The underlying causes of petroleum coke sharp decline......

The underlying causes of petroleum coke sharp decline......

1. Market Week in Review

This week, the overall domestic petroleum coke market showed a downward trend, and the main market low sulfur coke price fell, and the coke price of some refineries in local refining continued to decline. The global economy is declining, the uncertainty of petroleum coke prospects is increasing, and petroleum coke prices are under pressure. Graphite electrode(RP, HP, UHP) is made of low sulfur petroleum coke for EAF/LF steelmaking. At the same time, in late May, imported coke was concentrated in ports, and the overall market supply side rose, forcing refineries to actively reduce prices for shipment.

(1)Main refineries

In terms of main business, Sinopec, affected by the continuous decline of local petroleum coke price, the shipments were general, and coke price declined; In the northwest region, Petrochina refinery petroleum coke price was running smoothly; In the northeast region, low sulfur coke shipment was flat after the price reduction. The coking units of CNOOC Zhonghai Bitumen (Binzhou) started coking recently.

1. Jinzhou Petrochemical petroleum coke price reduced by ↓ 600 yuan to 7000 yuan/ton.

2. Jinxi Petrochemical petroleum coke price reduced by ↓ 1300 yuan to 7000 yuan/ton.

3. Dagang Petrochemical petroleum coke price reduced by ↓ 500 yuan to 7000 yuan/ton.

4. CNOOC (Taizhou) Petrochemical Co., LTD. petroleum coke price reduced by ↓ 400 yuan to 6900 yuan/ton.

(2)Local refineries

In terms of local refineries, the supply of high-sulfur coke resources continued to increase, the market entry enthusiasm of the demand side market was insufficient, and the coke prices of some refineries continued to decline. Affected by the coking price reduction in Shandong Province, some refineries in Northeast and North China have slowed down their shipments, and the refineries’ coke price has fallen, with a further reduction of 50~200 yuan/ton.

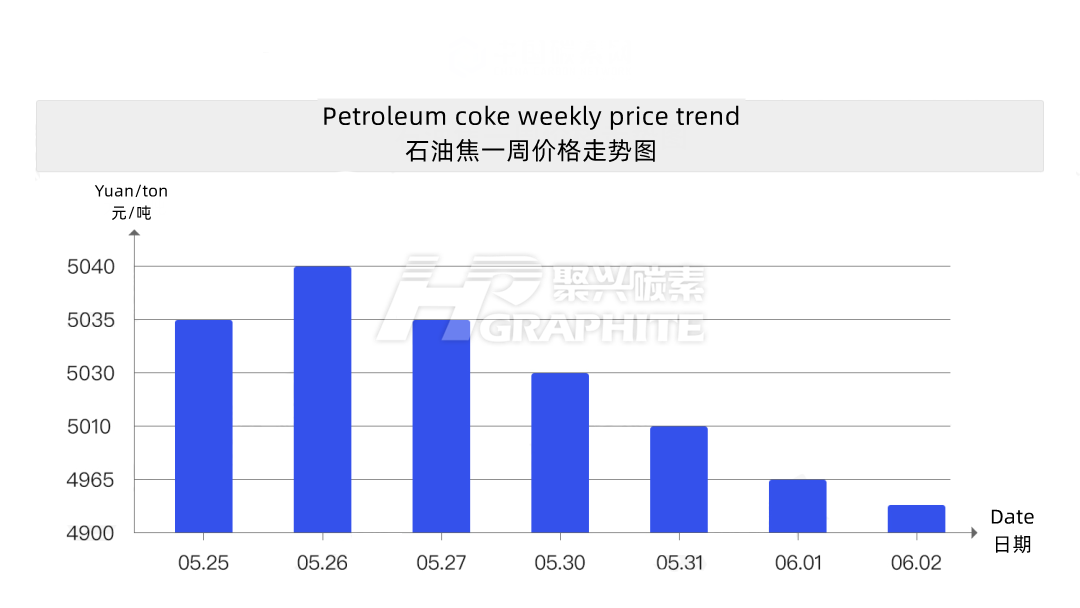

(3)Price trend

Petroleum coke price trend in recent week (2022.5.25~2022.6.2)

Petroleum coke price trend in recent six months (2022.1~2022.6)

2. Market forecast

Petroleum coke market price is expected to continually decline, the downstream enterprises wait-and-see sentiment will be strong, and will mostly purchase on demand. Refineries’ petroleum coke inventory will continue to increase, in the short term, part of petroleum coke prices will still have downward risks. Chat with us to learn more carbon market trend.

No related results found

0 Replies