【Graphite Electrode】Trading remains weak, and the Market is mainly Stabilizing.

【Graphite Electrode】Trading remains weak, and the Market is mainly Stabilizing.

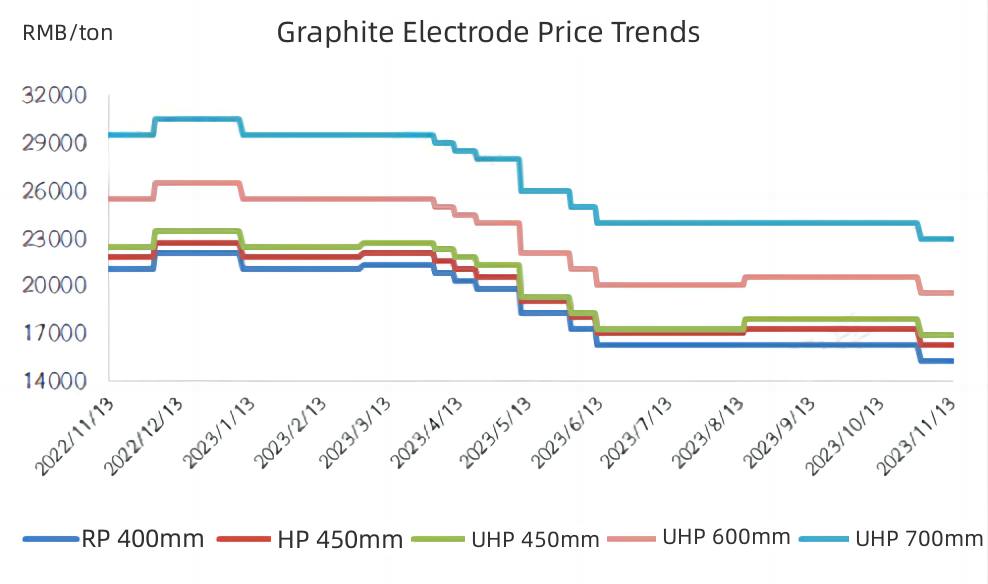

As of November 13, 2023, mainstream prices for graphite electrodes with diameters of 300-600mm in China are as follows: Regular power 15,000-16,500 RMB/ton; High power 15,500-18,000 RMB/ton; Ultra-high power 16,000-19,500 RMB/ton; Ultra-high power 700mm graphite electrode 22,500-23,500 RMB/ton.

Entering November, the graphite electrode market continues to experience weak trading, with prices mostly stabilizing but occasionally showing signs of decline. Transaction prices for graphite electrodes are somewhat chaotic, with significant price differences for individual specifications due to variations in quality and delivery methods. Negative factors still dominate the graphite electrode market, and companies in this sector are hoping for price increases amid the loss situation. However, intense competition within the graphite electrode industry, differences in raw material ratios among companies, and varying product quality result in fluctuating prices. Some graphite electrode companies prefer orders based on payment situations, while smaller companies consider low-price orders based on sales conditions.

Primary factors for the price weakness:

Supply perspective:

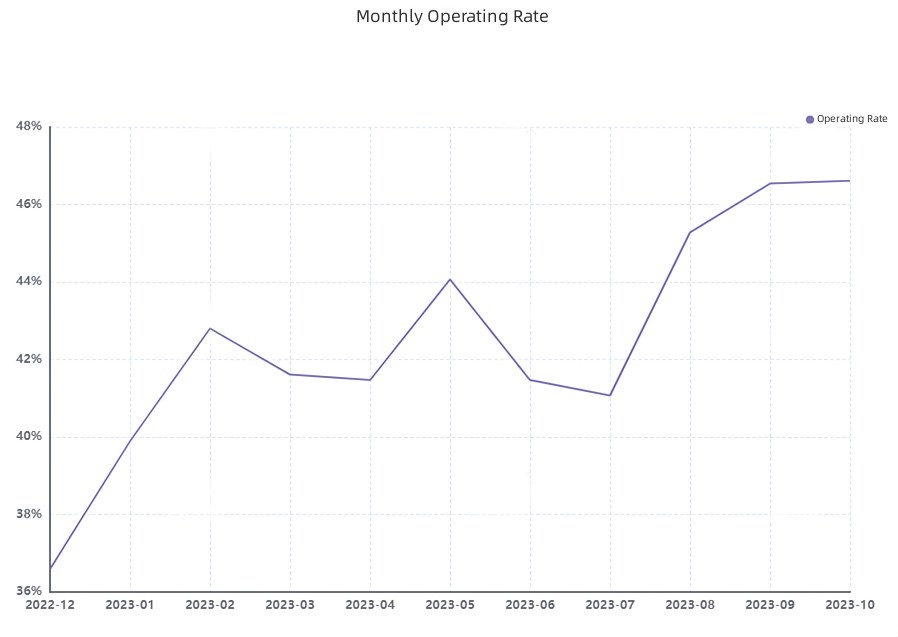

The current graphite electrode market still faces an oversupply situation. According to statistics, there is little difference in graphite electrode production levels from September to October. Mainstream graphite electrode companies in regions such as Gansu, Liaoning, and Jilin have generally maintained normal production. Some graphite electrode companies, considering the decline in raw material prices, have purchased raw materials at lower prices to save costs and cope with the future. Some companies planning to resume production at the end of November after depleting their inventory. In early November, cities like Tangshan and Handan in Hebei Province implemented emergency emission reduction measures due to environmental concerns, affecting graphite electrode companies. However, graphite electrode companies in Hebei have already resumed production as of November 13. As of November 13, some graphite electrode companies are shut down: 1 in Sichuan, 2 in Shanxi, 2 in Hebei, and 1 in Hunan.

Demand perspective:

In recent times, environmental restrictions have affected some regions, and steel mills have maintenance plans. Many long-process steel companies have announced maintenance and production control, expanding the scope of maintenance. Some areas require steel mills to stop production. In terms of short-process steel mills, although profits have increased recently, their production boost mainly focuses on consuming existing inventory of graphite electrodes. Regarding reflected orders from graphite electrodes, there is no significant increase in steel mill orders, with mainly on-demand procurement.

Cost & profit perspective:

Upstream raw material prices: The average price of petroleum coke in a certain refinery in the northeast has decreased by 100 RMB/ton from the same period last month, with a decrease of 2.8%. The average price of needle coke and pitch coke is relatively stable. The mainstream transaction price of low-sulfur calcined coke (raw material from a certain refinery in the northeast) is 3,800-4,000 RMB/ton. Calculated based on the current upstream raw material prices, the comprehensive theoretical cost of graphite electrodes is around 17,000-17,500 RMB/ton. However, the actual transaction prices for most graphite electrodes are below the cost line, and the graphite electrode market is running at a loss.

Future predictions:

The current graphite electrode prices are already at a low level. Although the profits of electric arc furnace steel companies are rising, and they are somewhat boosting the graphite electrode market, steel mills' willingness to stockpile in the short term is limited, and on-demand procurement is the main focus. Moreover, in the loss situation, graphite electrode companies face significant pressure on shipments. In the short term, it is expected that the graphite electrode market will stabilize, with prices for ultra-high-power graphite electrodes with diameters of 300-600mm ranging from 16,000 to 19,500 RMB/ton in China. Any inquiries about graphite electrode products, welcome to contact us.

No related results found

0 Replies