【Needle Coke】Rising Output Without Rising Profits — 2026 Urgently Needs a Price Increase

【Needle Coke】Rising Output Without Rising Profits — 2026 Urgently Needs a Price Increase

2025 marked an important turning point for China's needle coke market. Driven by downstream demand from the lithium battery anode materials sector, shipment volumes in the domestic needle coke industry improved significantly.

In 2025, domestic needle coke capacity entered a phase of slow growth. The nominal capacity of China's needle coke producers stood at 3.938 million tons, unchanged from 2024. However, actual output increased substantially. According to statistics, China's total needle coke production in 2025 reached 1.454 million tons (at the beginning of 2023, the author forecast China's 2025 needle coke output at 1.455 million tons), representing an increase of about 75% year on year. It is worth noting that coal-based needle coke producers endured a particularly difficult period but benefited from demand support from anode materials. As a result, some coal-based needle coke producers also achieved relatively stable shipments in 2025.

The strong performance of domestic needle coke producers in 2025 was inseparable from the strong support of the anode materials industry. In 2025, the global lithium battery market continued to expand, with surging demand for anode materials. Annual needle coke procurement exceeded 1.1 million tons, and it is forecast that domestic anode material demand for needle coke will reach a new high again in 2026.

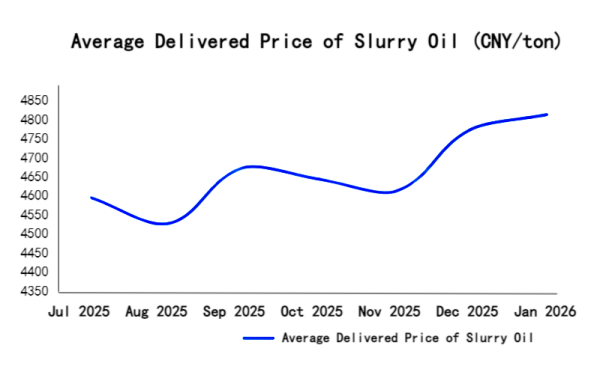

Looking at the current market situation, demand for anode materials remained strong at the beginning of 2026. Needle coke producers currently in operation continue to run at high utilization rates, with some producers shipping excessive volumes of green needle coke. Needle coke for anode use is in short supply, and inventories across producers remain at persistently low levels. Meanwhile, feedstock slurry oil prices continue to rise. Many needle coke producers reported that slurry oil has become increasingly difficult to procure, prices keep increasing, and in some cases, material is simply unavailable.

This cost–price inversion has placed many needle coke producers in a difficult operating dilemma. On the one hand, the rising difficulty and cost of procuring upstream slurry oil directly compress profit margins, and in some cases lead to the awkward situation of "the more you produce, the more you lose." Some producers, in order to maintain basic production continuity and customer relationships, have no choice but to continue purchasing high-priced raw materials, while remaining deeply concerned about future operating prospects. On the other hand, downstream anode material companies, leveraging their strong position in the industrial chain, strictly control procurement prices for needle coke, leaving needle coke producers with limited bargaining power to pass through costs. At the same time, most needle coke producers do not have abundant cash flow. Industry insiders stated: "Downstream buyers are holding prices down, needle coke faces strong resistance to price increases, raw material prices keep rising, by-products are unprofitable, and needle coke production costs are inverted. We are facing the decision of whether to cut output."

With cost inversion, surging demand, and tight supply, needle coke prices urgently need to rise from multiple perspectives. The current price adjustment is an inevitable stage for the industry to move toward maturity and for high-quality enterprises to stand out. Producers should stand together and support one another, and should no longer allow the leading companies to regret being the first to push prices higher.

Feel free to contact us anytime for more information about the Needle Coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies