EAF steelmaking plants out of the red? Will production resume soon?

Mysteel research: EAF steelmaking plants out of the red? Will production resume soon?

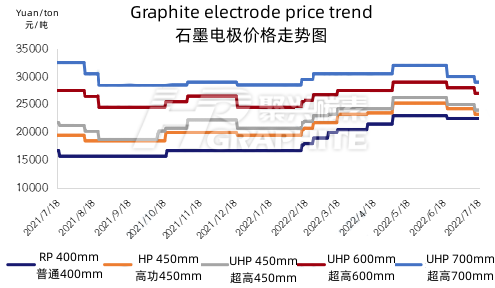

As of July 13, Mysteel surveyed 85 independent EAF (electric arc furnace) steel plants in China, with an average operating rate of 42.56%, with a week on week increase of 0.21% and a month on month decrease of 18.20%; Graphite electrode has excellent conductivity and thermal conductivity, which is widely used for electric furnace steelmaking.

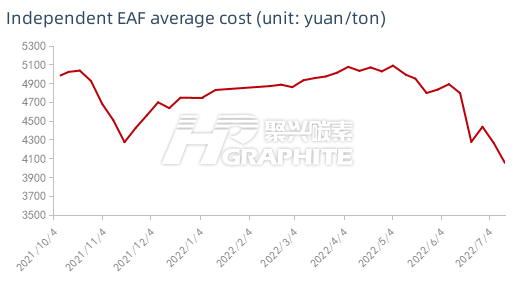

The capacity utilization rate was 31.89%, with a week on week increase of 20.22% and a month on month decrease of 17.01%. After nine times decline, EAF operating rate and capacity utilization rate finally began to increase slightly. Since May, EAF steel plants have been in deficit, steel plants have been reducing production or even stopping production, and EAF operating rate and capacity utilization rate have continued to decline. Recently, with the sharp decline of scrap steel prices, steel plants began to turn losses into profits, and some steel plants began to resume production. However, some steel plants due to inventory pressure still choose to stop production, resulting in a slight increase in EAF operating rate and capacity utilization.

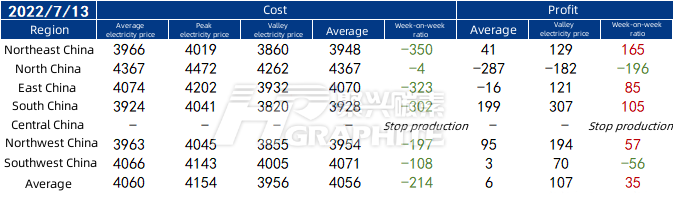

Independent EAF construction steel plant weekly cost survey (July 13, 2022) (unit: yuan/ton)

Among the 40 sample data this week, 17 steel plants stopped production due to losses, which was not included in this survey. Therefore, Mysteel investigated 23 independent EAF construction steel plants this week, among which, EAFs in Central China are out of production. The survey showed that steel plants average cost fell sharply and the profit rebounded. The situation is as follows:

Cost aspect: According to Mysteel research this week, the average cost of independent EAF construction steel plants was 4056 yuan/ton, down 214 yuan/ton compared with last week. China's scrap overall prices fell sharply this week. Stimulated by the drop of 100 yuan/ton in billet prices over the weekend, steel plants in various regions sharply reduced scrap purchase prices, and price reduction range is from 200 ~ 550. The decline in the Southwest and Northwest regions was relatively small. Although the price in North China fell sharply, the scrap price of EAF plants in the data has not been adjusted yet, and the cost is relatively stable. In Northeast China, East China, South China, Central China and other regions, scrap steel prices fell significantly. Affected by the sluggish demand for finished products and losses, steel plants were willing to reduce the scrap steel price. Blast furnace steel plants reduced the scrap steel consumption. In the case of low scrap demand, the scrap price drops greatly, and the cost of EAF steel plant decreases obviously.

Profit aspect: At present, independent EAF steel plants average profit is 6 yuan/ton, and the valley electricity profit is 107 yuan/ton, an increase of 35 yuan/ton compared with last week. As the decline of scrap steel far exceeded that of rebar this week , most EAF steel plants began to turn losses into profits. The profits of South China and Northeast China rebounded significantly, and the decline of scrap steel was more than twice that of finished products. The peak steel production profit in South China is nearly 200 per ton, so some EAFs that have previously stopped production are ready to resume production. Except for North China, the production profit of valley electricity in other regions is acceptable, and the enthusiasm of steel plants may be improved.

Overall, scrap prices still show a significant downward trend, EAF steel plants cost will continue to decline, and steel plants' profits may continue to expand. However, it is worth considering that the current steel demand is in the off-season, coupled with the recent repeated epidemic, resulting in a continuous decline in demand. Although some steel plants have resumed production, there are still some chose to suspend production, steel plants began to decide whether to produce according to finished goods inventory and sales. However, it is undeniable that some EAFs have begun to resume production, so their operating rate and capacity utilization rate may be slightly improved, with limited growth in the short term. If you are interested in the electric arc furnace industry report, please feel free to contact us for more information.

No related results found

0 Replies