Costs,...

Calcined petroleum coke, with its high carbon content, low sulfur, and low impurities, plays a vital role in modern manufacturing, especially in the aluminum and steel industries.

【Petroleum Coke】Year-on-Year Increase of 48.76%! Capacity Release and High Costs, November Imports Expected to Continue Declining

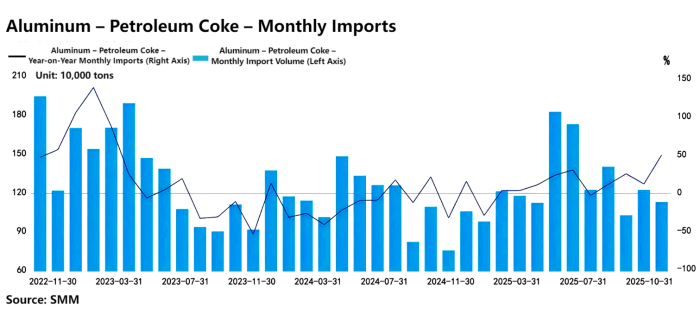

Customs data show that in October 2025, China imported 1.1324 million tons of petroleum coke, down 7.54% month-on-month, but up 48.76% year-on-year; a rough estimate puts the October petroleum coke import price at 225.02 USD/ton, up 5.47% month-on-month and 60.97% year-on-year. From January to October 2025, China's cumulative petroleum coke imports totaled approximately 13.0862 million tons, up 15.24% year-on-year.

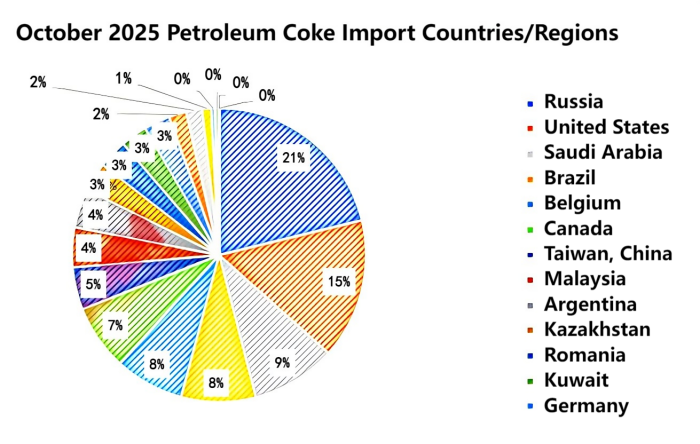

In terms of import countries, in October 2025 China's petroleum coke mainly came from Russia, the United States, and Saudi Arabia, with import volumes (import shares) of 240,000 tons (21%), 175,000 tons (15%), and 105,800 tons (9%), respectively.

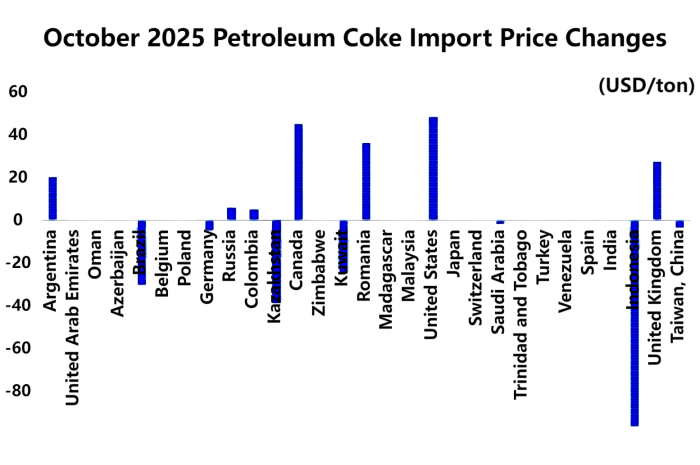

Regarding import prices, petroleum coke import prices in October 2025 showed mixed movements, with an average import price of approximately 225.02 USD/ton, up 5.47% month-on-month.

In October, petroleum coke was imported from a total of 20 countries/regions, among which 14 countries had continuous import volumes. The import prices from the United States, Canada, and Romania increased significantly, with rises exceeding 30 USD/ton. Prices from Indonesia, Kazakhstan, and Brazil declined noticeably, with Indonesian petroleum coke prices falling by over 90 USD/ton, making it the source country with the largest price fluctuation.

Since the fourth quarter, the domestic petroleum coke market supply side has shown a dual divergence trend of accelerated domestic capacity release and contraction in imported supplies, and the market supply-demand pattern is undergoing a phase adjustment.

From the domestic supply perspective, entering the fourth quarter, refinery maintenance schedules have slowed significantly, and new maintenance plans have been greatly reduced. At the same time, previously shut-down refineries have accelerated their restart processes, and some long-term idle enterprises have gradually resumed production, causing domestic petroleum coke output to continue rising. The incremental effect on domestic supply is gradually becoming apparent.

On the demand side, since November, after petroleum coke prices climbed to high levels, downstream companies' willingness to take delivery has cooled, and market purchasing has become more cautious, creating a certain absorption pressure on domestic supply increments.

The domestic petroleum coke market fundamentals have not provided a good basis for imports. Coupled with adjustments in international trade, imports from the United States are expected to continue declining due to rising costs, and international petroleum coke prices remain high, further suppressing import purchasing enthusiasm. Overall, domestic petroleum coke imports in November are very likely to continue the downward trend.

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies