【Calcined Petroleum Coke】Weak Downstream Demand, CPC Shipments Under Pressure

【Calcined Petroleum Coke】Weak Downstream Demand, Calcined Petroleum Coke Shipments Under Pressure

Market Overview

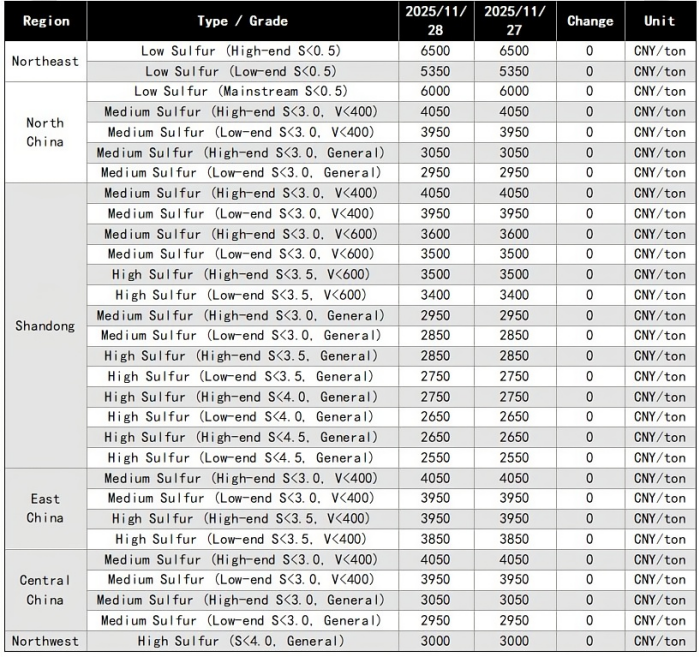

On November 28, the average market price of calcined petroleum coke was 3,710 RMB/ton, down 13 RMB/ton from the previous working day, a decrease of 0.35%. Today, the low-sulfur calcined petroleum coke market remained stable, with low-sulfur raw coke prices holding steady, but downstream market demand remained weak. There are few positive factors supporting the low-sulfur calcined petroleum coke market, and mainstream transactions were mostly stable. Today, shipments of medium- and high-sulfur calcined petroleum coke were ordinary, with downstream enterprises maintaining a wait-and-see attitude, purchasing cautiously. Some enterprises reduced calcined petroleum coke prices under pressure by 50–100 RMB/ton.

Low-sulfur calcined petroleum coke (using Jinxi and Jinzhou petroleum coke as raw material) market mainstream transaction prices: 5,850–6,100 RMB/ton;

Low-sulfur calcined petroleum coke (using Fushun petroleum coke as raw material) ex-factory mainstream transaction prices: 6,400–6,500 RMB/ton;

Low-sulfur calcined petroleum coke (using Liaohe and Binzhou Zhonghai petroleum coke as raw material) market mainstream transaction prices: 5,350–5,700 RMB/ton.

Medium- and high-sulfur calcined petroleum coke (S 3.0%, trace elements not required) previous mainstream ex-factory contract cash price: 2,900 RMB/ton, today's discussed mainstream ex-factory cash price: 2,900 RMB/ton;

Medium- and high-sulfur calcined petroleum coke (S 3.5%, trace elements not required) previous mainstream ex-factory contract cash price: 2,750–2,850 RMB/ton, today's discussed mainstream ex-factory cash price: 2,750–2,850 RMB/ton;

Medium- and high-sulfur calcined petroleum coke (S 3.0%, V 400) previous contract cash price: 3,950–4,050 RMB/ton, today's discussed ex-factory cash price: 3,950–4,050 RMB/ton.

Supply Situation

Today, Chinese daily supply of commercial calcined petroleum coke was 28,154 tons, with an operating rate of 57.95%. Today's calcined petroleum coke market supply remained stable compared with the previous working day.

Upstream Market

Petroleum Coke: Today, Sinopec refineries maintained stable prices and shipments. In the Yangtze River region, anode orders still provided support, and shipments of anode coke were generally without pressure. Jingmen Petrochemical is expected to produce anode coke as the main product next month. In North China, Luoyang Petrochemical mainly shipped anode coke. In South China, demand remained stable, with Guangzhou Petrochemical mainly producing medium- and low-sulfur coke. In Northwest China, Tahe Petrochemical shipped outside the region, mainly for aluminum carbon use.

Today, CNPC refineries executed orders at stable prices. In Northeast China, refineries shipped normally with inventories generally unpressured. In North China, Daqing Petrochemical continued shipping by order, and Northwest China refineries traded at stable prices, mainly for aluminum carbon. Today, CNOOC refineries shipped according to orders.

Downstream Market

Graphite Electrodes: Entering the heating season this month, some regions experienced increased air pollution, causing environmental restrictions on production. Some enterprises reduced calcining processes by 50–70%, while other processes were less affected. Mainstream large producers showed no significant production changes. The graphite electrode market saw a slight slowdown in internal supply, but some companies maintained steady green coke production, and semi-finished product inventories remained sufficient.

Electrolytic Aluminum: From January to October, profits of large-scale industrial enterprises in China declined sharply year-on-year, reflecting weaker overall industrial vitality and slightly increasing operating pressure on downstream enterprises. Spot aluminum prices fell.

Anode Materials: Today, the anode material market remained stable. Market feedback indicates that downstream demand remains strong, with some enterprises reporting sufficient orders. Weekly overall operating rates of anode material enterprises increased slightly compared with last week. However, due to structural overcapacity in the anode material industry, the possibility of short-term price increases is low.

Market Outlook

Low-sulfur calcined petroleum coke raw materials are bearish for the market, and downstream demand continues to be sluggish. Low-sulfur calcined petroleum coke prices are expected to remain weakly stable. The medium- and high-sulfur calcined coke market is trading steadily, with downstream enterprises mostly purchasing as needed. Calcined petroleum coke prices are expected to fluctuate within a narrow range.

(Source: Baiinfo)

Feel free to contact us anytime for more information about the calcined petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies