Petroleum coke main business remained stable, overall market was improved!

Petroleum coke main business remained stable, local refineries adjusted slightly, downstream procured steadily, overall market was improved!

Current review

On May 1, 2022, China's petroleum coke overall market operated stably, with active market transactions.

Three main refineries, Sinopec South China high sulfur coke price is partially callback, and the rest coke prices remain stable; Juxing graphite electrode is made of 1# GRADE A petroleum coke with better physical and chemical indexes than national standard. CNPC refineries coke price increases by about 200 yuan/ton, refinery shipments are stable and inventories remain low; CNOOC refineries have no inventory pressure and mainly focus on stable price trading. Local refineries shipment is positive. Some coke prices have been raised by about 100 yuan/ton, the market trading performance is good, and the overall market is mainly adjusted upward. Concerns about tight upstream international crude oil supply remain dominant. The global economic recovery is slowing down, oil prices are under pressure, and crude oil prices are generally bearish.

The stocking of downstream carbon enterprises before May Day is basically coming to an end, and some enterprises hold a wait-and-see attitude under the capital pressure at the end of the month. Most coke market transactions are purchased on demand. Under the condition of tight supply and high coke price, carbon enterprises continue to bear pressure on raw materials, and the subsequent transactions are expected to be stable. Related infomration of petroleum coke, please contact us.

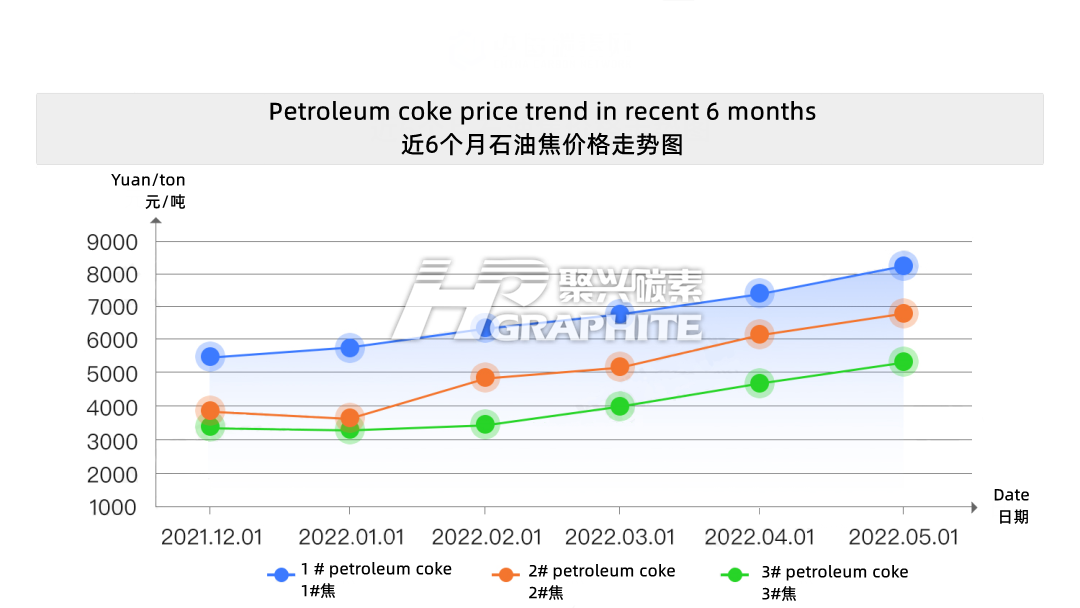

Price trend

No related results found

0 Replies