【Anode Materials】2026 Industry Panorama Outlook: Leading Structure Remains Solid, ...

The rapid growth of the EV and energy storage industries is boosting demand for high-performance lithium batteries, driving the market for quality petroleum coke and synthetic graphite. The quality and particle size of calcined petroleum coke directly affect synthetic graphite performance, especially in anode production.

【Anode Materials】2026 Industry Panorama Outlook: Leading Structure Remains Solid, with Technology Upgrading and Global Expansion Resonating to Open a New Upcycle

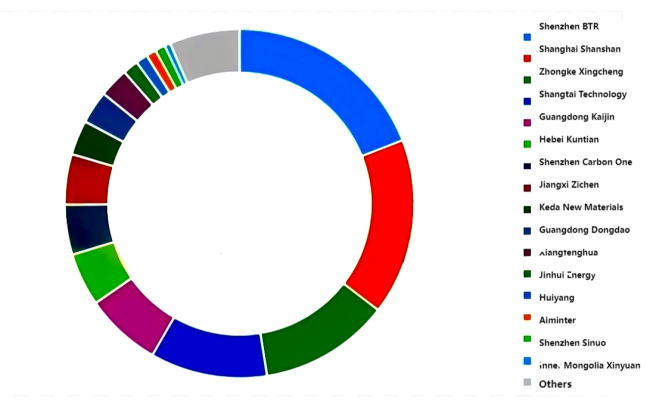

In 2025, BTR maintained its dominant position by leveraging continuously leading technological accumulation, strong customer stickiness, and a stable global supply chain, ranking first in the anode materials industry for sixteen consecutive years. Shanghai Shanshan, supported by deep technical foundations and strong product competitiveness, continued to see a steady increase in market share. Zhongke Xingcheng and Shangtai Technology accelerated their catch-up, with shipment growth becoming increasingly significant. Guangdong Kaijin saw a year-on-year improvement in market share. Jiangxi Zichen continued to adhere to a profitability-oriented sales strategy and remains the company with the strongest overall profitability in anode products within the industry. Hebei Kuntian and Carbon One achieved substantial shipment growth through more aggressive sales strategies. Guangdong Dongdao realized stable shipments by strengthening cooperation with leading customers and emerging power battery clients. Jinhui Energy performed notably in niche segments such as heavy-duty trucks and energy storage; confirmed orders from top-tier battery manufacturers in 2026 are expected to propel the company to a new level. Huiyang and Aomint achieved new growth in the energy storage sector. In addition, Keda New Materials began to emerge strongly in the energy storage field this year. Looking ahead to 2026, additional anode material companies are expected to enter the spotlight, including Baowu, Jereh, and Tianhongji, among others.

Figure: Global Anode Materials Market Landscape in 2025

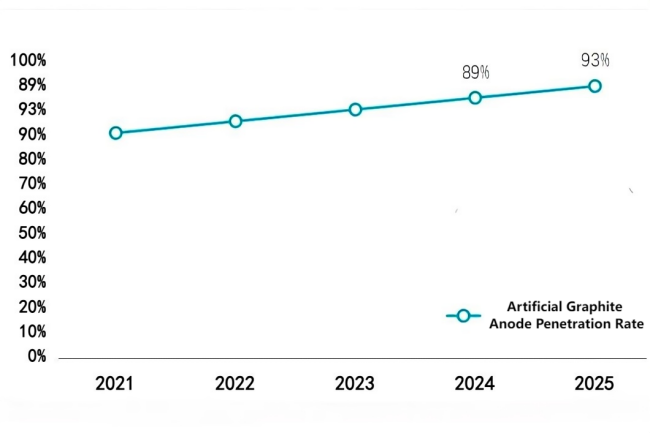

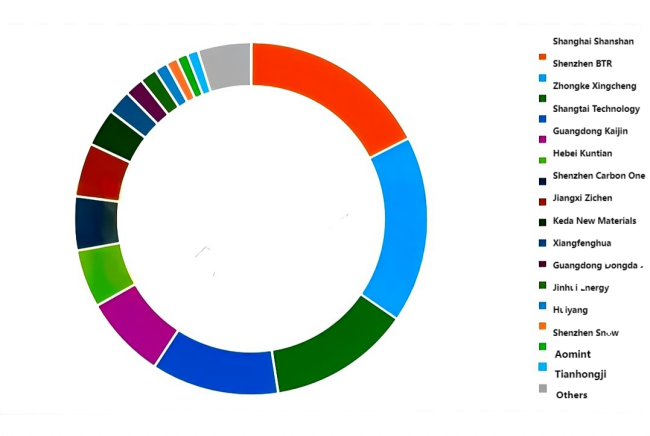

Artificial Graphite Anode Penetration Rises to Nearly 93%, Shanghai Shanshan Retains the Top Position

In 2025, the global penetration rate of artificial graphite anode materials further increased to 93%. Thanks to superior product performance and high cost-effectiveness, artificial graphite anodes continued to gain market share. Shanghai Shanshan's leading position in artificial graphite anodes remained solid, retaining the top rank in 2025. Meanwhile, the natural graphite market—particularly overseas natural graphite—continued to shrink, with ongoing declines in both production volume and market share.

Figure: Global Artificial Graphite Anode Penetration Rate (%)

Figure: Global Artificial Graphite Anode Materials Market Landscape in 2025

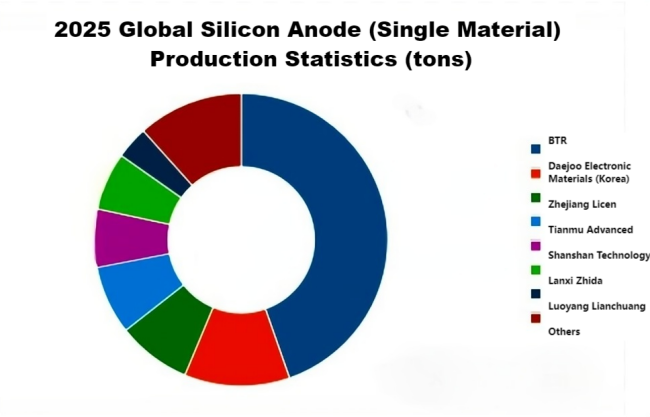

Significant Growth in Silicon-Based Anodes: Strong Pull from Consumer Electronics, Initial Adoption in Power Batteries

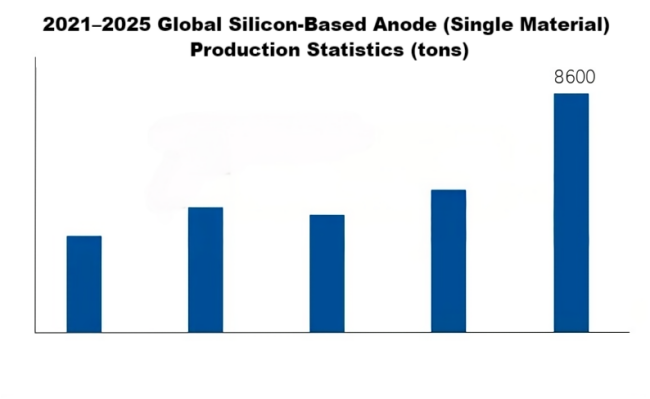

In 2025, global production of silicon-based anode monomers reached 8,600 tons, representing a year-on-year increase of 67%. BTR remained the market leader in terms of share. Zhejiang Lichen, Tianmu Pioneer, Shanshan Technology, and Lanxi Zhde were also major shipment contributors in China's silicon anode market in 2025, each demonstrating strong performance through differentiated products and customer channels.

From a consumption structure perspective, silicon oxide and milled silicon continued to account for the majority of the market, while shipments of new CVD-based silicon materials increased significantly, reflecting strong market enthusiasm. Demand for small cylindrical batteries remained the core application base for silicon-based anodes. The increased blending ratio of silicon-based anodes in consumer electronics was one of the key drivers behind shipment growth in 2025. In addition, the application of large-format 46-series cylindrical batteries in the power battery market, as well as demand for high-capacity cells from emerging sectors such as low-altitude economy and humanoid robots, further expanded the silicon-based anode market. Expectations surrounding solid-state batteries have also brought new opportunities to the silicon-based anode sector.

Based on industry operating characteristics in 2025 and the latest market assessments, the global lithium battery anode materials market in 2026 is expected to continue along three main themes: "bottom recovery + technological upgrading + accelerated globalization," with both challenges and opportunities coexisting.

Beta returns (β returns) driven by demand growth, together with alpha returns (α returns) formed through technology and cost advantages, will remain the greatest growth opportunities in the anode market.

■ The rapid expansion of the energy storage market will gradually form a dual support structure alongside the power battery market on the demand side of anode materials.

■ Order spillover from leading anode manufacturers will revive the "capacity-sharing" dividend in the contract processing segment, lifting overall industry operating rates.

■ Petroleum coke and needle coke prices are expected to see a continued upward shift in their pricing center as demand grows, accompanied by seasonal fluctuations.

■ Fast-charging anodes—especially 4C and above—are expected to see penetration rise from around 15% in 2025 to approximately 25%, driving higher value-added processes such as carbon coating.

■ Localization demands in Europe and the United States will accelerate the overseas expansion of Chinese anode material companies.

■ Silicon-based anodes will enter a ten-thousand-ton incremental market, with applications shifting from consumer electronics to power batteries, low-altitude economy, humanoid robots, and other fields, and achieving scaled adoption in power batteries.

■ Growth in sodium-ion battery energy storage, commercial vehicles, and battery swapping orders will boost demand for hard carbon anodes, making 2026 a year of opportunity for hard carbon materials.

In 2026, the anode industry is expected to exhibit characteristics of "simultaneous volume and price growth, technological differentiation, and accelerated globalization." Clear opportunities lie in three incremental scenarios: energy storage, fast charging, and silicon-based anodes, as well as the opening of the "first year of sodium-ion batteries," which will benefit hard carbon anodes. Core risks stem from broad-based increases in raw material prices, reductions in export tax rebates, and uncertainties in EU policies. Companies that can lock in low-cost coke resources early, accelerate silicon–carbon validation, and complete overseas localization layouts will be well positioned to gain an advantage in the next cycle. Overall, after nearly three years of stagnation, the anode industry is poised to enter a new upward cycle, with simultaneous growth in volume and price becoming the main theme of the 2026 market.

Feel free to contact us anytime for more information about the Anode Material market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies