【CPC】Alert! Over 3.6 Million Tons of New Capacity Incoming, Price Ceiling Emerges!

【Calcined Petroleum Coke】Alert! Over 3.6 Million Tons of New Capacity Incoming, Price Ceiling Emerges!

Looking ahead to the second half of the year, with the gradual release of new capacity, the trend of abundant supply will continue, while the structural differentiation of downstream demand will become the key factor affecting market direction and price fluctuations, likely presenting a "third-quarter rebound, fourth-quarter decline" oscillation pattern.

First Half of the Year: Coexistence of Oversupply and Cost-Driven Prices

Supply Side: Slight Decline in Production, Increased Imports, Overall Ample Supply

In the first half of 2025, the total supply of calcined petroleum coke market reached 13.2782 million tons, a slight year-on-year decrease of 0.36%. The supply structure showed a characteristic of "domestic decrease, foreign increase":

Domestic Production Decline:

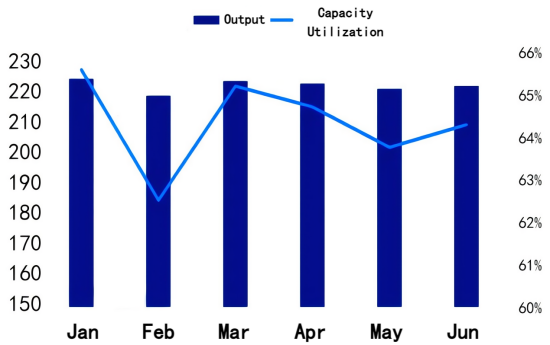

Affected by downstream demand, domestic companies' production enthusiasm was low. The total domestic output in the first half was 13.16 million tons, down 70,000 tons year-on-year, a decrease of 0.53%.

Specifically, the carbon for steel market (graphite electrodes, etc.) was weak, leading low-sulfur calcined petroleum coke companies to reduce production or halt production; the aluminum carbon (prebaked anodes) market demand was good, but the anode material market slowed its restocking in Q2. Medium- and high-sulfur calcined petroleum coke companies mostly produced based on orders, resulting in a slight year-on-year decline in output.

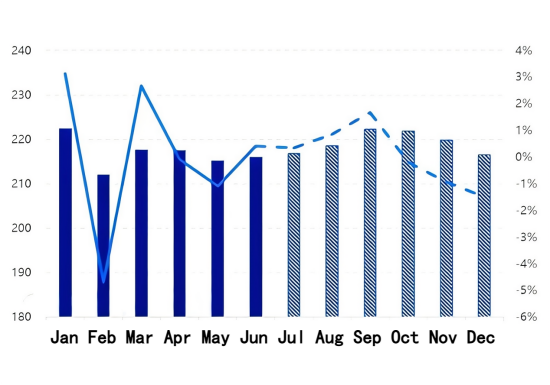

First Half Calcined Petroleum Coke Production and Operating Rate Trend Chart

(from Oilchem, same below)

Significant Increase in Imports:

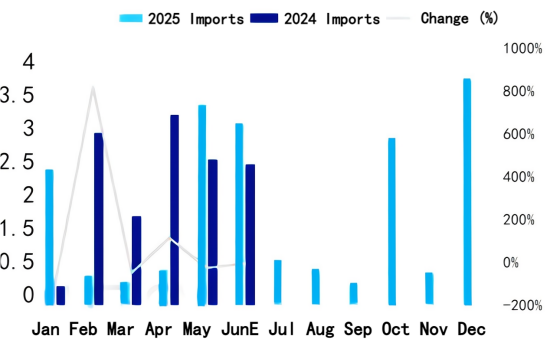

In the first half of the year, imported calcined petroleum coke was estimated at 118,200 tons, a significant year-on-year increase of 24.55%.

The main reason was that during February to April, domestic raw material costs were high, driving calcined petroleum coke prices sharply upward, while overseas prices remained relatively stable. The price gap advantage attracted downstream users to import. After May, as domestic prices fell, imports began to decline.

Calcined Petroleum Coke Import Volume Trend Chart (Jan-Jun)

Price Trend: Cost-Driven Rise Then Fall, Significant Year-on-Year Increase

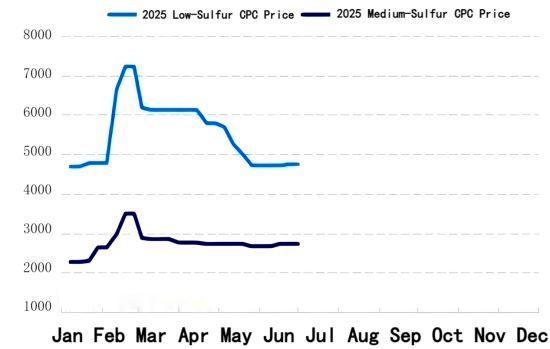

In the first half, calcined petroleum coke prices were closely linked to cost trends.

According to Longzhong data estimates, the average market price of low-sulfur calcined petroleum coke in H1 was 5,571 CNY/ton, up 26.98% year-on-year; the average price of medium- and high-sulfur calcined petroleum coke was 2,709 CNY/ton, up 25.53% year-on-year.

First Half Calcined Petroleum Coke Price Trend Chart

Late January to Late February:

Supported by rising raw petroleum coke prices and concentrated restocking of prebaked anodes and anode materials downstream, cost support was strong, pushing calcined petroleum coke prices to the annual peak.

March to Present:

Downstream restocking was basically completed, demand support weakened, and coupled with falling raw material prices, calcined petroleum coke prices declined accordingly. Especially for low-sulfur calcined petroleum coke, due to the persistently low operating rate in the graphite electrode market downstream, demand dropped sharply, putting greater downward pressure on prices.

Second Half of the Year: Continued Supply-Demand Contradictions, Prices Under Pressure

Supply Side: New Capacity Continues to Release, Oversupply Pattern Intensifies

In the second half, supply pressure in the calcined petroleum coke market will further increase.

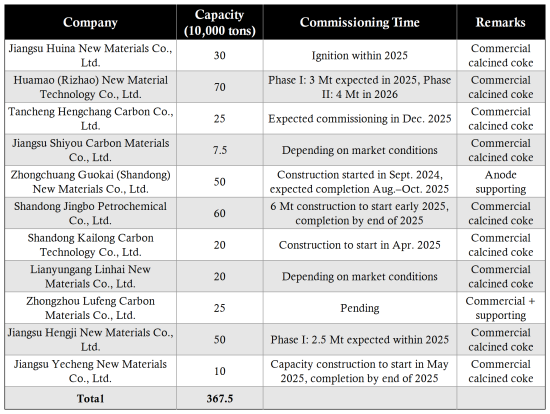

Capacity Expansion:

It is expected that 3.675 million tons of new capacity (including commercial and supporting) will be put into operation in H2, with total national capacity reaching 44.735 million tons/year by the end of the year.

Production Increase:

With new equipment coming online and reduced downtime losses, domestic calcined petroleum coke production in the second half is expected to rise to 13.2 million tons, up 0.3% from the first half.

Total Supply:

Including the estimated 113,000 tons of imports, total market supply in H2 is expected to reach 13.313 million tons, a 0.26% sequential increase.

Overall, the "supply exceeding demand" situation will continue in H2, with market supply remaining ample.

Demand Side: Clear Structural Differentiation, Limited Overall Growth Space

Total demand in H2 is expected to show a "rise then fall" trend, but the growth rate will be limited.

Total Demand Forecast:

Q3 consumption is expected to be 6.57 million tons, a sequential increase of 1.38%; Q4 consumption is expected to be 6.59 million tons, a slight sequential increase of 0.3%.

H2 2025 Downstream Demand Forecast Chart (10,000 tons)

Downstream Market Performance Differentiation:

Prebaked Anode Market (Stable Demand):

As the main consumption field, operating load in H2 will remain stable at 76–78%, providing solid demand support for the calcined petroleum coke market.

Anode Material Market (Main Growth Point and Variable):

In Q3, driven by downstream restocking and hydropower price incentives in southern regions, operating load is expected to rise; however, Q4 will enter the traditional off-season, and demand will decline. The average operating load in H2 is expected to be 64%.

Graphite Electrode Market (Continued Drag):

Affected by weak demand in the terminal steel industry, operating load in H2 is expected to remain around a low 30%, with limited improvement in demand for low-sulfur calcined petroleum coke.

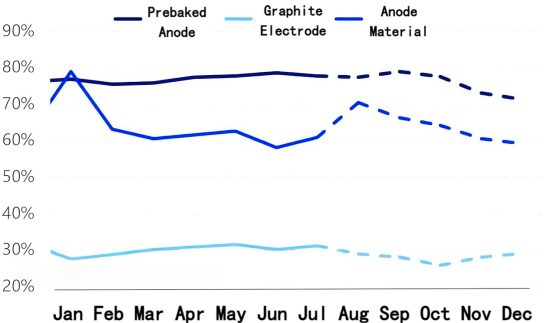

H2 2025 Downstream Capacity Utilization Forecast Chart

Price Forecast: Rebound in Q3 Driven by Demand, Pressure to Fall in Q4

Comprehensively analyzing both supply and demand, changes in demand will be the core driver of price trends in H2.

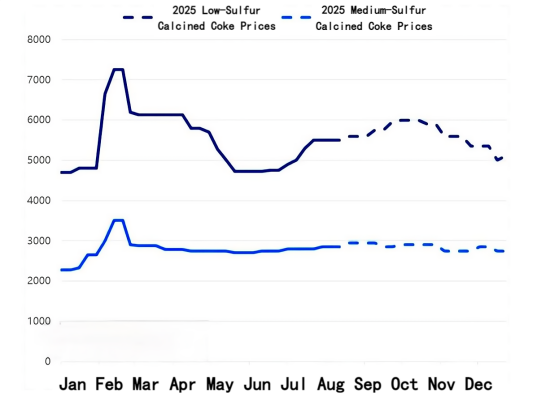

Calcined Petroleum Coke Market Price Forecast Chart (CNY/ton)

Q3:

Phase-based procurement demand from the anode material market will be the main market driver, boosting trading activity.

The average price of low-sulfur calcined petroleum coke is expected to fluctuate between 5,500–5,950 CNY/ton, and medium-sulfur calcined petroleum coke adjusted to 2,700–2,950 CNY/ton.

Q4:

As the anode material market enters the off-season, coupled with environmental policy impacts in some regions, negative factors increase. Downstream procurement demand will gradually slow, supply-demand contradictions will intensify, and transaction prices will face downward pressure.

The average price of low-sulfur calcined petroleum coke is expected to fall to 5,100–5,300 CNY/ton, and medium-sulfur calcined petroleum coke adjusted to 2,500–2,750 CNY/ton.

Summary

Looking ahead to the second half of 2025, the fundamentals of the calcined petroleum coke market are unlikely to fundamentally reverse.

On the supply side, continued new capacity deployment will further loosen the market, while on the demand side, although there is stable support from the prebaked anode market and temporary highlights from anode materials, they are insufficient to fully absorb the supply increment, and the continued weak graphite electrode market exacerbates structural oversupply.

Therefore, the market will overall continue to show a supply-exceeding-demand pattern, with price trends mainly driven by seasonal changes in downstream demand, presenting a "third-quarter rebound, fourth-quarter decline" oscillation pattern, but overall upside space will be significantly constrained by oversupply.

Feel free to contact us anytime for more information about the calcined petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies