【Petroleum Coke】Supply–Demand Outlook: Based on Capacity Commissioning Plans and Supply...

Calcined petroleum coke, with its high carbon content, low sulfur, and low impurities, plays a vital role in modern manufacturing, especially in the aluminum and steel industries.

【Petroleum Coke】Supply–Demand Outlook: Based on Capacity Commissioning Plans and Supply–Demand Data, China's Petroleum Coke Fundamentals Are Expected to Tighten in 2026

I. Expected New Capacity Commissioning of Petroleum Coke and Downstream Industries, 2026–2030

1. Statistics on New Delayed Coking Capacity

From 2026 to 2030, the period of rapid expansion in delayed coking capacity, which peaked in 2022, has ended. Capacity growth during this cycle will be slower than in 2021–2025, with new projects mainly concentrated in major refinery upgrading and transformation projects. As domestic refined oil consumption has peaked, the proportion of delayed coking in newly added capacity is declining, while more new capacity will come from residue hydrocracking units. Future incremental delayed coking supply will mainly be concentrated in Northeast China, Northwest China, North China, and East China.

Figure 1: China's Planned Delayed Coking Capacity, 2026–2030 (kt/year)

From 2026 to 2030, China's newly added delayed coking capacity is expected to total 9.5 million tons per year, mainly concentrated in East China. However, due to uncertainties in project construction schedules, most of the new delayed coking capacity is likely to be commissioned in 2027–2028.

By the end of 2026, Huajin Aramco Petrochemical Co., Ltd. is expected to complete and possibly commission a 1.6 million tpa delayed coking unit. In addition, Hebei Lunte's 2.0 million tpa residue deep-processing project may also be completed. No delayed coking capacity shutdowns are currently expected in 2026. As both units are scheduled for completion at the end of the year, their contribution to petroleum coke supply in 2026 will be limited.

2. Statistics on Expected New Downstream Capacity

According to currently announced downstream capacity data, China's major petroleum coke downstream sectors will continue expanding from 2026 to 2030, supporting continued growth in petroleum coke consumption, although at a slower pace than during 2021–2025.

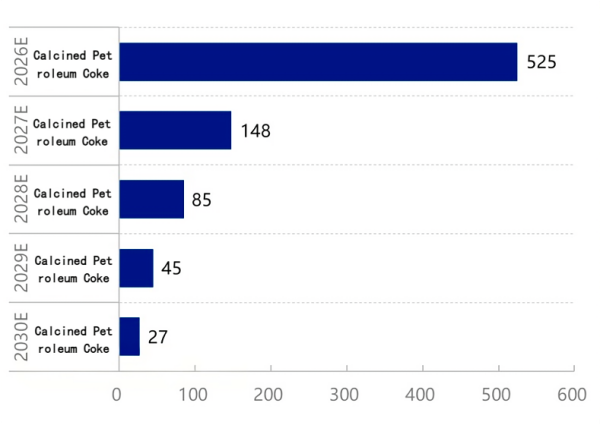

Figure 2: Planned New Calcined petroleum coke Capacity, 2026–2030 (kt/year)

Calcined petroleum coke capacity will grow rapidly in 2026–2027, accounting for 81% of total new capacity additions over the next five years. Capacity expansion will slow in 2028–2029, contributing only 19% of the five-year total. At present, terminal demand for primary aluminum has reached its capacity ceiling, leaving limited room for incremental demand. This has been transmitted upstream, sharply reducing the number of new entrants.

Nevertheless, calcination remains the most important intermediate step for petroleum coke in downstream consumption. Industries such as prebaked anodes, recarburizers, and graphite electrodes all require calcination. The Calcined petroleum coke sector therefore continues to dominate petroleum coke downstream demand.

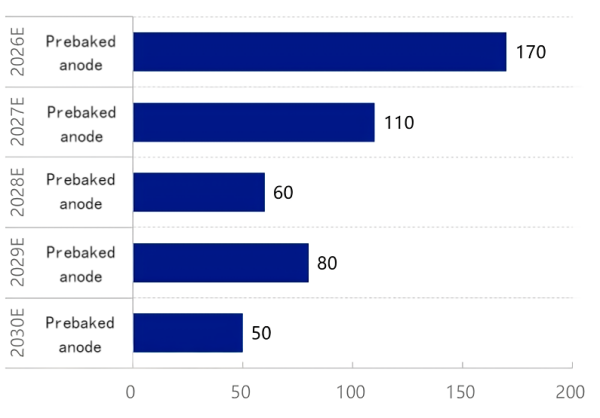

Figure 3: Prebaked Anode Capacity Trend, 2026–2030 (kt/year)

From 2026 to 2030, the prebaked anode market will still see a large number of new proposed projects. Despite the "capacity ceiling" of the primary aluminum industry, operating rates remain high at 97–100%, and incremental demand is still emerging. By 2030, prebaked anode capacity is expected to reach 36.5 million tons per year.

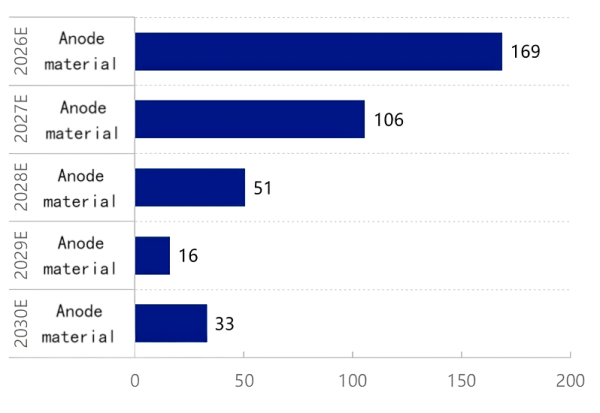

Figure 4: Planned New Anode Material Capacity, 2026–2030 (kt/year)

Within downstream capacity expansion, anode materials are expected to show a rise first and then decline pattern over the next five years. After peaking in 2026–2027, capacity expansion will rapidly slow during 2028–2030. By 2030, anode materials are expected to account for 10% of total petroleum coke consumption, up 4 percentage points from 2025.

II. Monthly Petroleum Coke Supply–Demand Balance in 2026

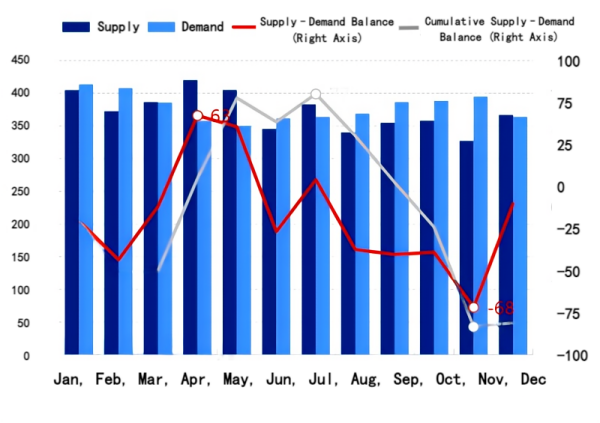

In 2026, China's petroleum coke production is projected at 29.6 million tons, and with approximately 15.05 million tons of imports, total supply will reach 44.65 million tons. On the demand side, consumption by Calcined petroleum coke, prebaked anodes, anode materials, and other major sectors is expected to reach 46.8 million tons. Overall, the annual supply–demand gap is estimated at –2.15 million tons, indicating a structural shortage with demand exceeding supply.

Figure 5: Monthly Petroleum Coke Supply–Demand Balance in 2026 (kt)

The monthly balance shows that supply–demand differences in the first half of the year alternate between surplus and deficit. In January–February, the market is undersupplied, with the supply–demand gap reaching 350,000 tons in February. In April–May, port inventories increase significantly, prices decline, and downstream buyers mainly consume previously stocked raw materials. From June onward, the balance turns negative again, providing price support.

In the second half of the year, the monthly supply–demand balance is mostly negative, with July being the only surplus month. Combined with upstream and downstream commissioning cycles, downstream capacity expansion in 2026 will further widen the supply gap, drive port inventories lower, and strengthen market support. The market is expected to shift from tight balance toward supply shortage.

It should be noted that the above 2026 monthly supply–demand balance is based on comprehensive estimates derived from domestic petroleum coke and downstream capacity expansion plans, refinery maintenance schedules, historical monthly production and maintenance losses, and import–export data.

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies