【Graphite Electrode】Price Hike Hard to Sustain! Upstream Costs Rise, Downstream Buys...

【Graphite Electrode】Price Hike Hard to Sustain! Upstream Costs Rise, Downstream Buys on Demand — How Long Can Prices Stay "Stable"?

Market Overview

Prices of low-sulfur petroleum coke, a key upstream raw material, have slightly increased, offering mild support to market sentiment. However, downstream demand remains sluggish, with limited new orders. Most graphite electrode producers are focused on fulfilling previous contracts. To ease inventory pressure and maintain production-sales balance, some firms are considering production cuts. While mainstream enterprises remain stable in output and sales, the overall market sees minor fluctuations with prices holding steady.

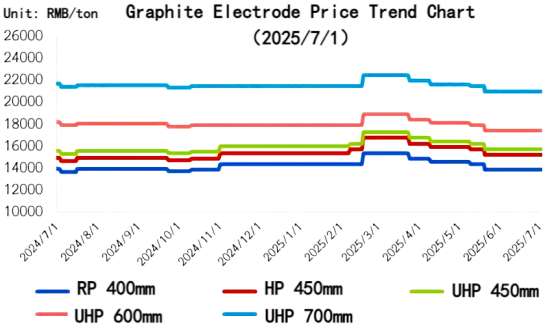

Price Range (Diameter 300–600mm):

1) Regular Power: ¥13,500–15,200/ton

2) High Power: ¥14,500–17,000/ton

3) Ultra High Power: ¥15,000–17,900/ton

4) UHP 700mm: ¥20,500–21,400/ton

Supply

Operating rates remain at medium-to-low levels. Most enterprises continue stable production with orders largely from long-term clients. Output is based on actual sales.

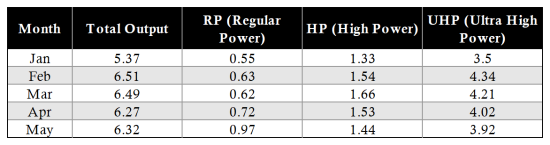

Monthly Graphite Electrode Production (10,000 tons)

Cost

Downstream buyers are actively entering the market.

1) Low-sulfur petroleum coke: Average price ¥3,593/ton, up 2.28% WoW

2) Calcined needle coke: Average price ¥7,927/ton, unchanged WoW

3) Coal tar pitch: Average price ¥3,724/ton, up 0.08% WoW

Overall, raw material price fluctuations are limited, and comprehensive costs for graphite electrodes are slightly rising.

Demand

1. Steel Sector: Construction steel prices dropped significantly this month. Profit margins for steel mills are under pressure, and the current off-season for end-use construction projects has reduced operational motivation. Many mills are reducing or controlling output, lowering overall operating rates, and consequently reducing electrode consumption.

Steelmakers are mainly purchasing based on immediate needs, relying on in-house stock and bidding cautiously.

2. Non-Steel Sectors: Phosphorus and silicon metal producers increased operations during the wet season due to electricity discounts, slightly boosting graphite electrode demand. However, given weak markets and poor profits, they often bargain down prices.

Export

Ongoing overseas conflicts are raising risks in China's graphite electrode exports. Trade and transport challenges have made exporters more cautious. The expanding Israel-Iran conflict is particularly problematic, affecting both local trade and logistics.

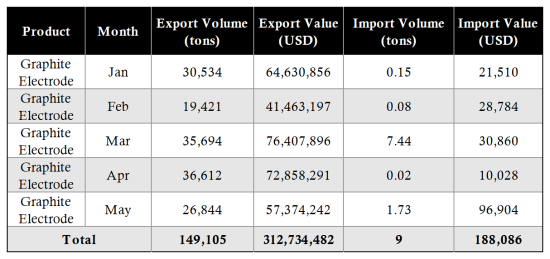

Customs Data (May 2025):

1) Export volume: 26,800 tons, down 26.68% MoM, up 5.14% YoY

2) Jan–May total: 149,100 tons, up 5.70% YoY

3) Top export destinations: Russia, UAE, South Korea

China's Graphite Electrode Import and Export Volume and Value (Jan–May 2025)

Market Outlook

Supply Side:

Some previously idled producers are preparing to restart production next month. However, due to weak market conditions, enthusiasm for production remains low, and output could decline for some producers.

Demand Side:

Steel mills may increase operations to rush projects before peak summer heat, offering some improvement in graphite electrode demand.

Export Side:

Higher sea freight rates and disruptions on some shipping routes are negatively affecting graphite electrode exports.

Overall Outlook:

Demand-side signals are turning positive, but whether they can drive prices upward remains uncertain. In the near term, mainstream graphite electrode prices are expected to remain stable, with the market in a wait-and-see mode.

Feel free to contact us anytime for more information about the Graphite Electrodes market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies