【Anode Materials】Overall Gross Margin of China's Lithium Battery Anode Materials Industry...

The rapid growth of the EV and energy storage industries is boosting demand for high-performance lithium batteries, driving the market for quality petroleum coke and synthetic graphite. The quality and particle size of calcined petroleum coke directly affect synthetic graphite performance, especially in anode production.

【Anode Materials】Overall Gross Margin of China's Lithium Battery Anode Materials Industry in Mid-December

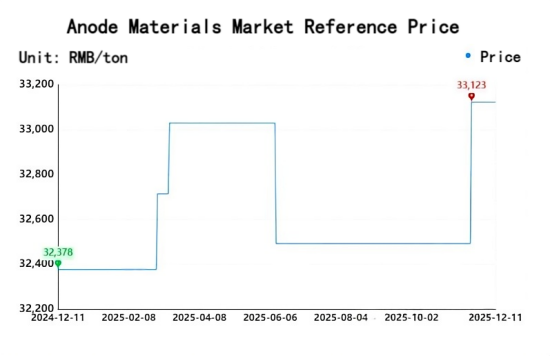

1. Market Price Situation

This week, the average market price of lithium battery anode materials in China was 33,123 yuan/ton, remaining generally stable compared with last week. Mainstream prices for high-end anode materials were 42,000–65,000 yuan/ton, mid-end anode materials were 23,000–32,000 yuan/ton, and low-end anode materials were 17,000–23,000 yuan/ton. Overall market trading was mainly stable this week.

On the cost side, the decline in prices of medium- and low-sulfur petroleum coke during the week led to a slight decrease in production costs for anode material producers. However, current anode material prices have approached the cost line, making cost reduction and efficiency improvement across the entire industry chain increasingly urgent. Meanwhile, some downstream cell manufacturers still have expectations of further lowering procurement prices, and profit margins of anode material producers remain under pressure.

Overall, industry survival pressure has intensified significantly. Small and medium-sized enterprises lacking differentiated product advantages and strong cost control capabilities continue to face the risk of being eliminated from the market.

2. Supply and Demand

Supply:

It is estimated that anode material output this week was approximately 64,000 tons, of which artificial graphite anode materials accounted for about 58,700 tons, representing 91.7% of total weekly anode material output, while natural graphite anode materials accounted for about 5,300 tons, representing 8.3% of total output.

Demand:

As year-end grid connection of energy storage projects enters a concentrated period, multiple hundred-megawatt-level energy storage power stations have been commissioned across various regions in China. At the same time, explosive growth in the global energy storage market has driven a surge in export orders. As a result, the battery cell industry may exhibit a "traditionally slow season that is not slow," with full-capacity operation, and some leading enterprises already have orders scheduled through 2026.

Under the resonance of dual demand drivers, anode materials, as a core supporting component, have seen solid support on the demand side.

3. Cost and Profit

Cost:

This week, the production cost of anode material enterprises was approximately 23,039.45 yuan/ton, down 56.42 yuan/ton from last week, a 0.24% week-on-week decrease.

The price of 1# petroleum coke fell by 82 yuan/ton compared with December 4; 2# petroleum coke prices declined by 34 yuan/ton compared with December 4. Coating pitch prices remained stable; needle coke green coke prices were stable; and outsourced anode graphitization processing fees remained stable. Overall, production costs for anode material enterprises moved downward.

Profit:

This week, the overall gross margin of China's lithium battery anode materials industry was approximately 2,893.05 yuan/ton, up 1.95% week on week.

With production costs declining slightly and anode material prices remaining stable, overall production profits of anode material enterprises increased.

4. Market Outlook

From the demand perspective, continuous growth in the energy storage market has become the core driving force for anode material demand growth, while demand from the power battery and consumer electronics markets has remained stable without significant fluctuations. Together, these factors support overall stable demand for anode materials.

From a market perspective, the issue of overcapacity in the anode material market has not yet been resolved, and operating rates of some small and medium-sized enterprises remain below the industry average. Against this backdrop, competition for orders within the market is becoming increasingly intense, and low-price competition has shown no clear improvement.

Overall, favorable factors and pressures coexist in the anode material industry. Although growing energy storage demand provides support, continued cost-reduction pressure across the entire industry chain and the overcapacity landscape are likely to limit short-term price increases. Therefore, it is expected that anode material prices will remain stable next week, namely:

High-end anode materials: 42,000–65,000 yuan/ton

Mid-end anode materials: 23,000–32,000 yuan/ton

Low-end anode materials: 17,000–23,000 yuan/ton

Feel free to contact us anytime for more information about the Anode Material market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies