【Lithium Battery Materials】Why Are Anode Materials So Important?

The rapid growth of the EV and energy storage industries is boosting demand for high-performance lithium batteries, driving the market for quality petroleum coke and synthetic graphite. The quality and particle size of calcined petroleum coke directly affect synthetic graphite performance, especially in anode production.

【Lithium Battery Materials】Why Are Anode Materials So Important?

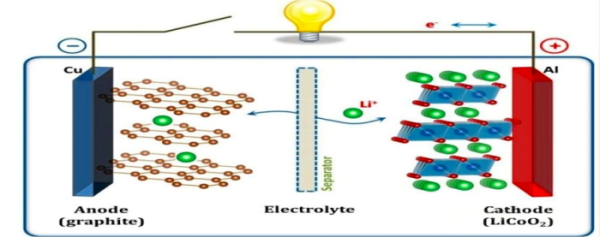

Anode materials are one of the key materials in lithium-ion batteries. The competitive landscape is relatively stable, while downstream industry prosperity continues and demand remains strong. Anode material manufacturers have a certain degree of pricing power and are able to pass on cost pressures periodically. Companies with a high proportion of self-supplied graphitization capacity face relatively less pressure and are able to maintain reasonable profit margins. Downstream companies are accelerating the adoption of silicon anodes, and driven by the industrialization of the 4680 battery, silicon anodes are expected to scale up rapidly.

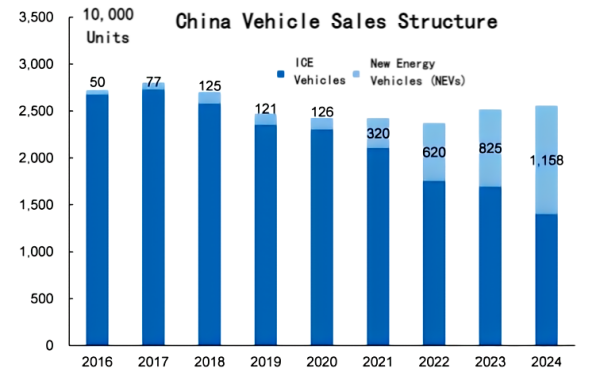

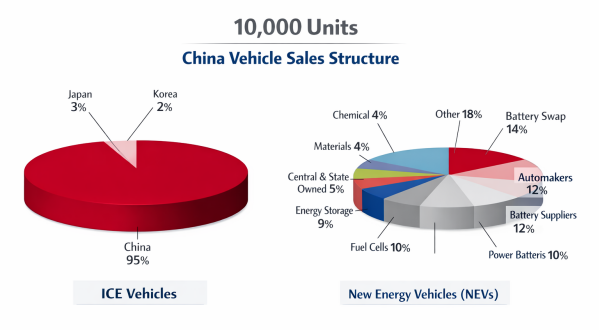

The new energy vehicle market continues to prosper. In 2022, global new energy vehicle sales reached 9.2 million units, of which 6.2 million units were sold in China, corresponding to global power battery demand of 580 GWh. The energy storage market has enormous potential. As the cost of electrochemical energy storage declines and its advantages become more evident, it is expected to become the mainstream direction for new installed capacity. In terms of demand, total anode material demand was approximately 830,000 tons in 2022 and is expected to reach 1.83 million tons in 2025, with a CAGR of 30%, indicating sustained demand growth.

Anode material manufacturers have a certain degree of pricing power and can periodically pass on cost pressures. Although capacity expansion in the anode industry is relatively aggressive, the long construction cycle and the need to verify new capacity and new technologies mean that effective supply is still concentrated among leading anode producers, with limited incremental supply. Affected by rising raw material prices and graphitization processing fees, anode material costs have increased and profitability has continued to be squeezed. It is expected that anode producers will continue to pass on part of the cost pressure to downstream customers through price increases, while companies with a higher proportion of self-supplied graphitization capacity will be relatively less affected.

Integrated layouts and improvements in furnace efficiency are the key to cost reduction. As energy policies tighten, the release of graphitization capacity—due to its high energy consumption—is constrained, making it a bottleneck for anode capacity expansion. Graphitization costs account for 60% of the cost of artificial graphite, and increasing the self-supply ratio of graphitization can significantly reduce production costs. The industry is undergoing technological upgrading, with box furnaces and continuous graphitization showing clear advantages in electricity consumption and output per unit area, making them likely to become the future development direction. Anode producers with forward-looking layouts in graphitization capacity and new processes will seize the initiative and gradually widen the cost gap with their peers.

Silicon anodes have become a key competitive battleground in the industry, and leading manufacturers will enjoy both technological and demand dividends. Higher energy density remains the primary development direction for new energy vehicles. Because silicon anodes have much higher specific capacity than graphite anodes, they are regarded as the most promising next-generation anode material for lithium-ion batteries. Since 2021, downstream companies have been actively introducing silicon anode applications, and driven by the 4680 battery, silicon anodes are expected to achieve accelerated volume growth. Silicon anodes have high technical barriers and require significant R&D and capital investment. Leading manufacturers entered the field earlier and have first-mover advantages, enabling them to benefit from both technological leadership and demand growth.

Feel free to contact us anytime for more information about the Anode Material market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies