【Needle Coke】Imports and Exports Improve, Market Outlook Positive for H2 2023

【Needle Coke】Imports and Exports Improve, Market Outlook Positive for H2 2023

Continuing the market trend before the May Day holiday, the needle coke market is under pressure. As of now, the calcined needle coke prices are in the range of 6,900-10,500 yuan/ton, and the green needle coke prices are in the range of 5,000-6,500 yuan/ton. Needle coke companies are flexibly adjusting production rhythms and actively cooperating with downstream companies to launch new products.

"Our R&D personnel have formed a technology R&D team with R&D personnel from multiple downstream companies, striving to develop products with strong adaptability, high energy density, and high cost performance." said a needle coke manufacturer.

In terms of downstream demand, the lithium-ion battery market is expected to recover in May, with several battery manufacturers ramping up production to varying degrees. The May expected orders for negative electrode materials have increased compared to April, and as downstream stocking gradually resumes, the demand for negative electrode materials is showing signs of recovery. "Many negative electrode material manufacturers are now inquiring about prices, but the quantities are not large, and the procurement is relatively cautious. Moreover, most negative electrode manufacturers want payment terms, which is a headache for us," said a needle coke manufacturer.

In terms of exports, overseas demand for needle coke has gradually recovered this year. In March, China's exports of oil-based needle coke increased by about 60% compared to January, and the shipment price reached 12,500-13,500 yuan/ton. Below is the situation of China's needle coke exports from 2022 to now.

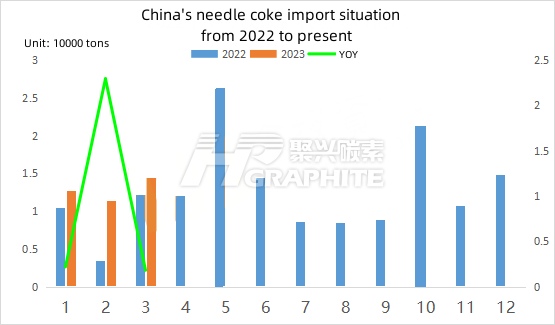

In terms of imports, China imported approximately 14,500 tons of needle coke in March, an increase of about 18% year-on-year. The specific details are shown in the following chart.

In terms of raw materials, the prices of coal tar pitch and slurry have both shown a tendency to stabilize after a post-holiday decline.

Regarding coal tar pitch, there is currently a weak supply-demand situation in the market as the deep-processing industry of coal tar continues to lower its operating rate, and the supply of coal tar pitch is gradually decreasing. Overall, downstream demand for coal tar pitch is also weak. Due to sustained losses in the steel industry, the operating rate of the steel sector is gradually declining. Some blast furnace enterprises will reduce production in the future, leading to a decrease in demand for coal and coke and thus a decrease in coal tar production. As for the current demand in the coal tar pitch market, it is expected to trend towards a stabilized decline in May.

As for slurry, international crude oil prices have fluctuated downward after the holiday, leading to poor downstream delivery sentiment and a downward adjustment in slurry prices. This has slightly eased the production pressure for oil-based needle coke. Currently, the inventory of low and medium sulfur slurry refineries is not high, and downstream demand has slightly improved. Refineries are noticeably holding their prices firm, and it is expected that low and medium sulfur slurry prices will remain stable in May.

Although the price of raw materials has decreased, the pressure on needle coke manufacturers remains unabated. Some needle coke enterprises have expressed that downstream enterprises now demand high cost-effectiveness. Although the price of raw materials has decreased, many needle coke enterprises still have a large inventory of high-priced raw materials. When customers try to negotiate lower prices, needle coke manufacturers are also hesitant to lower their prices. Needle coke manufacturers are operating at a low level, primarily selling high-priced inventory from earlier periods. There is a large price gap between buyers and sellers, becoming the main contradiction in the current needle coke market.

Overall, after the holiday, needle coke enterprises are under pressure. Overseas demand for needle coke is beginning to recover, and the downstream new energy lithium-ion battery market is picking up. The demand for negative electrode materials is also showing signs of recovery. In May, needle coke enterprises will focus mainly on depleting their inventories. With the continuous improvement in the downstream market, the needle coke market will improve in the second half of the year. Post-holiday needle coke market trend forecast, further consultation available.

No related results found

0 Replies