【Steel】Outlook for China's Steel Industry Under Declining Domestic Demand and...

Graphite electrodes are the "lifeline" of EAF steelmaking! As the core material for arc conduction and heating, they feature high conductivity and heat resistance, directly affecting molten steel quality and output. Mastering graphite electrodes means mastering the initiative in EAF steelmaking!

【Steel】Outlook for China's Steel Industry Under Declining Domestic Demand and Rising Export Pressures

Domestic demand is weak, leading to a surge in steel exports and triggering anti-dumping investigations by Europe, the United States, and other countries. At the same time, China's central government has repeatedly emphasized the need to curb disorderly expansion of steel capacity and promote "high-quality development." The sharp rise in steel exports has already drawn the attention of regulators. During the phase of "global industrial chain restructuring" and "China's economic transformation," China's steel industry is shifting from "scale expansion" toward "quality upgrading."

Domestically, the industry must actively align itself with steel demand from advanced manufacturing sectors such as new energy vehicles, wind and solar power equipment, high-end equipment manufacturing, and national defense and military industries. Internationally, it must optimize its export product mix and actively expand into Belt and Road and other emerging markets. In addition, it must proactively adapt to global green rules in order to reshape its future competitiveness.

I. China's Steel Market Has Been "Cold at Home, Hot Abroad" in the Past Two Years

Since the start of the 14th Five-Year Plan period, steel consumption has continued to decline from its 2020 peak. According to data from the National Bureau of Statistics, China's apparent crude steel consumption fell from 1.04 billion tons in 2020 to 890 million tons in 2024. It is estimated that China's steel consumption in 2025 will be about 808 million tons, a year-on-year decline of 5.4%. Among them, the real estate sector, which has been the main demand engine, has seen double-digit declines in development investment, directly leading to a sharp contraction in demand for construction steel (rebar and wire rod).

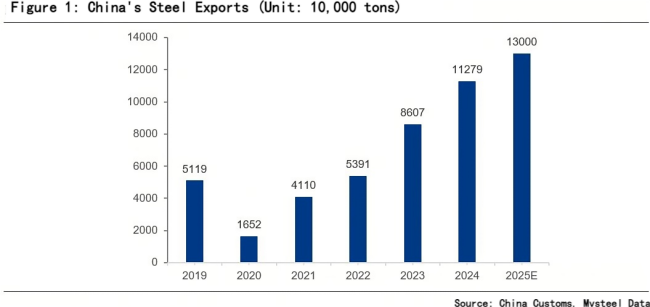

Structurally, while domestic demand has fallen, steel exports have increased year after year. According to data from the National Bureau of Statistics and Customs, China's net exports of crude steel (billets plus finished steel) rose from 16.52 million tons in 2020 to 112.79 million tons in 2024, and net crude steel exports are expected to exceed 130 million tons in 2025.

The phenomenon of a "cold domestic market and hot export market" in steel is mainly the result of weak domestic demand and China's active expansion into overseas markets. In addition, persistently depressed domestic steel prices have created a price gap with international markets (especially Southeast Asia and the Middle East), which has become the direct driving force behind the surge in exports.

The rapid growth of steel exports is a necessary result of market self-rescue, but it is also a form of "domestic involution spilling over abroad." It delays the pain of domestic capacity clearing and may also slow the pace of structural adjustment.

II. Steel Exports Are Shifting from a "Floodway" to a "High-Pressure Valve"

The massive export of steel driven by weak domestic demand has triggered strong backlash from Europe, the United States, and other regions, with a surge in new trade-remedy investigations. Because Chinese steel mills' export quotations are extremely competitive, since early 2024 the EU, the United States, Mexico, and many other countries have launched anti-dumping investigations into Chinese steel products. In 2024–2025, countries and regions accounting for about 50% of China's steel export volume initiated a total of 59 anti-dumping and countervailing investigations, making the export environment increasingly severe.

At the national level, the government has repeatedly emphasized curbing disorderly expansion of steel capacity and promoting "high-quality development." The surge in steel exports has attracted the attention of regulators. In December 2025, the Ministry of Commerce and the General Administration of Customs jointly issued export license management for 300 HS codes covering the vast majority of steel products, pig iron, and steel billets. Export traders are now required to apply for export licenses using export contracts and quality inspection certificates issued by producers. This will directly impact the "shadow" or "name-borrowing" exports that exist in the market.

III. Strategies for Steel Enterprises Under Declining Domestic Demand and Rising Export Pressures

1. Diversification of Export Markets

The European Union plans to sharply cut steel import quotas by 47% to about 18.3 million tons starting in 2026, while raising the out-of-quota tariff from the current 25% to 50%. The United States has imposed a 50% tariff on Chinese steel and steel derivatives under Section 232. The global industrial chain is shifting from "efficiency-first" to "security-first," with North America and the EU erecting multiple trade barriers and promoting the reshoring of manufacturing, reducing their dependence on Chinese steel. South Korea, Japan, Vietnam, and other traditional major export destinations have significantly increased tariffs on Chinese steel. Against the backdrop of global industrial chain restructuring and rising trade protectionism, China should consolidate its traditional Southeast Asian markets while actively expanding into emerging Belt and Road markets such as the Middle East and Africa, reducing reliance on any single market.

2. Targeting Green and High-End Manufacturing and Optimizing the Export Structure

The transformation paths of the Japanese and German steel industries when they faced declining domestic demand offer useful lessons for China.

After domestic demand peaked following the oil crisis of the 1970s, Japan's steel industry pursued a transformation centered on "upstream control of resources and downstream binding with top-tier customers." Upstream, trading houses such as Mitsui & Co. and steelmakers such as Nippon Steel deeply invested in iron ore and coal mines in Australia and Brazil, securing long-term, stable, low-cost raw material supplies. They also established joint ventures in demand-growth regions such as Southeast Asia and the United States (for example, Nippon Steel's global alliances with ArcelorMittal). Downstream, they focused on developing products for automobiles (high-strength steel, silicon steel), electronics (galvanized sheets), and energy (pipeline steel).

After the restructuring following German reunification and the 2008 financial crisis, Germany's steel industry followed a path of "downsizing, greening, and deep embedding into domestic high-end manufacturing." On one hand, it focused on niche but high-margin global markets such as defense, aerospace, and luxury automobiles, forming tight industrial clusters with domestic automotive, machinery, and chemical giants such as Volkswagen, Siemens, and BASF. On the other hand, environmental pressure was turned into a technological advantage, with giants such as Thyssenkrupp and Salzgitter investing heavily in disruptive technologies such as hydrogen-based direct reduced iron (H2-DRI), leading the green steel revolution.

During the phase of "global industrial chain restructuring" and "China's economic transformation," China's steel industry should domestically bind itself to steel demand from advanced manufacturing sectors such as new energy vehicles, wind and solar power equipment, high-end machinery, and national defense, achieving a transformation into a "high-end manufacturing service provider." At the same time, steel enterprises should actively upgrade their export product mix from large-volume, low-price commodity steel and billets to higher-value products such as flat steel, coated and galvanized products, steel pipes, and steel structures, using differentiation to avoid low-end competition.

3. Proactively Adapting to Global Green Rules

Carbon management capability will become a new "export license." Enterprises must proactively establish full life-cycle carbon footprint accounting systems for their products and deploy low-carbon technologies such as electric-arc-furnace short-process steelmaking and hydrogen metallurgy.

Feel free to contact us anytime for more information about the EAF Steel market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies