【Petroleum Coke】Price Analysis

【Petroleum Coke】Price Analysis

Market Overview: On August 29th, the average market price of petroleum coke was 2307 RMB/ton, increased by 11 RMB/ton, with a growth of 0.48%. Main refineries maintained stable shipments, with some price increases in Sinopec's coke division. Regional refineries had moderate shipments, and downstream enterprises focused on purchasing as needed. Take a look at the average market price of graphitized petroleum coke.

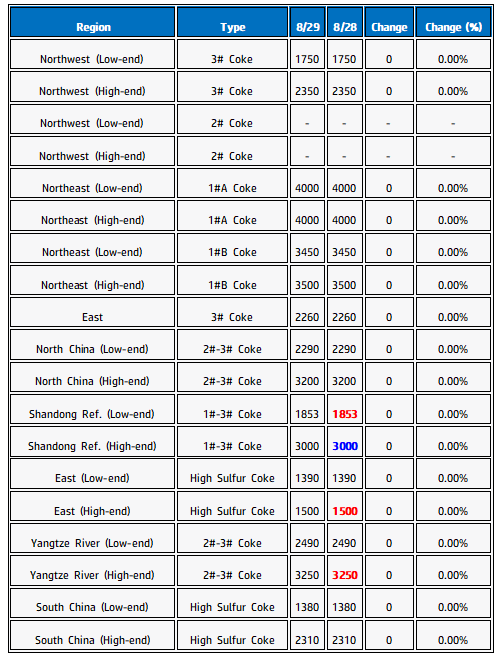

Main Regional Market Transaction Prices:

Sinopec Perspective

Sinopec's affiliated refineries maintain reasonable petroleum coke shipments. Some petroleum coke prices in the Yangtze River Delta and Shandong regions continued to rise by 20-50 RMB/ton, while certain coke grades experienced a decrease of 20 RMB/ton. With increased inquiries from negative electrode enterprises and the gradual resumption of production in the electrolytic aluminum industry, the overall market demand is positive, and refinery trading remains favorable. Sinopec's Northeast region refineries, Jinxi and Jinzhou Petrochemical, performed well in shipments with consistently low inventory. The Northwest petroleum coke market exhibited stable trading, with downstream demand primarily driven by as-needed procurement. In the East China region under China National Offshore Oil Corporation (CNOOC), refineries achieved reasonable overall shipments, with slight upward adjustments in prices at individual refineries.

Local Refinery Perspective

China local refinery petroleum coke market witnessed some price fluctuations. Currently, there is a shortage of petroleum coke with low sulfur content and trace elements, leading to continued price increases of 20-50 RMB/ton. On the other hand, high-sulfur general-grade petroleum coke faced downward pressure on prices due to the substantial circulation of imported coke in the domestic market, resulting in an abundant supply and a price decline of 15-200 RMB/ton. Notable market fluctuations include Xinyue Petrochemical resuming operations, and Jin Yuan Petrochemical's sulfur content rising to 2.7%.

Imported Coke Perspective

Recently, there have been numerous ships arriving at ports, but many traders have already pre-sold their stocks. Downstream enterprises are showing enthusiasm for picking up deliveries, leading to rapid port shipments and a gradual reduction in port inventory.

Supply Perspective

As of August 29th, there were 8 routine maintenance instances for coking units nationwide. The daily production of petroleum coke in China reached 87,180 tons, with a coking operating rate of 68.92%, maintaining stability compared to the previous workday.

Demand Perspective

With the resumption of aluminum electrolysis and the advancement of new production capacity, the overall demand for carbon used in aluminum remains favorable. The electrode market has weak but stable trading, primarily driven by essential procurement. Demand in the negative electrode market is gradually recovering, resulting in steady growth in shipments. Silicon carbide demand is moderate.

Future Outlook

The overall performance of the petroleum coke market in terms of shipments remains positive, supported by favorable downstream demand. It predicts that there will be some price fluctuations in the petroleum coke market, with changes focused around 50-100 RMB/ton. Feel free to contact us for more information about petroleum coke market analysis.

No related results found

0 Replies