【Petroleum Coke】Down 7.79%! November Independent Refinery Coke Prices Declined

Calcined petroleum coke, with its high carbon content, low sulfur, and low impurities, plays a vital role in modern manufacturing, especially in the aluminum and steel industries.

【Petroleum Coke】Down 7.79%! November Independent Refinery Coke Prices Declined

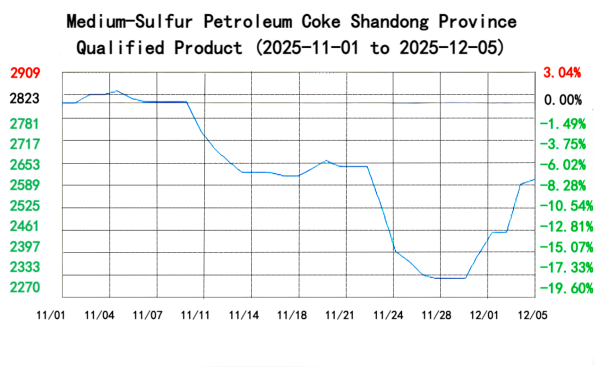

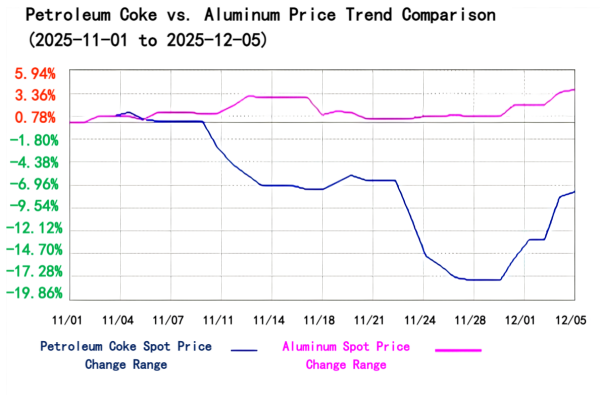

In November, the petroleum coke market of China's independent refineries moved downward, while the early December market showed signs of stabilization and rebound. As of December 5, the mainstream price of medium-sulfur petroleum coke from major independent refineries was 2,603.25 RMB/ton, compared with 2,823.25 RMB/ton on November 1, representing an overall decline of 7.79%.

Cost Side

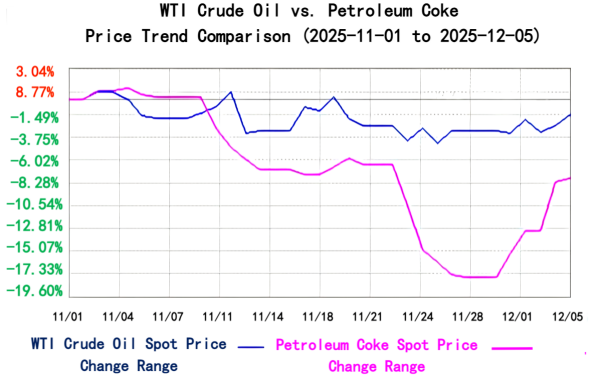

International crude oil prices fluctuated downward in November:

• Early in the month, markets weighed the impact of potential oversupply, while expectations improved as the U.S. government shutdown appeared likely to end, boosting economic and demand sentiment, resulting in rising oil prices.

• Mid-month, the United States proposed a new plan to restart Russia-Ukraine peace talks, easing geopolitical concerns and pushing international oil prices lower.

• Late in the month, rumors emerged that Ukraine had agreed to the revised Russia-Ukraine peace plan proposed by the U.S., further easing geopolitical concerns and driving oil prices downward.

Supply Side

Petroleum coke prices at independent refineries declined in November:

• In early November, the market remained mostly stable. Downstream demand performed well, and low refinery inventory supported petroleum coke prices.

• In mid-November, prices fell slightly, with some refineries adjusting product indicators. Petroleum coke prices fluctuated accordingly. Downstream procurement remained acceptable, lending some support to the market, and refinery shipments were manageable.

• In late November, prices dropped significantly. Refinery shipments were hindered, prompting widespread price cuts. With indicator adjustments at some refineries, prices changed noticeably. Downstream buyers grew more cautious, limiting support for the market, and refinery transactions weakened.

In November, imported petroleum coke was primarily delivered under previously signed contracts, while the signing of new orders was limited and prices declined.

Demand Side

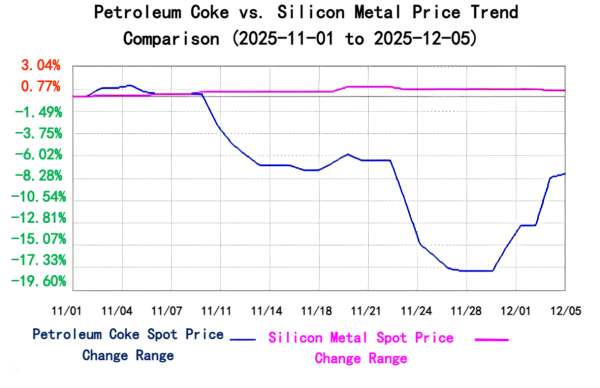

In November, overall silicon-metal supply decreased. Although some northern plants increased production, reductions in operating rates in Sichuan and Yunnan drove a decline in total market supply. Overall supply pressure eased. Downstream demand for silicon metal remained cautious, with buyers showing a degree of wait-and-see sentiment and mainly inquiring at low levels. Demand transmission remained relatively loose, but the silicon industry continued to exhibit certain demand for petroleum coke.

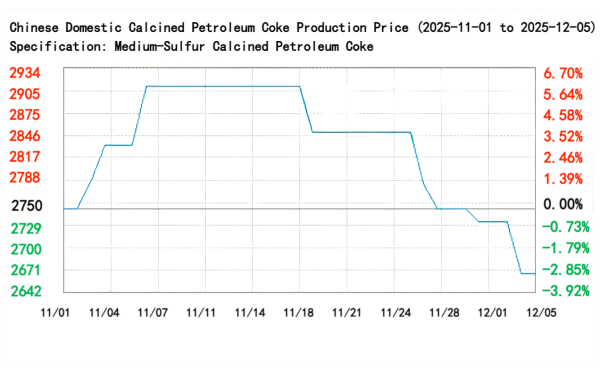

Prices of medium- and high-sulfur calcined Petroleum coke declined in November, mainly influenced by lower petroleum coke prices upstream. Downstream buyers mostly adopted a wait-and-see approach, and calcined Petroleum coke producers were cautious in their offers.

In November, electrolytic aluminum prices first rose and then fell. China's operating electrolytic aluminum capacity reached 44.06 million tons, approaching the policy cap of 45 million tons. Capacity utilization remained high, and most new projects were replacement capacity. For example, the 210,000-ton replacement project at Xinjiang Qiya Aluminum Power is scheduled to start production only at the end of 2026, meaning no new capacity will be added in December. Downstream carbon-product demand for petroleum coke remained rigid.

Market Outlook

Entering December, the independent-refinery petroleum coke market has stabilized and rebounded. Downstream producers still require petroleum coke, primarily for rigid-demand procurement. In addition, the December 2025 prebaked anode benchmark procurement price at a major aluminum plant in Shandong increased, providing positive support to the petroleum coke market.

However, some graphite electrode enterprises may face production disruptions due to seasonal factors and may plan shutdowns, which could reduce their petroleum coke demand. Overall, the petroleum coke market is expected to show narrow-range fluctuations in the near term.

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies