【Anode Materials】Year-End Inventory Control, Anode Shipments Remain Stable

The rapid growth of the EV and energy storage industries is boosting demand for high-performance lithium batteries, driving the market for quality petroleum coke and synthetic graphite. The quality and particle size of calcined petroleum coke directly affect synthetic graphite performance, especially in anode production.

【Anode Materials】Year-End Inventory Control, Anode Shipments Remain Stable

At present, downstream demand remains positive and anode orders are relatively abundant. However, year-end inventory control has weakened the enthusiasm for raw material procurement. Low-sulfur petroleum coke prices have ended their continuous rise, and graphitization processing orders remain stable.

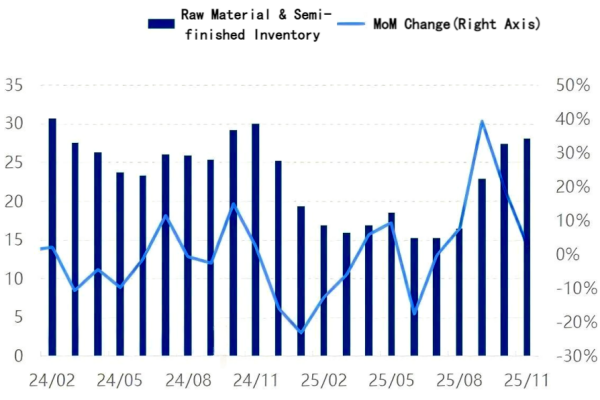

I. Raw Material and Semi-finished Product Inventories Increased 2.55% Month-on-Month in November

Figure 1: Comparison of Anode Material Raw Material and Semi-finished Product Inventories (Unit: tons)

Data source: Oilchem

In November 2025, the raw material and semi-finished product inventories of major anode material enterprises reached 281,900 tons, up 2.55% month-on-month. The growth rate of inventories slowed, mainly because raw material prices remained at high levels, and anode material purchasing slowed, focusing on maintaining just-in-time inventory for essential demand.

II. Anode Output Increased in November

In November 2025, anode material output reached 252,600 tons, up 75.34% year-on-year and 2.23% month-on-month. Demand for anode materials continued to grow, and production lines of leading battery companies were running at high operating rates, driving a slight increase in the operating rate of artificial graphite anode materials.

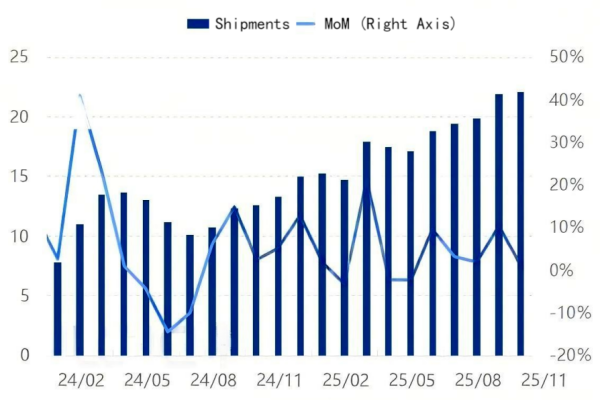

III. Stable Anode Shipments, Demand Remains Steady to Positive

Figure 2: Comparison of Anode Material Shipment Volumes (Unit: tons)

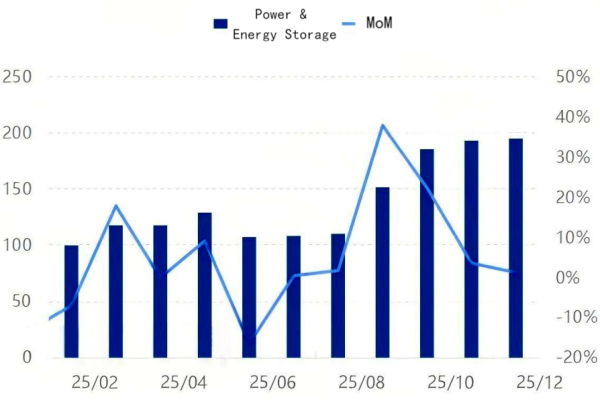

Figure 3: China's Mainstream Battery Production Schedule (GWh)

Data source: Oilchem

In November 2025, shipment volume of mainstream Chinese anode material enterprises reached 220,900 tons, up 0.96% month-on-month. Anode orders continued to increase, mainly concentrated in the energy storage market, while power battery demand also rebounded. Some anode material plants were executing previously signed contracts.

Battery production in December is estimated at 195.3 GWh, representing a 1.19% month-on-month increase. Energy storage demand has become the core driver in Q4, with grid-connection peaks stimulating strong demand for energy storage batteries. Meanwhile, European new energy vehicle sales continue to grow rapidly, supporting export demand.

In November, China's mainland power battery installations reached 93.5 GWh, up 39.2% year-on-year and 11.2% month-on-month, with lithium iron phosphate batteries accounting for 80.5%. During the same period, battery exports reached 32.2 GWh, up 46.5% year-on-year, indicating continued strong overseas demand.

Feel free to contact us anytime for more information about the Anode Material market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies