【Graphite Electrode】Month-on-Month Increase of 1.04%! Weak Downstream ...

Graphite electrodes are the essential consumables in EAF steelmaking. Due to their outstanding electrical conductivity and excellent high-temperature resistance, they play a critical role in ensuring efficient and stable furnace operation, thereby improving steel production capacity and product quality.

【Graphite Electrode】Month-on-Month Increase of 1.04%! Weak Downstream Support Limits Further Price Growth

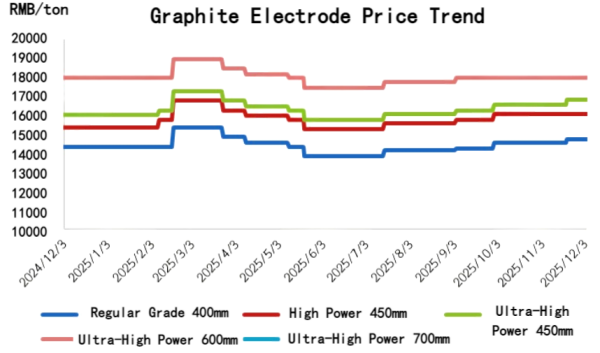

The graphite electrode market has remained relatively stable over the past month. Prices of small and medium-sized electrodes have increased slightly, and upstream raw material prices are gradually stabilizing. However, downstream market demand has been lukewarm since the National Day holiday, resulting in poor performance in new orders for graphite electrode enterprises. Overall shipments are mainly based on the execution of previous orders. By the end of October, bearish sentiment began to emerge in the market. Coupled with occasional end-of-year promotional orders, downstream steel mills showed stronger pressure for price reductions. At present, mainstream graphite electrode prices remain firm and stable.

Cost Trend

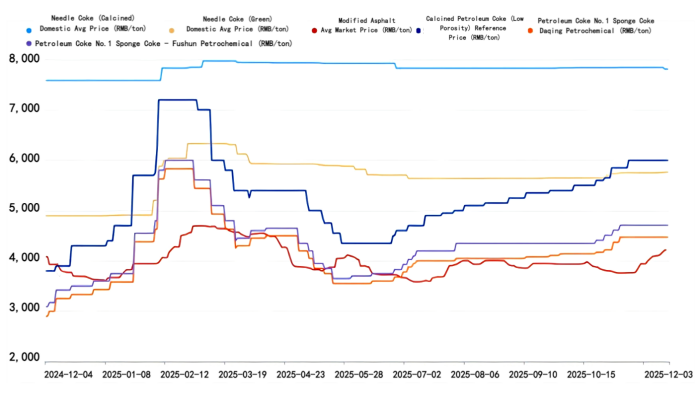

The needle coke market has shown a slight upward trend, mainly reflected in the green coke market. The calcined petroleum coke market shows little price fluctuation due to restricted demand. As of the time of writing, the average market price of calcined needle coke is 7,812 RMB/ton, down 0.37% from the same period last month and up 2.99% from the beginning of the year.

The petroleum coke market has seen slower trading activity. Price-pushing efforts by major refineries face resistance, and some local refineries have reduced prices recently. As of the time of writing, the average market price of low-sulfur petroleum coke is 4,520 RMB/ton, up 2.55% month-on-month and up 34.22% from the beginning of the year.

Coal tar pitch operating rates have declined, tightening supply in the market. Combined with rising raw material costs, prices have increased in some regions. As of the time of writing, the average market price of coal tar pitch is 4,215 RMB/ton, up 11.13% from last month and up 16.08% from the beginning of the year.

Low-sulfur calcined petroleum coke (using Jinxi/Jinzhou petroleum coke as raw material) has mainstream transaction prices of 5,850–6,100 RMB/ton;

Low-sulfur calcined petroleum coke (using Fushun petroleum coke as raw material) has ex-factory mainstream transaction prices of 6,400–6,500 RMB/ton;

Low-sulfur calcined petroleum coke (using Liaoyang/Binzhou CNOOC petroleum coke as raw material) has mainstream transaction prices of 5,350–5,700 RMB/ton.

Export Data

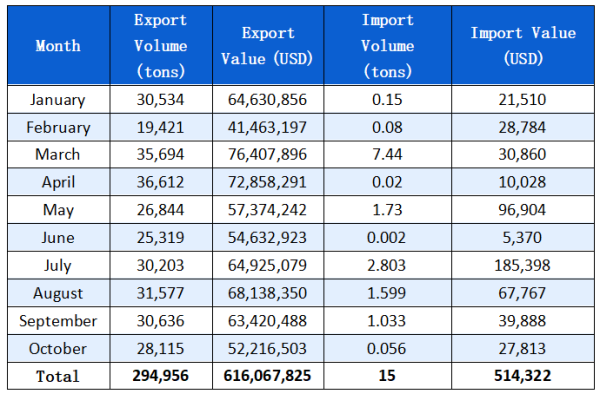

According to customs statistics, China's graphite electrode export volume in October 2025 was 28,100 tons, down 8.23% month-on-month and up 14.4% year-on-year. From January to October 2025, China's total graphite electrode exports reached 295,000 tons, an increase of 6.91% year-on-year.

The main export destinations for China's graphite electrodes in October 2025 were: UAE, Russia, and Angola.

Graphite Electrode Monthly Trade Data Table in 2025

Downstream Market

Steel Mills: In November, affected by environmental protection and production-restriction policies, some steel mills issued maintenance notices, leading to shortages in certain product specifications. Output remained low, supply tightened, and arrivals were still limited. Major steel mills significantly increased their ex-factory prices, providing some support to market prices.

On the other hand, the market entered a seasonal off-peak period, with weak circulation and declining trading activity. There were hidden price cuts in actual transactions, and mainstream traders saw reduced volumes. Some low-priced resources were traded off the market. With colder weather approaching, downstream operations decreased, resulting in further shrinking demand. End-user procurement plans also declined. Market participants have adopted a cautious approach, and pessimism dominates under the reality of weak demand.

Yellow Phosphorus: Due to rising electricity prices in major production areas such as Yunnan and Sichuan, yellow phosphorus production costs increased significantly. China's yellow phosphorus output in November 2025 decreased noticeably. According to incomplete statistics, output reached approximately 85,980 tons in November—down 13.85% month-on-month and up 8.7% year-on-year.

Compared with October 2025:

Yunnan output decreased by 12.76%

Guizhou output decreased by 17.57%

Sichuan output decreased by 16.45%

National operating rates for yellow phosphorus facilities stood at 70.12%, down 13.23% month-on-month.

Metallurgical Silicon: In November, the southwestern regions entered the flat-water and dry-water periods, leading to increased electricity prices and rising production costs. Most manufacturers reduced or suspended production under pressure. According to statistics, the total number of silicon furnaces is 796 nationwide. Compared with October 27, the number of operating furnaces decreased by 55. As of November 25, China had 265 furnaces in operation, with an overall operating rate of 33.29%.

Market Outlook

Currently, raw material prices for graphite electrodes are fluctuating frequently, but major refineries have no clear plans to adjust prices. Graphite electrode producers mostly remain cautious and adopt a wait-and-see attitude, with careful raw material procurement. Meanwhile, downstream steel mills will soon begin pre-Chinese New Year stocking, which will increase inquiries in the market. Enterprises will adopt more cautious price quotes.

In the short term, graphite electrode prices are not expected to fluctuate significantly in December. The expected price range is 14,300–21,900 RMB/ton.

Feel free to contact us anytime for more information about the EAF Steel market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies