【Petroleum Coke】Price (Feb. 5): A Strong Start! Up by 29 Yuan!

【Petroleum Coke】Price (Feb. 5): A Strong Start! Up by 29 Yuan!

On February 5, the average market price of petroleum coke was 2,442 yuan/ton, up by 29 yuan from the previous working day, an increase of 1.20%. The petroleum coke market continued its positive trend after the Spring Festival holiday, with overall trading activity remaining stable. Although a small volume of imported low-sulfur coke has arrived at ports, most of it had been pre-booked, providing limited supplementation to domestic supply. Low-sulfur coke from major refineries remains in tight supply, with active shipments. Medium- and high-sulfur coke is mainly fulfilling existing orders, with some price adjustments upward. Some local refineries have either halted operations or reduced production, leading to a strong price-supporting sentiment, with price increases prevailing.

As of February 6, 2025, the average market price of calcined petroleum coke (CPC) in China was 3,120 RMB/ton, up 52 RMB/ton from the previous trading day, an increase of 1.69%. This price increase was mainly driven by the rise in raw material costs. However, downstream demand remains limited, and acceptance of high-priced low-sulfur CPC is not strong. Currently, the mainstream transaction price for low-sulfur CPC ranges between 3,400–3,700 RMB/ton.

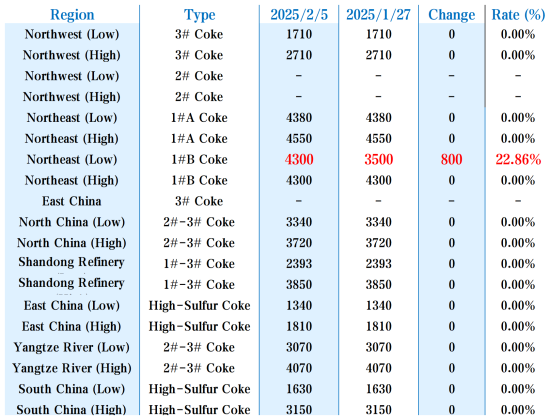

Major Regional Market Transactions

· Sinopec-affiliated refineries: Prices remained stable, with orders being executed as planned. Refineries in the Yangtze River region reported steady shipments, supported by high operating rates at major anode material producers and sustained end-user demand. Notably, Anqing Petrochemical and Hunan Petrochemical mainly supply anode material manufacturers. In North China, Yanshan Petrochemical primarily sold 4B-grade coke, Shijiazhuang Refinery supplied 4A-grade coke, while Cangzhou Refinery focused on 3#C and 4#A-grade coke shipments.

· CNPC-affiliated refineries: Prices remained largely unchanged. Low-sulfur coke in Northeast China saw strong sales, with overall supply remaining tight. In Northwest China, Yumen Petrochemical sold through competitive bidding, raising prices by 150 yuan/ton, while other refineries maintained stable trading.

· CNOOC-affiliated refineries: No auctions have been conducted yet, with the schedule pending confirmation.

· Local refineries: The petroleum coke market in independent refineries saw active trading, with price increases dominating. During the holiday, some refineries reduced production due to weak refining margins, leading to lower daily petroleum coke output. This supply contraction further supported petroleum coke prices, with most refineries increasing prices by 60–250 yuan/ton. However, a few refineries adjusted prices downward by 50 yuan/ton to stimulate sales.

o Tianhong Chemical's petroleum coke sulfur content rose to 4.15%, and vanadium content increased to 781 PPM, prompting a 60 yuan/ton increase in its auction reserve price.

o Jiangsu Xinhai's petroleum coke sulfur content decreased to 2.6%, with vanadium content falling to 389 PPM.

o Haihua Group's petroleum coke sulfur content dropped to approximately 1.4%, with the latest auction price at 3,853 yuan/ton.

o Xintai Petrochemical's northern facility saw its petroleum coke sulfur content decline to 3.8%, raising its price by 200 yuan/ton.

Imported Coke Market

During the holiday, new shipments of imported petroleum coke continued to arrive at ports. However, since most sponge coke shipments were pre-sold, supply remains tight. Overseas sponge coke tender prices continued to rise. Additionally, China announced that from February 10, 2025, it will impose additional tariffs on certain imports from the United States. However, petroleum coke is not included in this tariff adjustment, meaning U.S. petroleum coke import costs will remain unaffected.

Market Outlook

The supply shortage in the petroleum coke market is expected to persist, with domestic supply projected to decline further. Given the limited availability of imported coke as a supplement, the market remains well-supported. Downstream demand remains stable, with buyers continuing to purchase on a need basis. The petroleum coke market is expected to remain stable in the short term, with potential price increases for certain grades. It predicts that pellet coke prices will remain stable in the near term.

(Source: Baiinfo)

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies