【Graphite Electrode】Market Update for September

【Graphite Electrode】Market Update for September

In August, China domestic ultra-high power graphite electrode market showed signs of strength, with some specifications seeing a month-on-month increase of 500 RMB/ton due to rising production costs. However, with no significant recovery in downstream demand, prices rose only to later fall back, with smaller and medium-sized manufacturers experiencing slighter price increases. Here, I will provide an overview of the market trends for September.

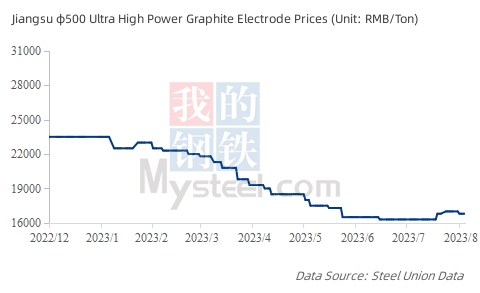

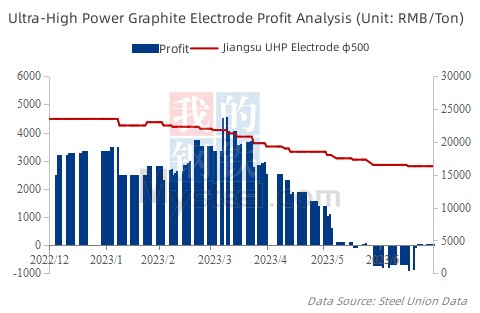

Ⅰ. Review - Prices Bottoming Out and Rebounding

In August, driven by rising production costs, prices of domestic ultra-high power graphite electrodes surged. However, due to a lack of notable improvement in downstream demand, prices saw a subsequent decline after the initial increase, with smaller and medium-sized manufacturers experiencing a smaller upward price trend.

For instance, as of now, φ500 ultra-high power graphite electrodes in Jiangsu are quoted at 16,800 RMB/ton, down by 500 RMB/ton compared to the beginning of the month, and the transaction price is slightly lower by 300 RMB/ton.

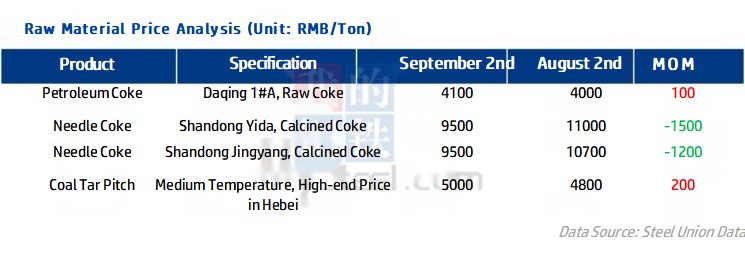

Ⅱ. Costs - Decline in Needle Coke Prices Eases Cost Pressure

In August, Daqing raw coke increased by 100 RMB/ton, while Shandong Yida calcined needle coke decreased by 1,500 RMB/ton, and Shandong Jingyang calcined needle coke decreased by 1,000 RMB/ton. Pitch prices also rose by 200 RMB/ton. After a slight increase in needle coke prices in the earlier period, they exhibited a significant decline, resulting in relatively weak actual production costs for ultra-high power graphite electrodes and returning profits.

Cost-related data indicates that based on a market price of 16,800 RMB/ton for φ500 ultra-high power graphite electrodes, there is a profit margin of 316 RMB/ton. However, analyzing based on current market transaction prices suggests that some markets for φ500 ultra-high power graphite electrodes may still be operating on the edge of cost.

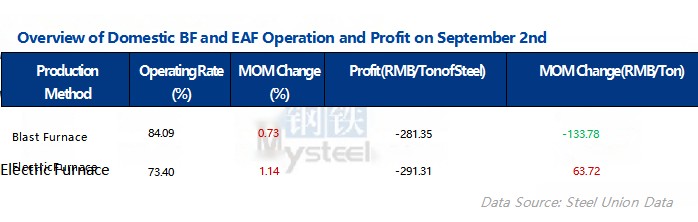

Ⅲ. Demand - Steel Market Demand Remains Weak, Profits Still in Deficit

Looking at the mainstream steel market, blast furnace and electric furnace operations have increased, but profits for rebar steel remain severely in deficit, with blast furnace profitability nearly approaching that of electric furnaces. In August, China's comprehensive building materials price index decreased by 2.6 percentage points compared to July, indicating a significant decline. Steel mills have maintained production during the off-season, coupled with weak demand, increasing pressure on the steel market.

Ⅳ. September Market Outlook - Demand Recovery, Prices Likely Stable

(1) Demand: Looking ahead to the steel market in September, there is some economic recovery, which may favor an increase in steel prices. Considering steel mill production control policies and a decrease in steel production compared to the same period last year, demand for ultra-high power graphite electrodes may remain weak. However, with the positive impact on steel prices, there may be some support for ultra-high power graphite electrode prices.

(2) Supply: In the latter half of August, some graphite electrode manufacturers expanded production slightly, with an expected increase in production of over 10%, possibly taking effect after the National Day holiday. Overall, the production of ultra-high power graphite electrodes in September may still be relatively tight.

(3) Costs: While petroleum coke and coal tar pitch have seen minor increases, needle coke prices have declined. In September, petroleum coke prices are expected to continue rising, potentially leading to stable cost trends.

In conclusion, with weak supply and demand, along with cost support, it is anticipated that the domestic ultra-high power graphite electrode market will maintain stable operations in September. Feel free to contact us anytime to learn about the graphite electrode market forecast.

No related results found

0 Replies