【Anode Materials】Market in China from January to June 2024: In-Depth Analysis

【Anode Materials】Market in China from January to June 2024: In-Depth Analysis

1. Overall Trends and Changes

From January to June 2024, the anode materials market in China showed a slight decline while overall market supply increased. Driven by a substantial rise in new energy vehicle (NEV) sales and significant year-over-year growth in the lithium battery energy storage market, the shipment volume of anode materials continued to grow. However, due to market oversupply and slow technological updates, market competition has become increasingly fierce. Many small and medium-sized enterprises still mainly produce low- to mid-end anode materials, with product homogeneity leading to persistently low transaction prices. Graphitized carburant largely come from by-products of anode material manufacturers and have wide industrial applications.

In June, the average market price for lithium battery anode materials was 33,000 CNY/ton. The mainstream prices for high-end anode materials ranged from 45,000 to 65,000 CNY/ton, mid-range prices from 23,000 to 31,000 CNY/ton, and low-end prices from 15,000 to 20,000 CNY/ton.

2. Market Share and Competitive Landscape

The market share for lithium battery anode materials in China is relatively dispersed, but some leading enterprises have emerged. Based on historical data and market trends, the market share for lithium battery anode materials in 2023 remained dispersed. However, leading companies such as BTR, Shanshan, and Jiangxi Zichen maintained their market dominance through technological strength and production capacity. Although their market shares may fluctuate, the overall landscape remains relatively stable. These companies leverage their technological prowess, production capacity, and market layout to maintain a competitive edge, but competition remains fierce, especially in the low- to mid-end market where price competition is particularly intense.

3. Market Demand, Growth Trends, and Key Drivers

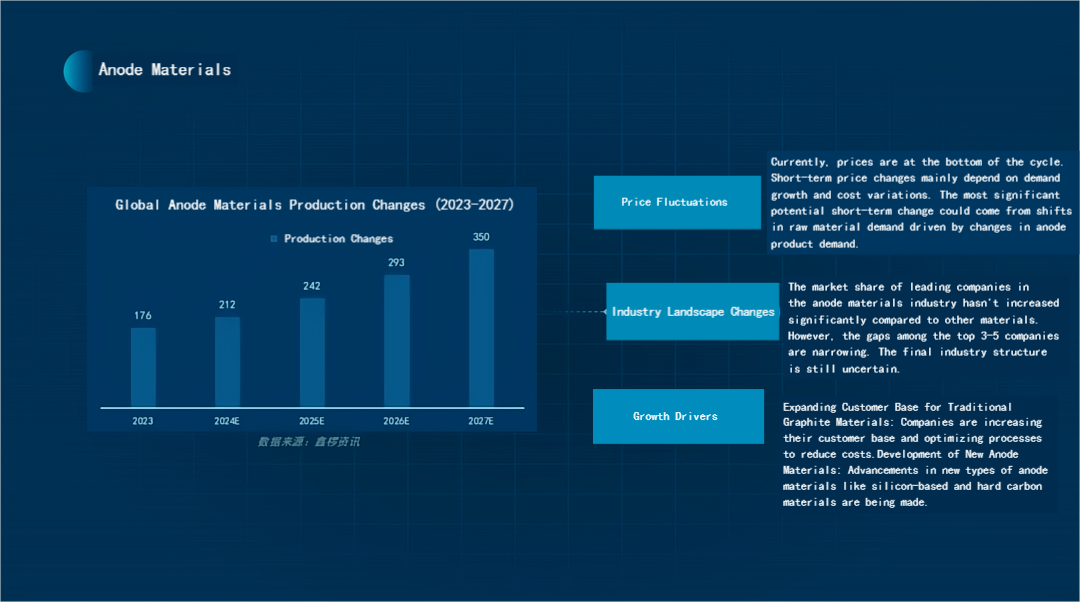

In terms of market demand, the rapid growth of the NEV market is the main driver for the increased demand for anode materials. It is predicted that in 2024, China's shipment volume of lithium battery anode materials will reach approximately 1.89 million tons, maintaining growth from 2023, though at a slower rate. Additionally, the growth of the lithium battery energy storage market also brings new growth opportunities for the anode materials market. Supportive NEV policies and advancements in battery technology further drive market demand.

4. Competitive Landscape, Market Opportunities, and Challenges

In terms of competitive landscape, the anode materials market faces intense competition from both domestic and international companies. As the NEV market continues to expand, both domestic and international companies are increasing their R&D investments and improving product quality and performance to capture market share. Market opportunities lie in the sustained growth of the NEV market and continuous advancements in lithium battery technology, offering a vast development space for the anode materials market. However, challenges such as raw material price fluctuations, rapid technological updates, and increased environmental requirements cannot be ignored.

5. Future Development Trends and Predictions

In the future, the lithium battery anode materials market is expected to continue its rapid growth. With the ongoing expansion of the NEV market and continuous advancements in battery technology, the market size for anode materials will further expand, with a stable growth rate. Moreover, the development and application of new anode materials, such as silicon-carbon alloys, will become an important direction for the market, potentially increasing battery energy density and cycle life. Environmental and sustainability requirements will also push companies to focus more on environmentally friendly and sustainable production processes.

6. Statistics on New Projects and Production Commencements

In the first half of 2024, several new projects and production commencements occurred in the domestic anode materials market. For instance, the 40,000-ton capacity project by Shanxi Ruijun New Materials is expected to start production in June; the 25,000-ton capacity project by Lanzhou Griffin Carbon Materials is also expected to start production in June. Additionally, several other projects by companies such as Xuancheng Carbon One New Materials, Anhui Yuling New Energy, and Huiyang (Guizhou) New Energy Materials are expected to start production by the end of 2024. These projects will further increase market supply and intensify market competition.

In conclusion, from January to June 2024, China's anode materials market maintained a slightly declining trend amidst the rapid growth of the NEV market and continuous advancements in lithium battery technology, with sustained market demand and intense competition. In the future, with the expansion of the NEV market and the development and application of new anode materials, the anode materials market will experience broader development opportunities. At the same time, companies need to pay attention to challenges such as raw material price fluctuations, technological updates, and environmental requirements, enhancing R&D and innovation capabilities to improve product quality and performance to meet the evolving market demands.

Feel free to contact us anytime for more information about the Anode materials market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies