【Graphite Electrode】Market Inventory in 2023H1 - Hints of Dawn, Followed by Rain

【Graphite Electrode】Market Inventory in 2023H1 - Hints of Dawn, Followed by Rain

Market Overview

In the first half of 2023, the graphite electrode market in China faced a situation of weak supply and demand, leading to inevitable price reductions. During the first quarter, the market briefly saw a "spring rebound" as graphite electrode prices shifted upwards with the continuous rise in raw material petroleum coke prices in February. However, this momentum was short-lived as raw material prices declined in late March, coupled with weak downstream demand, causing a slump in graphite electrode prices. In the second quarter, increased losses and production restrictions in short-process steel mills led to sluggish sales in the graphite electrode industry. Intensified internal competition resulted in aggressive price competition, further exacerbating losses for some medium and small-sized graphite electrode manufacturers, who faced the prospect of restructuring, suspension, or elimination.

Supply & Demand Analysis

Supply Analysis

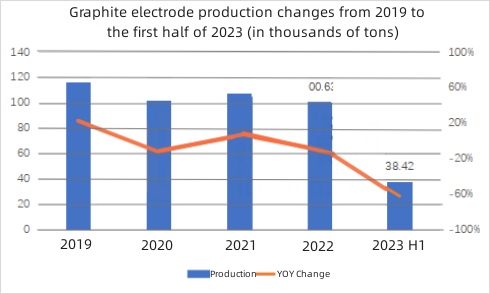

According to statistics, the capacity utilization rate of the graphite electrode industry in China remained low in the first half of 2023, resulting in a total production of 384,200 tons of graphite electrodes, a year-on-year decrease of 25.99%. Among these, the top graphite electrode manufacturers experienced a production decline of around 10% year-on-year, while the second and third-tier manufacturers faced declines ranging from 15% to 35%. Some medium and small-sized graphite electrode manufacturers even saw production plunges of 70% to 90%.

During the first half of 2023, China's graphite electrode production initially increased and then decreased. Starting from the second quarter, due to an increase in maintenance shutdowns of steel mills, graphite electrode companies turned more cautious in production, resulting in reduced supply of graphite electrodes.

The CR10 (concentration ratio of top 10 manufacturers) of China's graphite electrode industry reached 68.23% in H1 2023, indicating an increasing industry concentration despite the overall production decline.

Demand Analysis

In the first half of 2023, the overall demand for graphite electrodes remained weak.

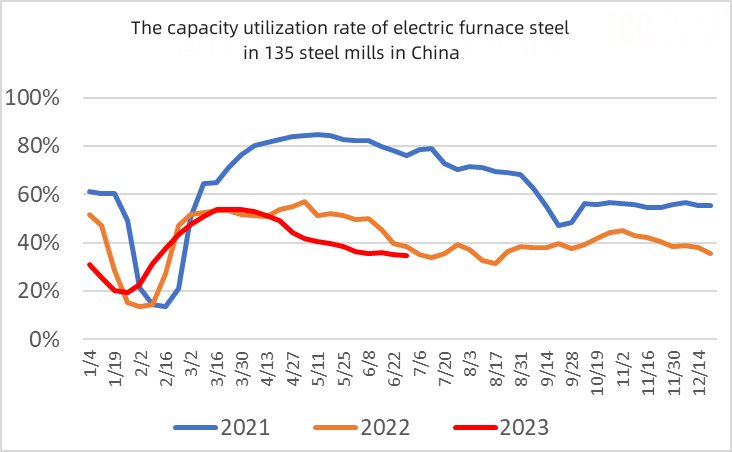

In the steel sector, poor performance in the steel market led to steel mill inventory accumulation, reducing the willingness to operate, particularly in the second quarter, where electric arc furnace steel mills in central, southwest, and northern China faced cost pressure, opting for production curtailment and shutdowns, leading to a further reduction in graphite electrode demand. Demand mainly consisted of sporadic restocking for long-process necessities, resulting in limited market transactions and lackluster procurement of graphite electrodes.

In the non-steel sector, the market performance for metal silicon and yellow phosphorus remained weak in the first half of the year. Some medium and small-sized silicon manufacturers reduced production pace due to significant profit reduction, resulting in moderate demand for regular power graphite electrodes.

Price Analysis

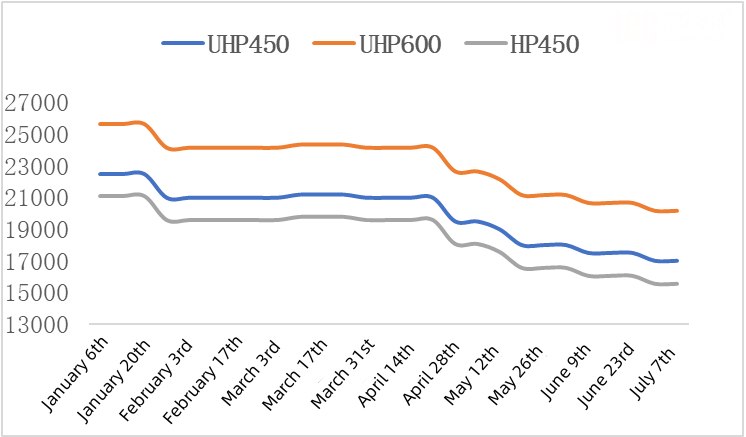

The graphite electrode market saw significant price declines in the first half of 2023, driven by reduced demand in each wave of downturns.

In the first quarter, January saw factory shutdowns and holidays due to the Chinese New Year, leading to low production intentions. In February, the strong upward trend in raw material petroleum coke prices led to price hike intentions among graphite electrode manufacturers. However, as raw material prices turned downward and coupled with weak downstream demand, graphite electrode prices started to loosen.

In the second quarter, the prices of upstream raw materials such as low sulfur petroleum coke, coal tar pitch, and needle coke began to decline. Coupled with increased losses and production cutbacks in downstream electric arc furnace steel mills, the demand for graphite electrodes diminished once again. Graphite electrode manufacturers were forced to compete at lower prices, resulting in a clear decline in graphite electrode prices.

Graphite Electrode Price Trend in China for 2023H1 (CNY/ton)

Market Forecast

Recently, the political bureau meeting has set the tone for the economic work in the second half of the year, aiming for stable progress. Policies will continue to lightly stimulate consumption and investment, and the real estate policy is likely to be further optimized. As a result, market expectations for China's domestic economy in the second half of the year have turned optimistic, and steel industry demand is expected to recover to some extent. However, it may take some time for the stimulated end-demand to be transmitted to the graphite electrode market. Nevertheless, driven by rising raw material costs in August, the graphite electrode market is expected to reach a turning point, and it is projected that domestic graphite electrode prices will primarily stabilize and show an upward trend in the second half of the year. Follow us to learn more about electrode market analysis.

No related results found

0 Replies