【Graphite Electrodes】Prices Remain Stable at an Average of 15,326 Yuan/Ton

【Graphite Electrodes】Prices Remain Stable at an Average of 15,326 Yuan/Ton

Market Overview

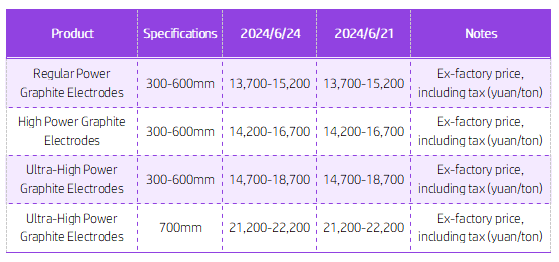

As of June 24, 2024, the market prices for regular, high power, and ultra-high power graphite electrodes range from 13,700 to 22,200 yuan/ton, remaining stable compared to the previous workday. The average price for graphite electrodes is 15,326 yuan/ton, with the market maintaining a steady trend. Graphite electrode production continues at a stable pace, with limited downstream demand, prioritizing a balance between production and sales. Despite a cautious trading atmosphere, actual transaction prices may fluctuate, and some companies, due to sufficient order reserves, show slight price increase intentions. Overall, the graphite electrode market remains stable with minor fluctuations. Current price ranges are as follows: for 300-600mm diameter graphite electrodes, regular power is priced at 13,700-15,200 yuan/ton, high power at 14,200-16,700 yuan/ton, and ultra-high power at 14,700-18,700 yuan/ton; for 700mm diameter ultra-high power graphite electrodes, the price ranges from 21,200 to 22,200 yuan/ton.

Market Prices

Upstream Market

Low-Sulfur Petroleum Coke: Currently, the prices of petroleum coke from PetroChina's refineries remain stable, with weak demand from the graphite electrode market providing little support. Although trading for petroleum coke used in anode materials is acceptable, intense competition in the anode industry means no price support and only transaction volume maintenance. Industrial silicon futures prices have recently declined, dampening market sentiment and limiting demand for petroleum coke from silicon producers.

Low-Sulfur Calcined Coke: Market transaction prices for low-sulfur calcined coke (using Jinxi and Jinzhou petroleum coke as raw materials) are 3,200-3,500 yuan/ton; for low-sulfur calcined coke (using Fushun petroleum coke as raw material), the ex-factory transaction price is 4,460-4,800 yuan/ton; for low-sulfur calcined coke (using Liaohe and Binzhou Zhonghai petroleum coke as raw materials), the market transaction price is 3,150-3,400 yuan/ton.

Needle Coke: The needle coke market in China is positive, with a slight increase in the operation rate. A coal-based enterprise in Henan is starting production of green coke in mid to late this month, primarily for self-use. Other companies continue stable production. Currently, the operation rate for oil-based needle coke is 38.52%, and for coal-based needle coke, it is 1.92%.

Downstream Market

Steel: Downstream steel mills are operating poorly, with some planning to reduce production, resulting in weak demand for graphite electrodes. Current in-market procurement is mainly for just-in-time inventory replenishment.

Market Outlook

The stable prices of upstream raw materials offer no positive support for graphite electrode negotiations. Transaction prices for graphite electrodes are primarily determined through actual discussions, with no significant changes in mainstream prices. In the short term, the graphite electrode market is expected to remain stable.

Feel free to contact us anytime for more information about the graphite electrode market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies