【Imports & Exports】Analysis of China's Uncalcined Petroleum Coke Trade Data

The rapid growth of the EV and energy storage industries is boosting demand for high-performance lithium batteries, driving the market for quality petroleum coke and synthetic graphite. The quality and particle size of calcined petroleum coke directly affect synthetic graphite performance, especially in anode production.

【Imports & Exports】Analysis of China's Uncalcined Petroleum Coke Trade Data

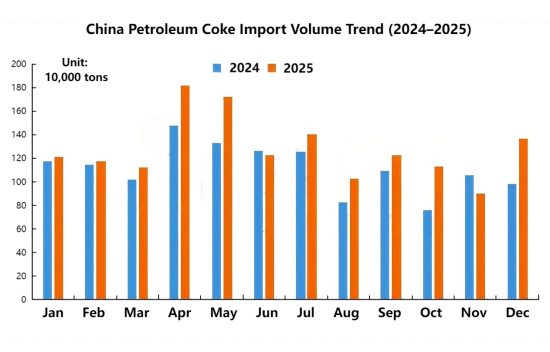

1. Analysis of China's Uncalcined Petroleum Coke Import Volume in December 2025

According to customs data, in December 2025, China's total imports of uncalcined petroleum coke reached 1.3702 million tons, an increase of 464,700 tons compared with the previous month, representing a month-on-month increase of 51.32% and a year-on-year increase of 39.4%. The average import price for the month was USD 229.34/ton.

From January to December 2025, China's cumulative imports of uncalcined petroleum coke totaled 15.3619 million tons, an increase of 1.9631 million tons compared with the same period last year, representing a year-on-year increase of 14.65%.

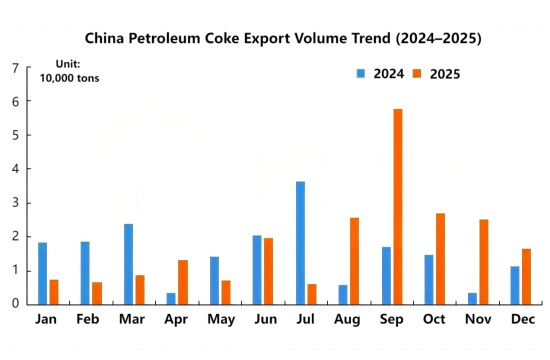

2. Analysis of China's Uncalcined Petroleum Coke Export Volume in December 2025

According to customs data, in December 2025, China's total exports of uncalcined petroleum coke amounted to 16,700 tons, a decrease of 8,400 tons compared with the previous month, with a year-on-year increase of 45.22%. The average export price for the month was USD 429.86/ton.

From January to December 2025, China's cumulative exports of uncalcined petroleum coke reached 221,000 tons, an increase of 33,000 tons compared with the same period last year, representing a growth rate of 17.55%.

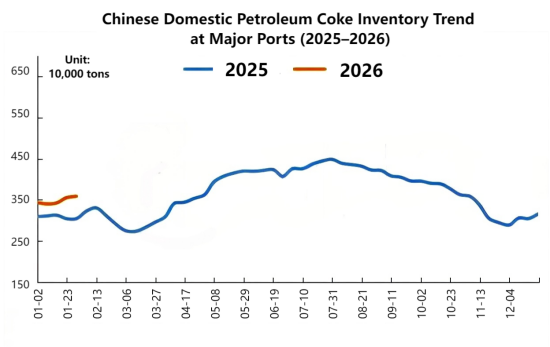

3. Analysis of Petroleum Coke Port Inventory

As of January 30, the average weekly inventory of petroleum coke at major domestic ports remained at approximately 3.6 million tons. Petroleum coke that arrived at ports earlier has basically been fully warehoused, while a small volume of imported petroleum coke continues to arrive at ports. Spot inflows exceeded outflows, and spot inventories continued to rise.

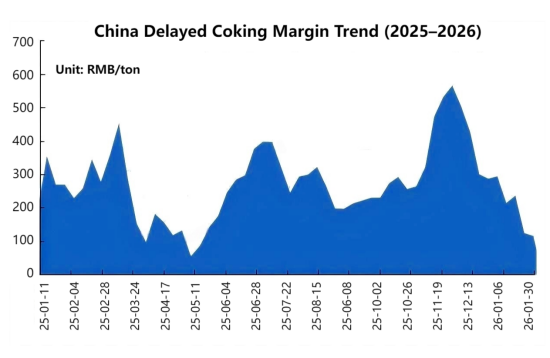

4. Domestic Delayed Coking Profit Trend of Petroleum Coke

This month, the production performance of China's petroleum coke delayed coking sample enterprises remained acceptable and is still in a profitable state, but profits showed a continuous downward trend during the month. Meanwhile, prices of other coking products mostly increased rather than declined, driving overall coking product prices upward. As a result, the theoretical profit of delayed coking decreased slightly. As of January 30, profits for some enterprises ranged from approximately RMB 116–295/ton.

Feel free to contact us anytime for more information about the Anode Material market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies