【Petroleum Coke Price】 Downstream On-demand Procurement, Market Remains Stable!

【Petroleum Coke Price】 Downstream On-demand Procurement, Market Remains Stable!

I. Petroleum Coke Market Analysis

Market Overview:

As of October 13, 2023, the petroleum coke market shows reasonable trading activity. Main refinery petroleum coke trading remains stable, while regional refinery petroleum coke shipments are moderate. Carbon enterprises primarily engage in on-demand purchases of low-sulfur coke, and overall, downstream businesses exhibit a strong wait-and-see sentiment with slightly less enthusiasm for receiving goods. The average petroleum coke price stands at 2,190 yuan/ton, a decrease of 0.27% compared to yesterday, to learn about the market information of calcined petroleum coke (CPC).

Main Refineries:

With petroleum coke prices holding steady, Sinopec's overall trading remains stable, and refineries have smooth shipments, with downstream businesses showing a willingness to stock up. PetroChina's refineries are executing order-based sales, leading to price stability. The latest round of competitive bidding at CNOOC refineries has concluded with prices largely stable.

Regional Refineries:

Regional refinery inventories mostly remain at medium to low levels. Active shipments and minor adjustments in coke prices have occurred. East China's Dongming Petrochemical's subsidiary in Zhoushan has shifted to produce 4A petroleum coke, implementing the latest quotations. Some refineries are adjusting coke prices based on their inventory levels, with changes in the range of -20 to 50 yuan/ton. In Northeast China, Haoye Petrochemical has adjusted the sulfur content of petroleum coke to around 3.2% and is implementing competitive bidding for sales.

Future Predictions:

In the short term, downstream demand remains relatively stable, primarily supported by essential users. The petroleum coke market continues to focus on reducing inventory, with no clear bullish factors in sight. Currently, port inventories are high, and daily petroleum coke production is steadily increasing, indicating ongoing supply-demand imbalances. It is expected that petroleum coke prices will remain stable in the short term, with minor adjustments in prices by individual refineries based on their specific circumstances. For more information on the future petroleum coke industry, feel free to contact us.

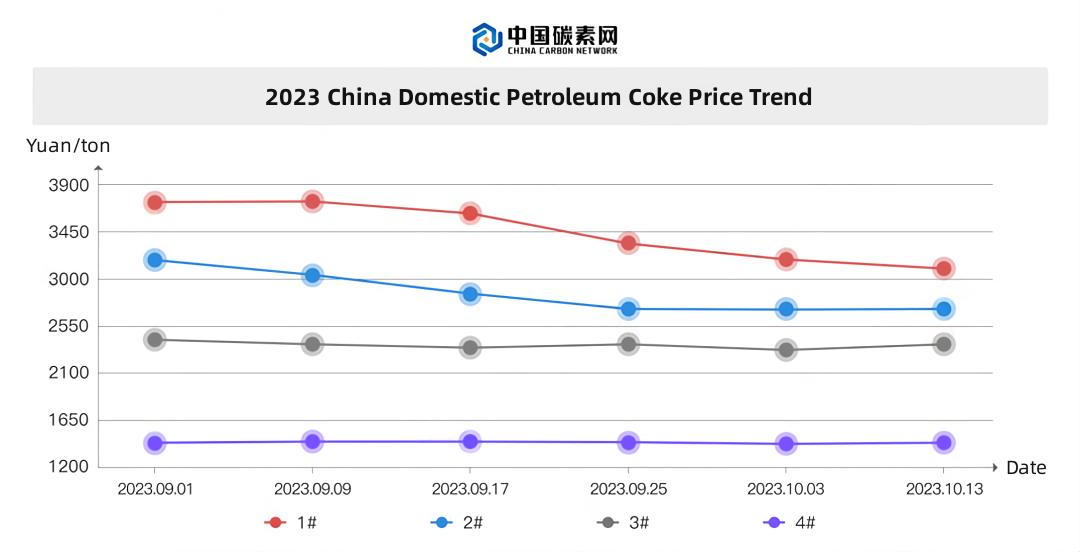

II. Price Trends

No related results found

0 Replies