Petroleum coke market analysis

Petroleum coke market analysis

1. Overview of petroleum coke

Petroleum coke is the product of heavy oil obtained from the distillation of crude oil and the separation of light and heavy oil, and then transformed into hot cracking. Petroleum coke can be used in graphite making, smelting, chemical industry and other industries according to its quality. In terms of appearance, coke is black block or granular with irregular shape and different sizes, with metallic luster. Coke particles have porous structure, and the main element composition is carbon. Petroleum coke has a wide range of functions. Low sulfur and high-quality burning coke, such as needle coke, can mainly be used to manufacture ultra-high-power graphite electrodes and some special carbon products. In the steel-making industry, needle coke is also an important material for developing new technology of EAF steelmaking. Generally speaking, medium sulfur and ordinary burning coke are widely used in aluminum smelting, while high sulfur and ordinary raw coke are used in chemical production, such as calcium carbide and silicon carbide and so on, of course, they are also used as fuel for metal casting.

2. Petroleum coke market analysis

Current review

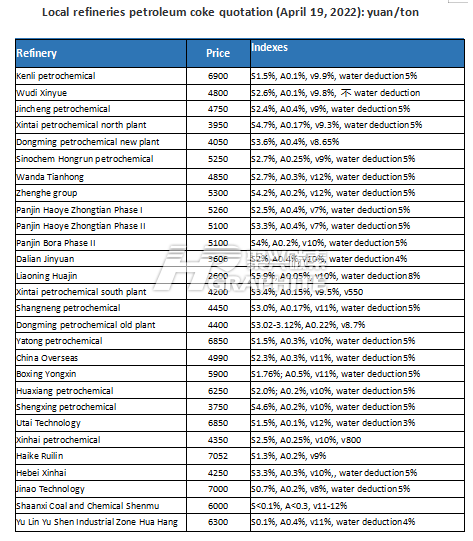

On April 19, 2022, China's petroleum coke overall market rose-and-fell alternatively. The coke prices of the three main refineries continued to rise, and some coke prices continued to decline.

Driven by the new energy market, the demand for anode materials and carbon for steelmaking increases, and low sulfur coke price continues to rise. In addition to being driven by low sulfur coke, the rise of medium and high sulfur coke is driven by the strong performance of aluminum price, aluminum enterprises maintained a high operating load, and the demand side gave support to the rise of medium and high sulfur coke. However, as the price of petroleum coke continues to rise, the funds of downstream carbon enterprises are tight, the enthusiasm of receiving goods is weakened, and the market transaction is relatively light. As a result, locally refined petroleum coke price began to fall.

Future outlook: At present, refineries operating load remains low, the terminal demand performance is acceptable, and petroleum coke is strongly supported by the supply and demand side. However, the high price of petroleum coke leads to downstream capital tension. In the short term petroleum coke price is generally stable, part of the coking prices are at risk of further decline. In the medium term, petroleum coke may continue to be strong. Reading more coke market forecast please contact us.

Price trend

No related results found

0 Replies